In this behind-the-scenes case study, I will share the exact account-based marketing program Cross Knowledge (a former Wiley brand), has implemented to:

- Increase marketing contribution to qualified pipeline from 35% to 60%. More importantly, these efforts are now focused on the specific kind of target accounts that the company has a proven success with.

- Allowed their sales reps to engage 26% of their target accounts in multiple meetings and project discussions (35 out of 130 target accounts during the pilot)

You’ll walk away with insights about:

- How to get buy-in from leadership for a new ABM and demand generation program

- How to involve and work with sales, including inside sales reps and the account executives (AEs)

- How to prioritize the target accounts when the vast majority of them are not buying (budgets are set far in advance—sometimes for three years at a time)

- Account-based journeys: how enterprise sales reps can create multi-channel, multitouch journeys to book multiple meetings with 26% of their target accounts

- Four transformations most B2B marketing teams need to make, and the step-by-step breakdown of how we implemented these at Cross Knowledge

Throughout the case study, I’ll share quotes from Ken Roden, former head of marketing at CrossKnowledge, as well as a unique perspective of Magali Perdu, an enterprise sales rep who joined the ABM team.

0 to ABM

– The ABM Good, Bad and Ugly

– 5 keys to ABM success

– How to warm-up accounts before outreach without display ads

– How to get a 40-60% reply rate to outreach campaigns

– 3 ABM campaigns on a Ramen budget

Table of Contents

ToggleOverview of the program and results

Over the period of six months, we have developed and implemented a pilot ABM and demand generation program, and made a strategic shift in the way CrossKnowledge markets and sells to their customers.

This strategic shift doubled the share of pipeline generated by marketing, increasing it from 30-40% to 60%, and set the foundation for a more sustainable, scalable approach to enterprise sales.

From the sales perspective, the ABM pilot ran for six months across 130 target accounts, delivering outstanding results:

- Engaged 35 accounts (26% of target list)

- Multiple meetings and project discussions initiated

- Increased credibility and direct access to top executives

- More strategic and early off-the-record insights

- Better visibility into budget availability and buying intent

“Over a six month period out of 130 target accounts, we managed to engage 35 accounts. Involving multiple meetings and project discussions.

There is a stronger perception that we are peers to our clients, that we are part of the community. Directly from that, what we get is we receive more strategic and early “of the record information”. Another benefit is, we speak directly to directors and top executives.

Okay. We, we directly, We are at the right level, and we know earlier if there is a budget or buying intention. .”

– shared Magali Finet-Perdu during the interview she gave at our podcast.

Even beyond pipeline numbers, the shift boosted team morale:

“The most rewarding part was seeing my team take pride in their work again. We were no longer just lead generators—we were business drivers.”

– said Ken Roden during his interview on our podcast.

The Three Challenges of Enterprise Sales in a Highly Competitive Market

CrossKnowledge is a pioneer in digital corporate learning, with 20 years of experience, serving 500 clients and reaching 12 million learners.

CrossKnowledge sells to some of the world’s largest organizations—Global 1000 enterprises—where deal sizes exceed $500,000 and contract terms typically last three years or more. This means that winning new business is not just about generating leads; it requires a deep understanding of the buyer’s organization, long-term relationship building, and precise sales timing.

The company operates in a highly competitive and mature market, where buyers are already familiar with digital learning solutions and have established partnerships. Winning deals in this space is difficult because:

1. The complex sales process with multiple decision makers

- Enterprise deals involve multiple decision-makers across different departments, including HR, L&D (Learning & Development), IT, and Finance.

- Each stakeholder has different priorities and needs, making it challenging to align interests and move deals forward.

“We have many people to speak to. There are multiple decision-makers, and budgets are decided far in advance. It’s a long process.”

– said Magali during her interview on our podcast.

2. Long buying cycles

- Unlike smaller businesses that can purchase quickly, enterprise buyers make decisions slowly and methodically.

- Procurement processes are highly structured, with budgets set far in advance. Learning platforms are often part of a multi-year strategic plan, meaning budgets are set far in advance—sometimes for three years at a time.

- A decision to buy today might have been influenced by marketing and sales interactions from two or three years ago.

- If CrossKnowledge isn’t engaged at the right time, they might have to wait years for the next opportunity.

“Budgets are not decided on the spot. A company may make a purchase decision once every three years.”

– said Magali.

3. Standing out in a crowded market

- The digital learning space has many strong competitors, including both established providers and new market entrants offering AI-driven or low-cost alternatives.

- Buyers are often overwhelmed with options, many of which are full-featured, matured products, making it harder to differentiate based on product features alone.

Why CrossKnowledge Needed a New Approach: Four Key Reasons For Change

1. The Way That Buyers Buy Has Dramatically Changed

It became clear that the way buyers were making decisions had changed, and the company’s marketing approach was no longer delivering results.

“One thing that is really important to understand is the way that buyers explore and try to uncover solutions to meet their needs has dramatically changed. My team was observing that—the way that we used to do things, our very MQL-driven marketing strategy and function, was just not cutting it anymore for us. And we started to realize that we needed to look for other ways to evolve our marketing strategy to align to those changes that were happening in the market.”

– said Ken Roden during his interview on our podcast.

The key changes in the buying behaviour were:

- Buyers were increasingly doing their own research long before engaging with sales.

- Traditional cold outreach and mass email marketing weren’t effective anymore—buyers ignored them.

- Decision-makers trusted their peers and internal research more than vendor marketing content.

“When I started looking for a solution for our marketing challenges, I didn’t fill out a contact form. I followed potential vendors for 9 months before I engaged with their sales.”

— Ken reflected on his own experience as a buyer.

2. Limited inbound opportunities with high-value target accounts

Previously, sales depended heavily on inbound leads from events, downloads, and general marketing efforts. The shift to ABM was driven by the need for a more strategic, proactive approach to targeting accounts.

“I used to work mainly on inbound leads. But I wanted to add intelligence and a more proactive approach to targeting accounts.”

— Magali.

This is one of the most common complaints we hear from many B2B companies focusing on enterprise buyers: an unpredictable inbound pipeline, with the majority of inbound leads not being the target enterprise accounts, and having a low revenue potential.

Many potential customers weren’t actively looking for a new solution, so traditional marketing and lead generation tactics weren’t enough and CrossKnowledge needed to proactively create demand.

“We’ve been in this market for 20 years, and we know it well. But our leadership team recognized that to generate pipeline and increase our win rate, we needed to change how we approached enterprise sales.” — Magali

3. Ineffective MQL model

- CrossKnowledge’s marketing was focused on generating leads (MQLs), but these leads weren’t converting into pipeline at sufficient rate.

- Even in the company’s best-performing campaign month, when marketing generated 3,500 MQLs, very few resulted in actual opportunities.

- Sales teams didn’t trust the leads and often saw them as low quality.

“We had a month where we generated 3,500 MQLs. I thought we struck gold, but the results were disappointing. We were just chasing MQLs without clarity on who our real buyers were.”

— Ken Roden

4. Disconnect Between Sales and Marketing

Instead of working together, sales and marketing were operating in silos, with misaligned KPIs and no shared ownership of pipeline generation.

“Marketing and sales were not speaking the same language. Sales didn’t trust MQLs, and marketing was stuck in a loop of generating leads that weren’t converting.

We had to drop the mentality of ‘it’s not my job’ or ‘it’s not your job.’ We were trying to solve problems together, and so that required us to rethink how we actually structured our marketing team and how we work with sales.”

— Ken Roden

The turning point

The leadership team also saw that existing sales and marketing efforts weren’t delivering enough pipeline to meet growth targets. After analyzing the data and speaking with internal teams, Ken Roden, then Senior Director of Marketing, realized that they needed a fundamental shift in their strategy.

”This was more than just changing tactics—it was about changing how we thought about marketing and sales as a unified function”

– concluded Ken.

The goals became clear. Adopt an account-based marketing (ABM) and demand generation strategy, shifting from volume-based lead generation to highly targeted, multi-channel demand generation and engagement with key accounts.

“We needed a methodology to engage the right accounts at the right time and build a system that could scale.”

– said Magali

Objectives for the new program

- Selecting the right target accounts – prioritizing companies that fit their Ideal Customer Profile (ICP).

- Accelerating the sales cycle by engaging earlier and more strategically – instead of waiting for inbound leads, proactively identify and nurture ideal customers over time.

- Improve the signature rate by targeting the right accounts and building stronger relationships with decision-makers.

- Move beyond lead generation – Shift from chasing MQLs to creating real demand among target accounts.

- Improve marketing’s contribution to the pipeline and revenue – Ensure that marketing wasn’t just generating leads but actively generating and accelerating high-value opportunities.

- Align sales and marketing – Create a shared approach where both teams are focused on the same goals.

- Building relationships over time – Engaging potential buyers through valuable insights and thought leadership rather than traditional sales pitches

- Tracking engagement across the funnel – Measuring marketing’s impact through pipeline generation rather than just lead volume.

As Ken put it, “We needed to rethink how we measured success. MQLs weren’t helping us drive real business impact. Instead, we needed to focus on marketing-sourced pipeline and the quality of sales conversations.”

Getting The Leadership And Sales Buy-in

One of the biggest challenges in transitioning from an MQL-driven model to an ABM approach was securing executive and sales buy-in. This wasn’t just a marketing shift-it required a fundamental change in how the organization measured success, allocated resources, and structured collaboration between teams.

Ken approached this challenge by treating his internal stakeholders like a buyer’s journey – understanding their concerns, educating them, and gradually moving them toward alignment.

Step 1: Engaging executives & peers with data to get the shared understanding of the problem

Before proposing a full transformation, Ken focused on building awareness among leadership and key stakeholders about the problems in the existing model.

He began by sharing data and observations with executives and peers in a non-confrontational way, asking questions rather than making direct proposals.

“I didn’t go in saying, ‘We need to stop MQLs and do ABM.’ Instead, I asked: ‘Are you noticing that event engagement is dropping? Are MQLs converting at the same rate as before?’”

By framing the conversation around real challenges the company was experiencing—such as declining conversion rates and increased sales frustration—he got leadership to recognize that something needed to change before presenting a solution.

Key steps in this process:

✅ Analyzed four years of MQL data to show declining lead quality.

✅ Highlighted discrepancies between high MQL volume and low pipeline contribution.

✅ Pointed out shifts in buying behavior, showing that buyers were researching independently and engaging later in the process.

The takeaway: Data alone doesn’t convince people to change—but data combined with the right questions and stories gets them thinking.

Step 2: Finding & Empowering Internal Change Agents

Ken knew that not everyone in the organization would embrace the shift immediately. Instead of trying to convince everyone at once, he focused on early adopters—people who were already frustrated with the existing model and looking for something better.

“I identified who was already open to change. I looked for sales reps, marketing colleagues, and CS team members who were struggling with the status quo and ready to try something new.”

These change agents became champions of the new model, helping spread the message internally.

“Once I had a small group of people who were excited about the shift, they helped me advocate for it. It wasn’t just me pushing the idea—it was a team effort.”

This approach was critical because executives and leadership teams trust insights from multiple voices, not just one person.

Step 3: Addressing leadership & sales concerns

Even with data and internal advocates, executive and sales teams had legitimate concerns that needed to be addressed.

The deck below summarizes the most common objections executives and sales raise, and how to address them.

Step 4: Starting with a small pilot instead of disrupting the whole process

Rather than trying to force a full transition, we proposed a pilot program to test the ABM approach with a controlled group of accounts.

“Convincing an entire organization to change its GTM model is like climbing Mount Everest. A pilot allowed us to work out the kinks before expanding.”

The pilot served multiple purposes:

✅ Allowed sales and marketing to test new workflows before a full-scale rollout.

✅ Provided early success stories to showcase the impact of ABM.

✅ Gave executives tangible results to evaluate before committing to broader change.

How the pilot was structured:

- Focused on a small set of high-value accounts.

- Aligned marketing and sales goals from the start.

- Defined clear KPIs based on pipeline contribution, not lead volume.

- Implemented new engagement strategies, including personalized outreach, multi-channel campaigns, and strategic content distribution.

By demonstrating quick wins, the pilot helped secure full buy-in for expanding the program.

Step 5: Over-Communicating Wins & Building Momentum

Even after the pilot started showing results, Ken knew that keeping stakeholders engaged was crucial.

“People have short memories. If you don’t constantly share progress, they’ll forget why you’re making the change.”

To maintain momentum, Ken and his team:

✅ Shared small wins regularly – even if they were just high-value engagement metrics at the start.

✅ Highlighted qualitative feedback from sales – showcasing how they were having better conversations with target accounts.

✅ Used screenshots and real examples to make the impact visually clear to leadership.

“We had an opportunity to pitch to senior leadership, and we were ready. We had examples of major enterprise brands engaging with us on LinkedIn, participating in thought leadership, and moving into the pipeline.”

This constant reinforcement ensured that leadership stayed committed and that the program had full organizational support.

Finding The Right Partner

Before diving into the details of the programs, and sharing examples of account journeys and a step-by-step process we used to prioritize and engage target accounts, I wanted to address CrossKnowledge’s decision to work with a consulting partner.

Transitioning from an MQL-driven model to an account-based marketing (ABM) strategy was a major organizational shift for CrossKnowledge. To accelerate the process, avoid common pitfalls, and ensure success, Ken Roden and his team sought a consulting partner with deep expertise in B2B enterprise sales, ABM execution, and change management.

1. Why CrossKnowledge Needed a Consulting Partner

While the internal team at CrossKnowledge had strong marketing, sales, and operational experience, implementing ABM required specialized expertise and an outside perspective.

Key reasons for bringing in a consulting partner:

✅ Objective Perspective – Internal teams often struggle to see blind spots in their current strategy. A consulting partner provides an external, unbiased view of what’s working and what’s not.

✅ Proven Playbooks – Instead of experimenting from scratch, Ken wanted a partner with battle-tested ABM frameworks and execution strategies.

✅ Faster Implementation – With limited internal resources, they needed a team that could guide them step by step and ensure the transition happened efficiently.

✅ Change Management Support – Aligning sales and marketing was a major challenge. A consulting partner helped facilitate alignment and create a structured adoption plan.

“We needed a partner who not only understood ABM conceptually but could also help us operationalize it within our specific business context. One of the biggest differentiators in our decision to work with FullFunnel was that they were practitioners, not just theorists. They had big ideas, but they also knew how to apply them to the business”

2. Evaluating Potential Partners

Ken didn’t rush into selecting a consulting firm. Instead, he observed and followed potential partners for months before engaging:

- Followed consultants on LinkedIn – Ken monitored potential partners’ content, looking for thought leadership that aligned with his challenges.

- Compared real-world case studies – He sought out firms that had successfully implemented ABM for similar enterprise-level B2B companies.

- Engaged in industry discussions – Through marketing Slack groups and LinkedIn, he gathered peer feedback on different ABM consulting firms.

- Assessed practical expertise vs. theory – Some consultants were great at explaining concepts but lacked real-world application.

“I followed FullFunnel for about nine months before engaging. I wanted to make sure they truly understood enterprise ABM—not just in theory, but in execution.”

When Ken finally engaged with FullFunnel, what stood out was their ability to provide both high-level strategic guidance and tactical execution support.

3. The Role of the Consulting Partner in the ABM Transformation

Once CrossKnowledge decided to partner with FullFunnel, the consultants became an extension of the internal team, guiding the ABM transition in a structured, hands-on way.

Here are four key areas where the consulting partner has provided value to the CrossKnowledge team.

1️⃣ ABM Strategy Development

- Helped define the Ideal Customer Profile (ICP) and prioritize high-value accounts.

- Developed multi-channel engagement strategies tailored to enterprise buyers.

- Shifted marketing KPIs from MQL volume to pipeline contribution.

2️⃣ Sales & Marketing Alignment

- Facilitated workshops to align sales and marketing teams on ABM strategy.

- Worked with leadership to adjust sales KPIs and compensation models to support the shift.

- Provided playbooks and training to help teams adopt the new approach.

3️⃣ Execution & Optimization

- Helped structure the ABM pilot team and workflows.

- Provided content frameworks for LinkedIn engagement, thought leadership, and sales enablement.

- Conducted weekly stand-ups with the team to review progress, troubleshoot issues, and refine tactics.

4️⃣ Measurement & Iteration

- Defined core ABM KPIs (e.g., Marketing-Sourced Pipeline, Account-to-Pipeline Ratio).

- Set up dashboards to track ABM performance in real-time.

- Iterated based on early pilot results to fine-tune the approach before scaling.

“The best part of working with FullFunnel was that they weren’t just consultants—they were hands-on partners. They sat down with our team, built playbooks, tested strategies, and adjusted based on real results.”

The ABM Program Break-down

In the following sections, I’ll dive into the details of the program. First, I’ll share the resulting account-based journey from the sales perspective, and then give a step-by-step overview of the strategy development and implementation steps.

The Account-Based Journeys: The Resulting Program From Sales’ Perspective

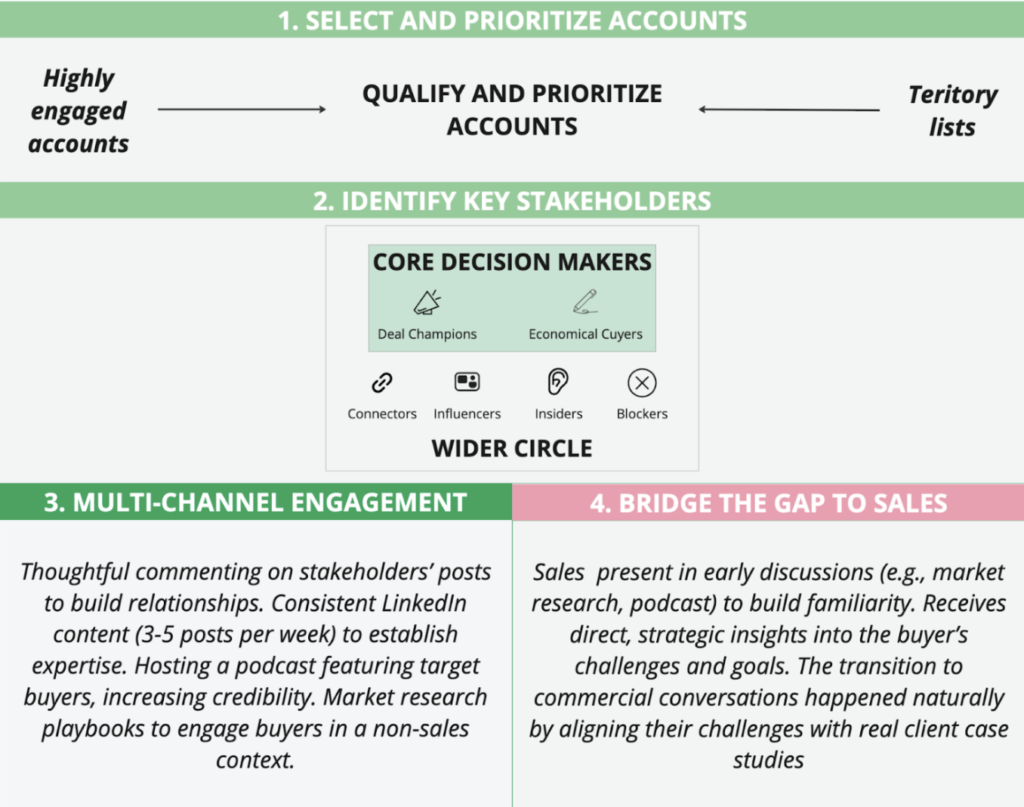

The ABM approach from the sales perspective was structured around multi-touch, multi-channel engagement with strategic accounts. The process was broken into the following steps.

1. Select & prioritize accounts

Accounts were selected based on:

- Geography and industries (with proven track record)

- Size & global footprint (multinational companies)

- Strategic transformation initiatives

- Potential to benefit from CrossKnowledge’s solution

- Engagement readiness (HR/L&D teams with a strong vision)

“We have to make choices. The selected accounts must align with CrossKnowledge’s priorities, including transformation initiatives and global needs.”

2. Identify Key Stakeholders

Using Sales Navigator, Magali mapped out the buying group in two stages:

- Wide circle: Broader influencers within the company to build visibility.

- Core decision-makers: HR/L&D leaders with purchasing authority.

Example:

- Targeted 11 people in a large industrial account.

- 8 of them connected on LinkedIn.

- Focused on 2 key decision-makers (one at HQ, one in a subsidiary).

“People trust their peers more than salespeople. By engaging a broad audience first, we build visibility and credibility before targeting decision-makers.”

3. Multi-Channel Engagement Strategy

To create awareness and nurture relationships, Magali implemented:

- Thoughtful commenting on stakeholders’ posts to build relationships.

- Consistent LinkedIn content (3-5 posts per week) to establish expertise.

- Hosting a podcast featuring target buyers, increasing credibility.

- Market research playbooks to engage buyers in a non-sales context.

“I post 3-5 times a week. This ensures my audience listens to me, builds visibility within target accounts, and fosters engagement.”

4. Bridging the Gap to Sales

Once engagement was established, Magali introduced the Account Executive (AE) at the right time:

- Sales was present in early discussions (e.g., market research, podcast) to build familiarity.

- Sales received direct, strategic insights into the buyer’s challenges and goals.

- The transition to commercial conversations happened naturally by aligning their challenges with real client case studies.

“We don’t just pitch. Instead, we listen, share relevant industry examples, and create value before transitioning into a sales conversation.”

How we got there: Developing The New Account-Based Go-To-Market Strategy

CrossKnowledge’s shift to an account-based go-to-market (GTM) strategy required a structured, data-driven approach that aligned marketing, sales, and customer success around a shared revenue goal. The program was designed to:

- Move away from high-volume lead generation to focused account engagement.

- Align marketing efforts with revenue contribution, not just MQLs.

- Build a repeatable, scalable ABM framework that could support both new business and expansion revenue.

Revenue Analysis

Before making changes, FullFunnel and CrossKnowledge conducted a deep revenue analysis to understand:

- Where the pipeline was coming from.

- Which types of deals are converted at the highest rate.

- The primary sources of closed-won revenue.

Key Findings:

✅ A significant portion of past revenue came from a small subset of high-value accounts.

✅ We identified specific priority industries and use-cases where we had a significant competitive advantage.

✅ Most MQLs never turned into pipeline.

✅ The fastest-closing, highest-value deals came from accounts where multiple stakeholders were engaged before the sales process began.

“Our best deals weren’t coming from mass lead generation. They were coming from strategic, multi-threaded engagement with key accounts.”

Win-Loss Deal Analysis & ICP Development

To refine account targeting and messaging, we conducted a win-loss analysis by interviewing key account executives, looking at:

- Common characteristics of won deals, to define detailed qualification criteria that we can use to build target account lists

- Factors that led to lost deals, to identify red flags and disqualification criteria

- Target use-cases, the main reasons why buyers decide to buy from us, and not our competitor

- The common challenges and the business triggers that would start a buying journey

- The typical steps that buyers went through as a part of their buying journey, including the questions and objections they had at each step

The Pilot Teams

CrossKnowledge structured its ABM team for maximum impact with a minimal overhead.

Core Team (3 + 1 roles)

- ABM Lead – Owned strategy and execution.

- SDR/Inside Sales – Built target lists and engaged prospects.

- Content Marketer – Created targeted thought leadership.

- Later, we added one Expansion Marketer to focus on upsell opportunities.

Supporting Team (3 roles)

- Account Executives – Were involved with activating highly engaged accounts.

- Subject Matter Expert – Provided deep industry insights.

- RevOps Expert – Managed data and reporting.

This structure ensured full alignment between marketing and sales.

Weekly ABM Pipeline Review Meetings To Drive Alignment & Execution

At CrossKnowledge, weekly ABM pipeline review meetings became a core ritual for ensuring that sales and marketing were fully aligned and focused on revenue goals. These meetings were not just check-ins—they are working sessions where teams reviewed active accounts, planned next steps, and refined their approach based on real engagement data.

These meetings transformed how sales and marketing worked together, replacing siloed work and finger-pointing with collaborative planning and execution.

Each meeting followed a structured framework covering five critical areas:

1. Account Insights and Engagement

Sales and marketing share real-time data on account engagement and interactions. This ensures that every action is based on evidence, not assumptions.

Example:

“We have every week pipeline review meetings between the key roles in the pilot, in the program where we actually review these lists and say, hey, you know what? We see this new activity from those accounts. Maybe we should add them to our ABM program and you should start focusing on them. And by the way, I’ve been trying six different touch points with this account, and we are not really getting a response. Well, let’s maybe move them back and replace, let’s say, that less active account.”

– said Magali.

🚀 Impact: These insights guide the next steps and ensure that both teams coordinate their efforts effectively.

2. Account Planning: What’s Next?

Once engagement data is reviewed, the team decides what actions to take next to influence each account.

Example:

- Marketing prepares a content hub including relevant industry case studies and references.

- Sales follows up with the Champion to get feedback on the materials before sharing them with another decision-maker.

- Sales & Marketing start engaging with the target buyers’ LinkedIn content to increase visibility and build rapport.

🚀 Impact: This ensures that every account is nurtured strategically, rather than relying on scattered outreach.

3. Leading Indicators: Are We on Track?

The team reviews key leading indicators to assess whether they are progressing toward pipeline and revenue goals. If targets weren’t met, they identify what slowed them down and how to remove bottlenecks or finetune the approach.

Example:

- The engagement is down, because the outreach for the new industry research report is not working as expected.

- Solution: review and improve the messaging, and create an industry report brief that the seller can share with buyers with FAQs for their communications team.

🚀 Impact: Helps the team iterate quickly and continuously optimize ABM execution.

4. Retrospective: What’s Working, What’s Not?

A quick but essential discussion on what’s driving results and what needs improvement.

Discussion Points:

✅ What’s moving us forward? → Identify successful strategies and double down on them.

❌ What’s holding us back? → Define bottlenecks and discuss how to eliminate them.

Example:

- The marketing team produced two fewer posts this week because the content marketer was pulled into another project.

- Solution: Adjust workload distribution to ensure content production stays consistent.

🚀 Impact: This helps the team stay proactive by identifying and fixing execution roadblocks before they impact pipeline growth.

5. ABM Pipeline Update: Adding & Removing Accounts

Accounts are continuously reviewed to ensure resources are focused on the right opportunities.

🔹 New accounts are added → Based on intent data, engagement signals, and recent activity.

🔹 Disengaged or disqualified accounts are removed → If an account hasn’t engaged after multiple touchpoints, it’s moved to a lower-priority nurture list.

🚀 Impact: Ensures marketing and sales efforts are concentrated on high-potential accounts, rather than chasing dead ends.

KPIs, Metrics and Reporting

The program’s success was measured with clear, revenue-focused KPIs:

🔹 Marketing-Sourced Pipeline (tracked dollar value, not just leads).

🔹 Account-to-Pipeline Ratio (percent of target accounts converted to opportunities).

🔹 Engagement Metrics (social engagement, two-way conversations with sales, event attendance).

🔹 Sales Feedback Loop (qualitative insights on lead quality).

Scaling the ABM Program Beyond The Pilot and Involving More Salespeople

Once the ABM pilot at CrossKnowledge proved successful, the next challenge was scaling the program across the organization and ensuring wider adoption among sales teams. Here are the key insights Ken and Magali shared about how they expanded the ABM approach and encouraged more account executives (AEs) to participate.

Step 1: Demonstrating Early Success to Gain Internal Buy-In

“We were able to use a pilot to not only work out the kinks but also understand and fine-tune areas where we weren’t as strong as we thought. This ensured we were ready to expand it beyond just a small group of people.”

– said Ken

The pilot program showed:

✅ Higher-quality pipeline—beyond growing the pipeline contribution from 35% to 60%, marketing was contributing more sales-ready accounts.

✅ Increased sales effectiveness—with 26% of target accounts initiating multiple meetings.

✅ Improved sales & marketing collaboration—teams were now working toward the same revenue goals.

Once leadership and sales saw the impact, scaling the program became a priority.

Step 2: Expanding AE Involvement Gradually

Magali emphasized the importance of starting small and scaling participation strategically:

“With sales teams, it’s important to realize they have peaks of activity—tender bids, RFI, RFPs—so they can’t always commit fully. Some are also hesitant to engage publicly on LinkedIn or participate in podcasts. Instead of forcing full engagement, we started with basic steps, like improving LinkedIn profiles and sharing best practices.”

The scaling strategy included:

✅ Selecting one champion AE—someone open to ABM, who managed five large accounts.

✅ Developing best practices with them and sharing wins with the broader sales team.

✅ Providing workshops on LinkedIn engagement, sequencing, and outreach strategies.

“We started with one AE who was open to ABM. They worked on five key accounts, and as we saw success, we shared those best practices across the team.”

This gradual approach made it easier for other salespeople to adopt ABM without disrupting their workflow.

Step 3: Expanding the Account-Based Playbook

To ensure scalability, CrossKnowledge refined ABM processes and documentation:

“After the pilot, we built a structured playbook to guide the expansion. We defined key engagement tactics, messaging frameworks, and multichannel outreach strategies, ensuring that new AEs could quickly adopt the approach.”

This playbook included:

✅ Account selection criteria—helping AEs identify which accounts to prioritize.

✅ Multi-channel engagement strategies—detailing LinkedIn engagement, content co-creation, and email outreach.

✅ Sales & marketing collaboration guidelines—ensuring continued alignment between teams.

By documenting the ABM approach, scaling became repeatable and efficient.

Key takeaways and the next steps

Lots of B2B organizations are faced with a declining pipeline due to the changes in buyer behaviour. For companies looking to improve marketing-sourced revenue, CrossKnowledge’s experience provides key takeaways:

- Don’t pitch ABM or demand generation. Start by showing why the current system isn’t working. Use data to highlight declining performance of current programs, and sales’ challenges and frustration.

- Start with a scoped down pilot, not a full rollout. Test the approach, prove success, then scale up.

- A multi-touch, multi-channel approach builds credibility. Awareness generation with relevant content and thoughtful engagement before outreach increases success rates.

- Align sales and marketing on the target accounts, their challenges and business triggers. Then, engage a highly engaged champion from the sales team to participate in the pilot, and demonstrate the effectiveness of the new approach.

- Shift marketing KPIs from MQL volume to marketing-sourced pipeline—aligning success metrics with revenue. But use leading indicators such as account engagement, buyer conversations and discovery calls to show early progress.

- Over-communicate progress. Share wins constantly—don’t assume leadership will remember.

- ABM weekly pipeline review is the core and a simple step towards marketing and sales alignment and effective execution.

If you need help with developing account-based (content) strategy, book a call here or dm me on LinkedIn with additional questions.

If you want to uplift your skills and learn more about the complete ABM strategy, get step-by-step guidelines on developing an ABM strategy from scratch and launching a joint ABM pilot campaign in less than a quarter, in our Full-Funnel ABM Playbook.

Inside you’ll find:

- 18 short, actionable training videos that explain how to launch a pilot ABM campaign on a minimal budget and land sales opportunities with dream accounts just in 6 weeks

- 4 actionable, orchestrated for you ABM campaigns

- Worksheets and dashboards you need to launch a pilot campaign including:

- Ideal customer profile template

- Account research template

- ABM campaign dashboard

- Pilot campaign slides

- Phone follow-ups template

- Account qualification template

- Campaign analysis template

- Lifetime access to the course and future updates

Learn more and access the Full-Funnel ABM playbook here.