Bonus workbooks: Ideal customer profile template, ICP checklist, PDF copy of this guide + in-depths questionnaire for customer interviews.

In this guide, I’m going to show you a proven framework on how to create an ideal customer profile (or ICP) for a B2B company.

This is the exact process we used to:

- Improve client positioning, so they were perceived as niche industry experts.

- Create a hyper-targeted list of B2B prospects that are likely to buy their product

- Generate $300k in sales opportunities with a pilot ABM campaign

I’ll also share with you a copy of the ICP template I use and The Diver Survey Method to collect valuable insights about your customers.

The kicker?

This client operates in a highly competitive space (software development) where they used to be a “one size fits all” vendor for many years.

So let’s dive right in.

Table of Contents

ToggleWhat is an ideal customer profile?

ICP is a list of attributes that your BEST customers from a SPECIFIC market segment have in common.

I emphasized BEST and SPECIFIC for several reasons:

1. Every segment has individual needs and different reasons why the companies from that segment buy your product.

2. All your customers are not created equal.

20% of your clients generate 80% of your revenue. Your ICP should be based on these clients.

The most common mistake B2B companies make is blending data from different segments and ending up with a broad definition of ICP.

As a result, they describe their ICP as “Startups from Boston that have raised money recently”, “Round A SaaS companies”, “European financial institutions”.

Guess what happens next?

These companies become “Jack of all trades” vendor with a generic positioning that doesn’t differentiate the company from the competition and rely heavily on outbound desperately trying to hit the sales quota.

The higher your ACV, the more precise should be your ICP. As simple as that.

Why do you need an ideal customer profile?

There are four purposes of the ideal customer profile.

1. Focus

ICP helps to align your marketing and sales team with what companies they should target instead of chasing everybody.

As a result, your company generates better sales opportunities with higher ACV and hit revenue targets.

2. Personalization.

Make your customers feel that your product was created exactly for them. This requires understanding customer jobs to be done, OKRs, goals, and challenges.

Next step – tailoring your positioning, website copy, content, ads, and landing pages to the collected insights.

3. Channels.

The fact that somebody tells you that TikTok or Snapchat is hot, doesn’t mean your buyers are hanging out there, and you’d be there as well.

ICP helps to identify the exact channels your target buyers use for research, education, and communication.

Don’t wear pink glasses thinking that senior execs with 10+ years of background hang out all day long on all the social media, and you just need to be everywhere to capture their attention.

4. Account qualification and disqualification for list building.

By analyzing your best customers you can define the commonalities between them (revenue, team size, stack, needs, etc). These criteria should be tangible, so everybody in marketing and sales could apply them and qualify or disqualify companies.

Now, when the ICP goals are clear, I want to answer the last question, and then jump into the step-by-step process of ICP creation.

What is the difference between an ideal customer profile and buyer personas?

You’ve probably heard all the buzzwords: customer avatar, buyer personas, and customer profile.

Now let’s put the final dot and finish the mess.

An ideal customer profile is a description of companies you want to prospect including 5 pillars:

- Firmographics

- Buying Committee (or B2B Buyer Personas)

- Account qualification

- Account segmentation

- Account enrichment

To make it simple, buyer personas are a part of ICP. These are the people with who you negotiate or those who can influence the deal.

In the next section, I’ll cover all 5 pillars in detail.

5 pillars of B2B ICP

1. Firmographics.

Firmographic criteria might include stack, revenue, location, team size, industry, geo market, etc.

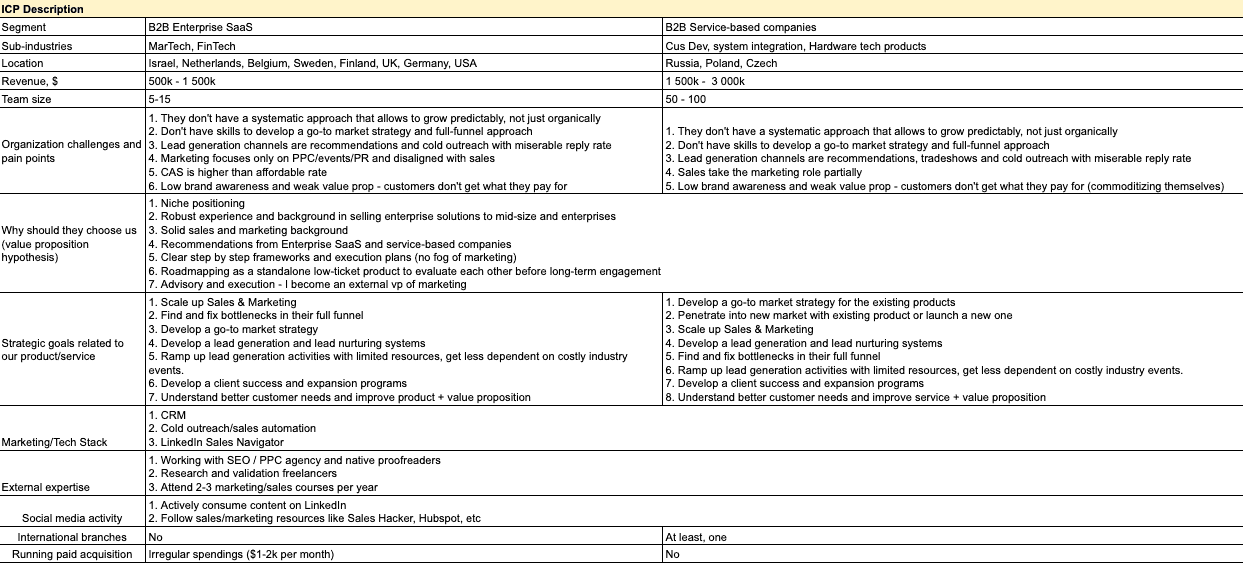

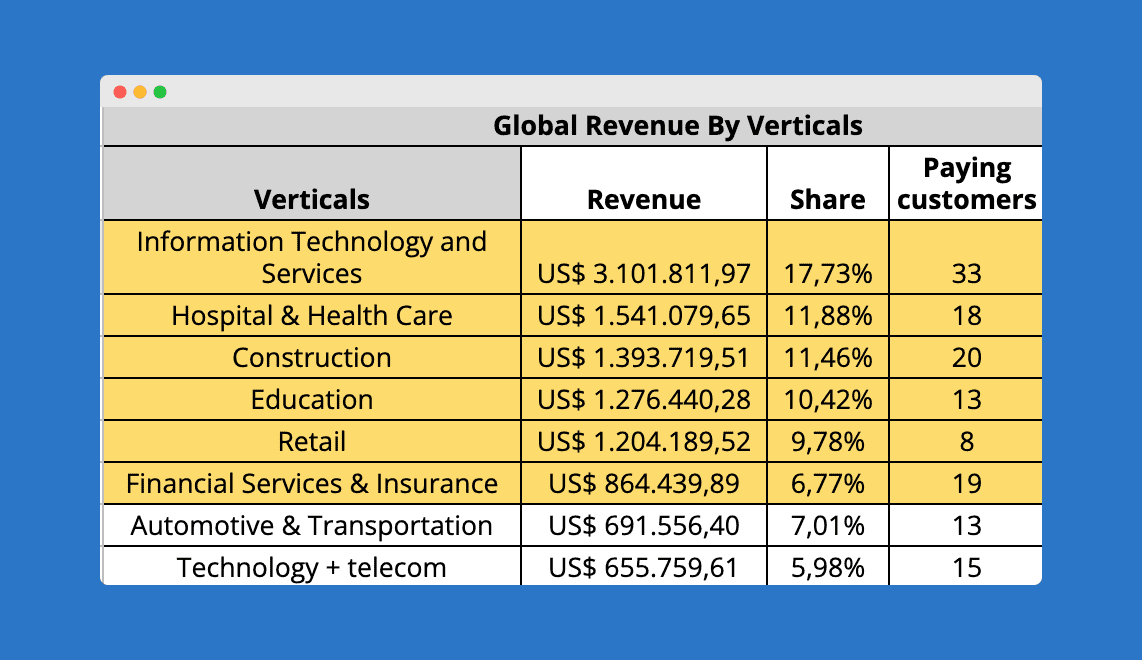

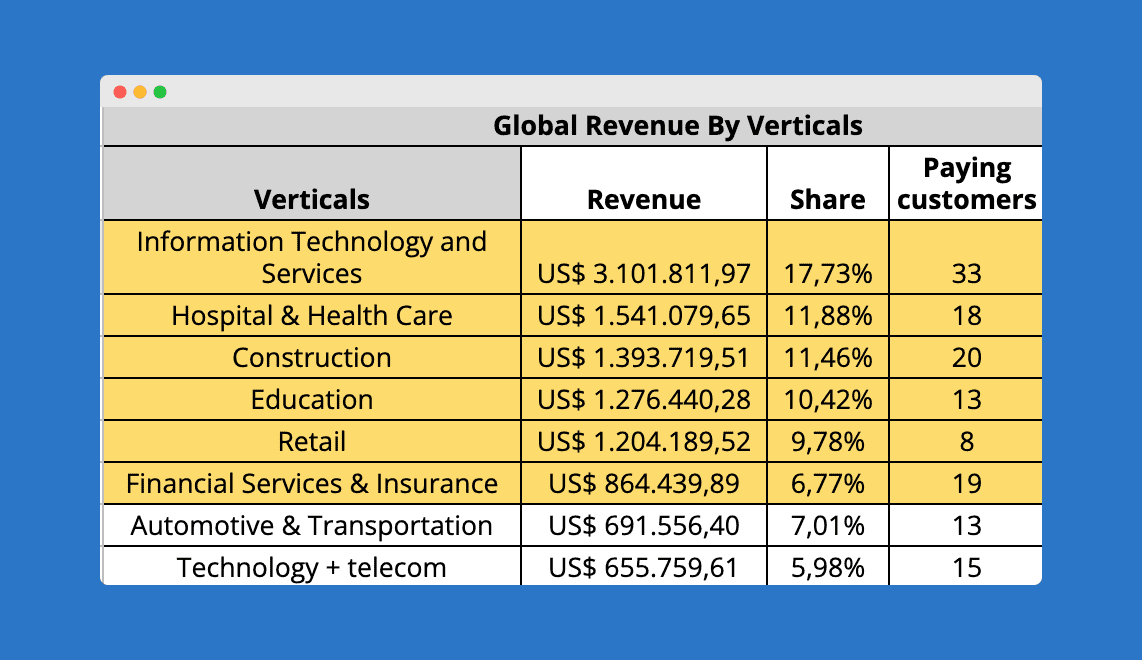

Once you defined a target market segment, you need to understand what sub-industries generate more revenue and are more profitable for your business.

Here is an example.

If you sell globally, this analysis is crucial.

If you are a European company, but your best customers are located on West Coast, don’t forget to adjust your working hours, content publishing and content calendar.

Sounds obvious, but you’ll be surprised how many companies neglect it.

If you want to focus heavily on a specific geo market, do thorough research, consider hiring local reps and localize your content.

For example, if you want to penetrate the German market, you need to know that Germans heavily use their own “LinkedIn” called Xing and highly appreciate if your company has a solid track record and history.

Localization will help you also to avoid silly marketing mistakes, as Clairol did with their curling iron in Germany. The iron was named “Mist Stick” without realizing that “mist” means manure in German.

The same stupid and funny mistake did Colgate when launching their toothpaste in France. They called it “Cue,” which is the name of a French porn magazine.

2. Buying Committee.

What is a buying committee?

It is a group of people that influence your deal inside target accounts. Here are 4 main roles.

1. Champions.

Those are the people who are usually in charge of initial product/vendor research.

They attend discovery calls with you, prepare comparison reports, and provide info with personal takeaways from calls to the decision-makers.

If you are targeting SMBs, quite often, you’ll face the situation that the Champion and the Decision-maker might be the same person (for example, CEO). We usually get requests from SMB CEOs because they are personally interested in getting results for their organization.

In mid-size and enterprise companies, champions usually are the end-users of your product or people who’ll collaborate with you.

In our case, champions are the VP of Marketing or CMOs.

For software development companies, champions could be product managers, cause they are in charge of product development, and your team becomes their team extension.

2. Decision-makers.

This role is obvious. Decision-makers are people who approve the deal and the budget.

While in SMB, decision-makers actively participate in the research negotiations, in mid-size and enterprise, they usually delegate it to Champions.

Champions must provide thorough research, personal opinion about the best solution, and the benefits their organization might get from buying.

In most cases, decision-makers are senior executives who approve the deal and the budget.

3. Influencers.

Influencers don’t usually participate in research or negotiations, but their opinion influences the deal..

Usually, it happens during team meetings where influencers share their opinion regarding the product or vendor.

Example.

Let’s pretend you are selling an enterprise account-based advertising platform. The Head of Marketing (Champion) is excited about the product, but the CEO (Decision-maker) wants to hear the thoughts of the external business consultant (Influencer).

The consultant (Influencer) proves that this product might help to warm up the target accounts and make them aware of their solutions. CEO approves the deal.

In this case, an external consultant was an influencer who influenced the deal positively.

Now let’s touch blockers.

4. Blockers.

Blockers are the buying committee members who are not interested in your solution or might see a danger for themselves.

Let’s use the prior example.

The Head of Marketing (Champion) is excited about the product, but the CEO (Decision-maker) wants to get feedback from CRO (Influencer).

CRO (Blocker) doubts that the AB< platform is worth its price. He tells that the budget invested in the platform could be used more wisely by arranging a private event for the key clients and prospects.

CEO agrees and blocks the deal.

Tune in here where I explain in detail how to identify and enrich the typical buying committee structure of your target buyers.

Why do you need to define the buying committee?

There are several reasons why you need to define the buying committee.

1. Influence the buying process.

The “black box factor” is a situation when you went through several discovery calls with the Champion.

You see Champion’s excitement, get an inquiry, and send the proposal hoping to close the deal. But then you hear “No” without having a clue why have you lost the deal.

When you know the typical buying committee structure, you’ll be able to warm up all the buying committee members, prepare the content that might motivate them to approve your deal, and engage with them timely.

2. Improve the efficiency of your campaigns.

One of the biggest mistakes I see marketers and BDMs make quite often is when they are prospecting the decision-makers only in mid-size or enterprise companies.

While it’s essential to engage with the decision-makers, in most cases, they’ll delegate the negotiations to the Champions.

And, you know, nobody likes when the vendors jump over their heads 🙂

Besides this, it’s much easier to get a meeting with Decision-makers via Champion.

If a Champion sees value in your solution, transparent personal and company’s/his department’s benefits, you’ll get much insider information.

You will know how to influence other buying committee members and close the deal successfully.

Buying committee enrichment

Here is a list of the main criteria I recommend to enrich when defining the buying committee.

Age

It’s impossible to talk the same way to young buyers and people over 50. These two categories have entirely different values, decision-making processes, and buying criteria.

You need to adjust your marketing message accordingly.

Job roles

Just as it is impossible to market different age groups the same way, it is impossible to target and pitch the same way key stakeholders and middle managers.

They have different factors that influence their purchasing decision, various benefits they can get from your product, and different reasons not to buy.

Analyze the personal benefits each of the buying committee members get from your product, reasons to block the deal, and what objections or concerns you faced while dealing with them.

When you figure out this information, you’ll be able to update all your marketing and sales content and improve the lead nurturing program to increase the amount of generated sales-qualified leads.

Check the B2B sales funnel playbook if you want to learn how to optimize and accelerate the sales pipeline.

Channels

Discover channels and platforms your buyers usually use for education, research, and evaluation.

Channels can include communities (like Trenches), blogs (like Fullfunnel.io blog), content curation platforms (like Growth Hackers), or niche news portals (like Hackernoon).

This analysis will give you comprehensive answers to the questions:

- Where you can reach your target audience

- What content does your audience consume and what content is in demand

- What social media you should leverage for lead generation and what social media you should avoid

Challenges

Companies hire your company or buy your product to solve a specific challenge they can’t solve themselves at the moment either because of a lack of knowledge, lack of resources, or lack of necessary technology.

In our case, it’s usually a lack of knowledge on how to build a GTM motion and consistently grow revenue while selling high ACV products with a long sales cycle.

They try the traditional outbound approach, ads, and SEO but see a miserable return.

When you know the challenges you solve, you’ll be able to address them in your marketing message and value proposition.

Reasons to buy

Why do your customers buy from you?

Is it because of a lower price, niche positioning, content you are publishing, or case studies and testimonials?

I always ask this question during the discovery calls.

Our clients say they are reaching out because they love the content and niche positioning. They understand that we have a solid track record of growing B2B companies that sell high ACV products with a long sales cycle.

Strategic goals

Startups don’t hire software development teams just to code. They want to have a partner who’ll be able to understand the business needs and create an MVP that the market expects at an affordable price and timeline.

B2B SaaS companies don’t hire digital agencies to create a website. They want to hire a partner who can create a website that will convert the traffic into free trials and customers.

B2B Sales teams don’t buy outreach software just to send emails or because they love to click buttons.

They want to create multithreaded engagement leveraging different layers of personalization and be aware when their prospects open, click the link or unsubscribe from email.

The only way to know it is to run in-depth customer surveys.

3. Account qualification and disqualification.

What makes an account a good fit aside from the standard firmographics criteria?

Analyze your best customers and find the patterns that unite them.

It could be tech stack, ad spending, business environment or situation, or, basically, anything that is unique for your business.

For example, for one customer who sells the Fintech enterprise software, the account qualification criteria we’ve identified were:

- low margin

- revenue and costs operated in a volatile local currency,

- hedging practice,

- export dominates in sale

- long sales cycle

Now comes the most interesting part B2B companies rarely consider – account disqualification.

Have you ever considered what makes the account a bad fit even if it fits firmographics?

This happens quite often.

Analyze the lost deals with companies that were matching your firmographics but ultimately didn’t buy from you because of the price, missing feature, location, brand, or whatever.

What do they all have in common?

If we’ll look at the prior example of our fintech client, our disqualification criteria were:

- CFO is in the 1st year in a current position.

- CFO spent more than 5 years in a current position.

In the first case, CFOs are usually learning and not willing to change the existing processes. While in the second case they usually have an established process and are unwilling to change it.

Here is a short video where I explain account disqualification in detail.

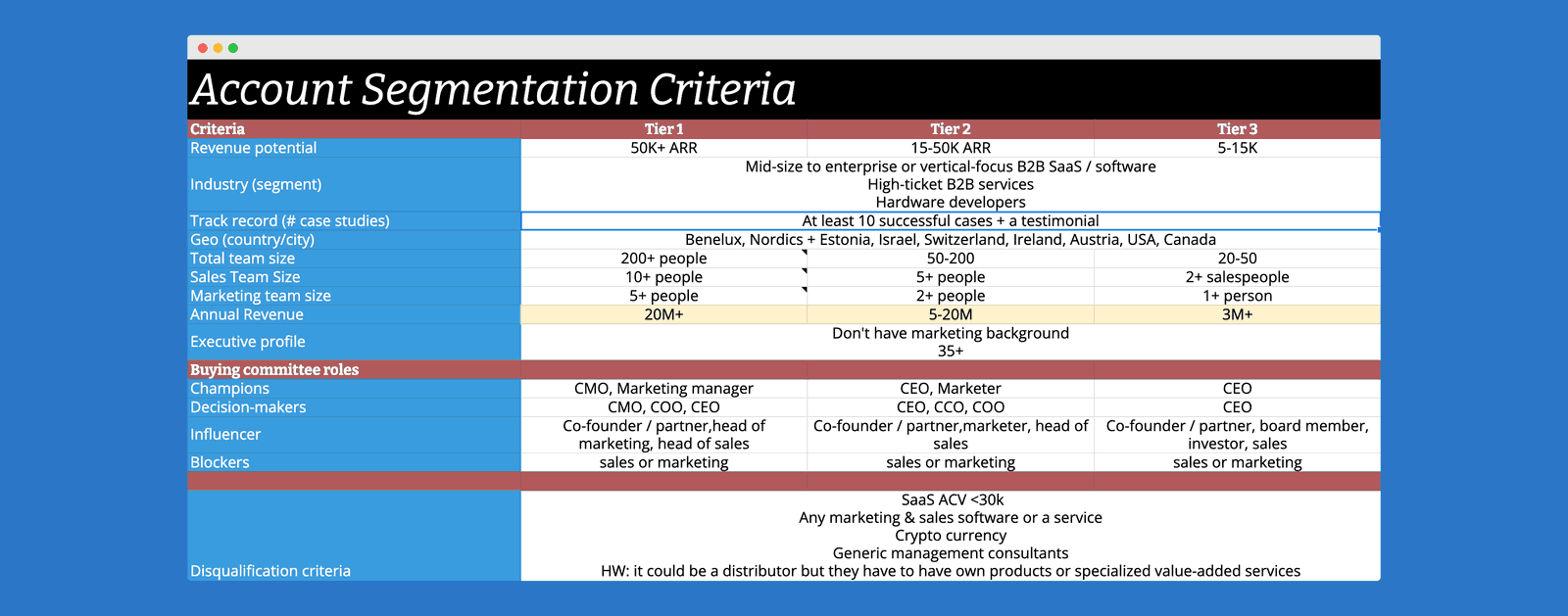

4. Account segmentation.

Not all prospects are created equal.

If one company can generate 10x more revenue than others, why should it be prospected and marketed the same way?

But most B2B companies make this mistake and combine the data from all customers ending up with a very broad definition.

The goal of account segmentation is to define 10-20% of customers that generate 60-70% of revenue and recreate ICP based on them.

It doesn’t mean that you should stop selling to smaller companies, but this will help you to narrow down your focus. Smaller companies will always come as an outcome of the demand generation programs dedicated to your ICP.

5. Account and buying committee enrichment.

Your ICP won’t be complete without understanding how your customers are buying and why.

The only way to figure it out is by hosting in-depth customer interviews.

Here are 6 groups of questions you’d ask:

- Buying triggers. What leads them to start looking for products like yours)

- Research process. Where and how do they search? What information they are looking for?

- Decision-making process. What influences their decision? Who is involved in the product approval process?

- Value they got from the product.

- Goals, needs, and challenges.

- Channel presence. Where do they get industry information? Whom do they follow?

I’ll cover the exact process we use to run customer interviews later in this guide.

The step-by-step process of how to create an Ideal Customer Profile

Let’s dive into the step-by-step process of ICP development.

1. Select a specific market segment.

As I mentioned earlier, ICP is the impersonation of your key customers from a specific market segment.

Lots of B2B companies miss this step and make the same mistake. They export all the data from the CRM and create a universal customer avatar.

As a result, they move to the “one-size-fits-all” approach and spray their efforts instead of focusing on specific segments. Keep in mind that for every market segment, you need to create a standalone ICP.

Start with exporting your historical data and analyze revenue by verticals and markets. You need to define a few industries that generate the most revenue, do custom scoring, and select a segment you’ll focus on.

Read more about marketing segmentation in the GTM strategy guide or watch a market segmentation workshop where we cover the process in detail.

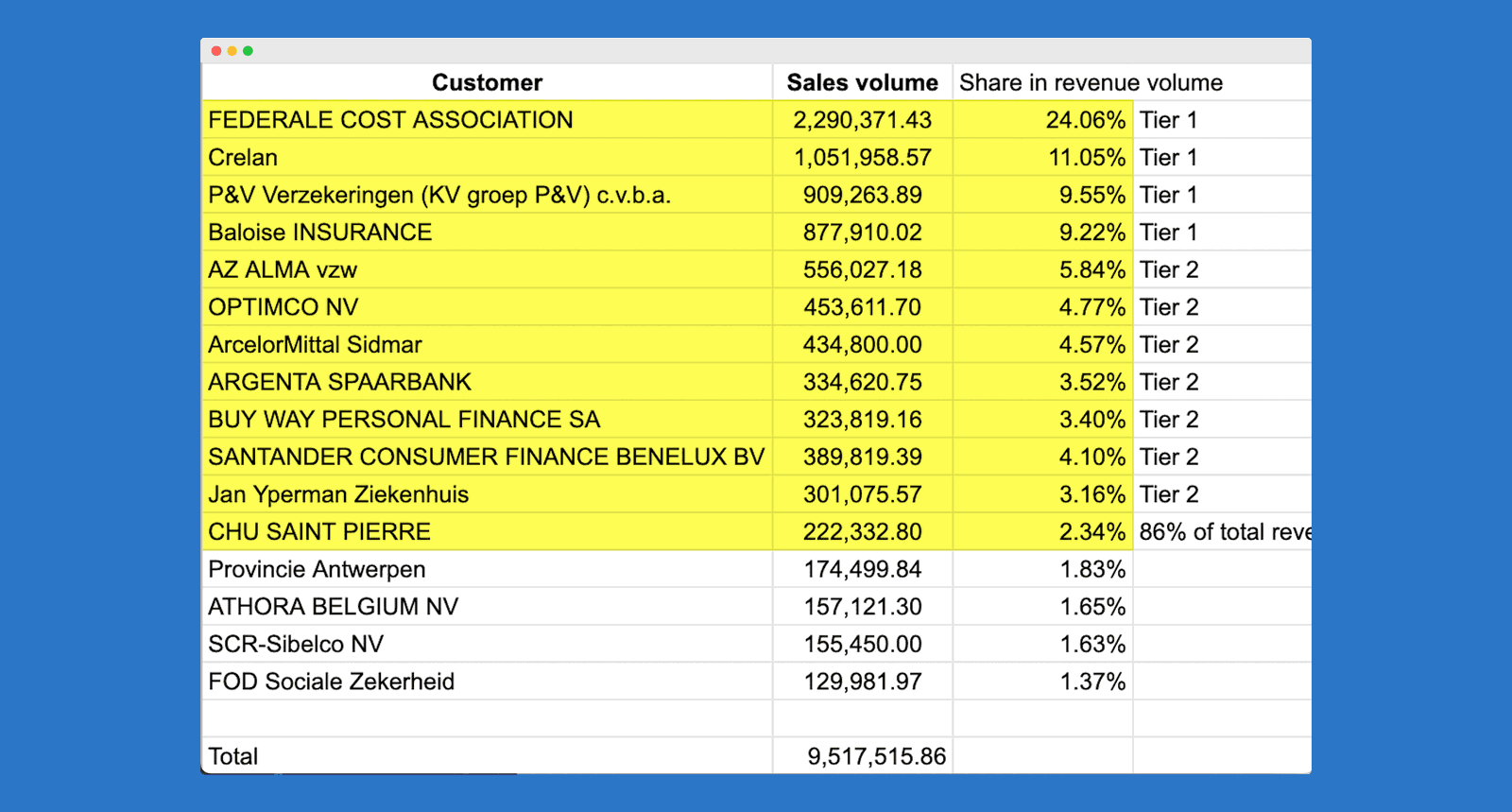

2. Segment revenue in a selected segment by clients.

All clients weren’t created equal.

When you selected a target segment, sort the revenue by clients. Our goal is to apply Pareto Principle and identify 20% of companies that generate 70-80% of the segment revenue.

This is the basic principle of account segmentation.

How to segment accounts:

1. Analyze revenue from a specific segment and define 10% of companies that generate the most revenue – Tier 1.

2. Next 10% add to Tier 2, and the other 80% add to Tier 3.

3. Define common firmographic patterns between these companies.

E.g Tier 1: revenue size – $20mln – $50mln, team size: 500-900, etc.

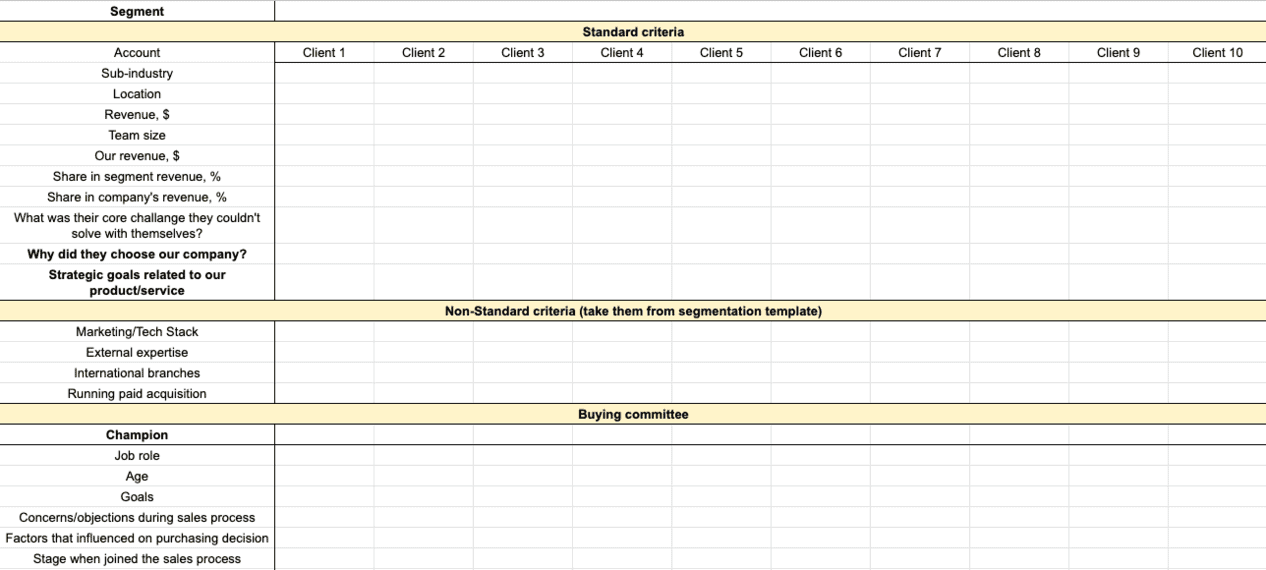

3. Select the 10 best customers and fill in the ideal client profile template

The next step is filling out the ICP template.

As a rule of thumb, I suggest adding only Tier 1 and some Tier 2 companies, but 10 max. You’ll need to analyze their firmographics, buying committee structure, and run in-depth customer interviews.

You can easily find this data from your CRM or LinkedIn.

4. Define and enrich the buying committee.

Our next step is to define the buying committee. There are several ways how we can do it.

The first step is to analyze CRM and talk to sales.

In CRM, check who was in the email thread. Look for replies and CC. The sales team might provide you with more insights. Ask them:

- Did the Champions or Decision-makers mention anybody from their team whom they want to talk to?

- Did anybody else from the client’s team join the calls/meetings?

Once you figure out these people, open LinkedIn Sales Navigator, and find them. If you don’t see them on LinkedIn, search on Facebook and Twitter.

If you still can’t find the buying committee members, here is a step-by-step process for you.

Export from CRM your clients’ emails to a CSV file (a plain text file that contains a list of data) and upload them on LinkedIn.

Go to My Network –> More Options –> Upload file and upload a file with the contacts of your customers. LinkedIn will show you their profiles.

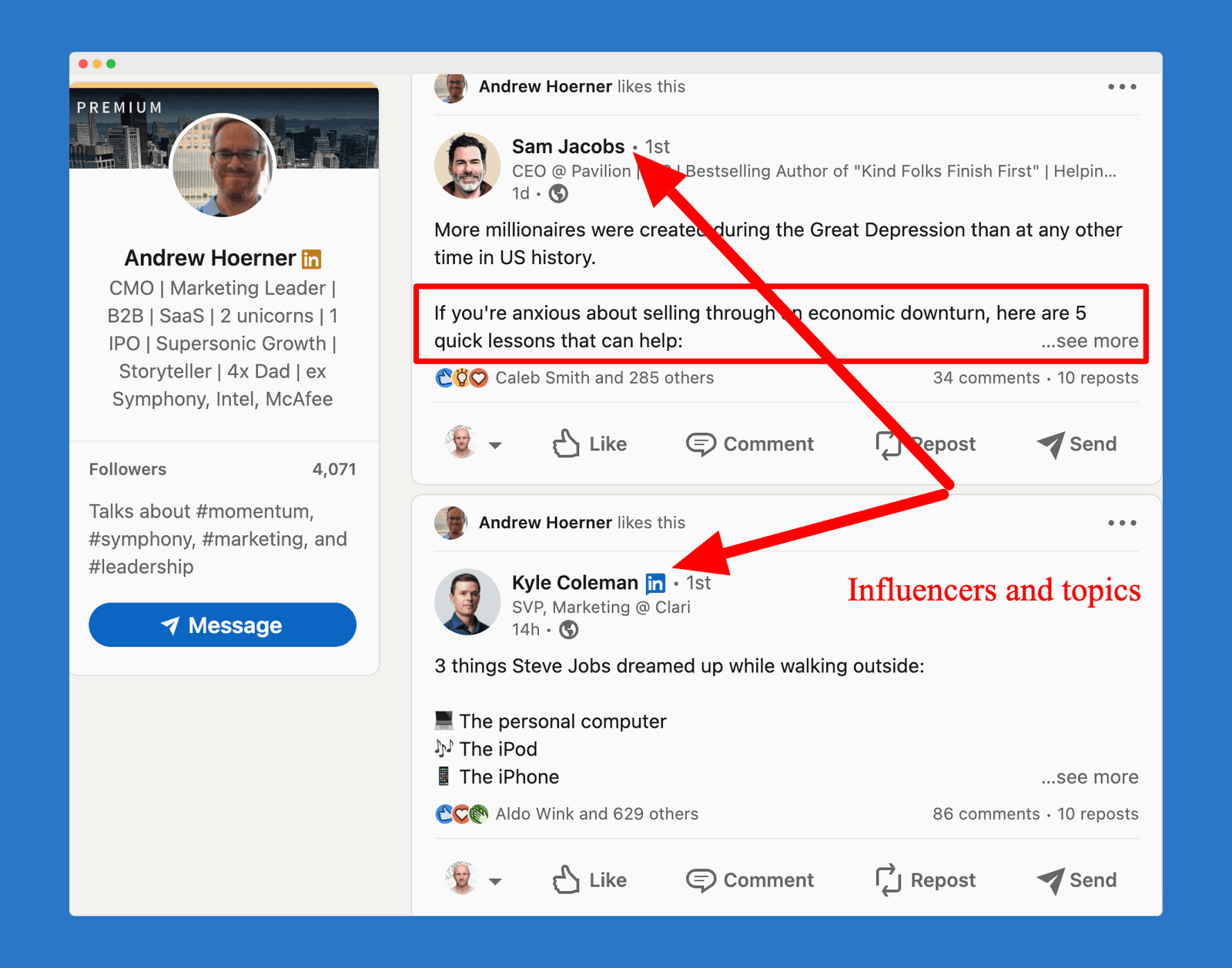

Once you finally find the buying committee members, copy to the ideal customer template their job roles, age, and social media activity (Do they post anything? How often?).

As well, I recommend checking who they follow and engage with.

This is the easiest way to identify influencers and media for co-marketing and content that resonates with your target audience.

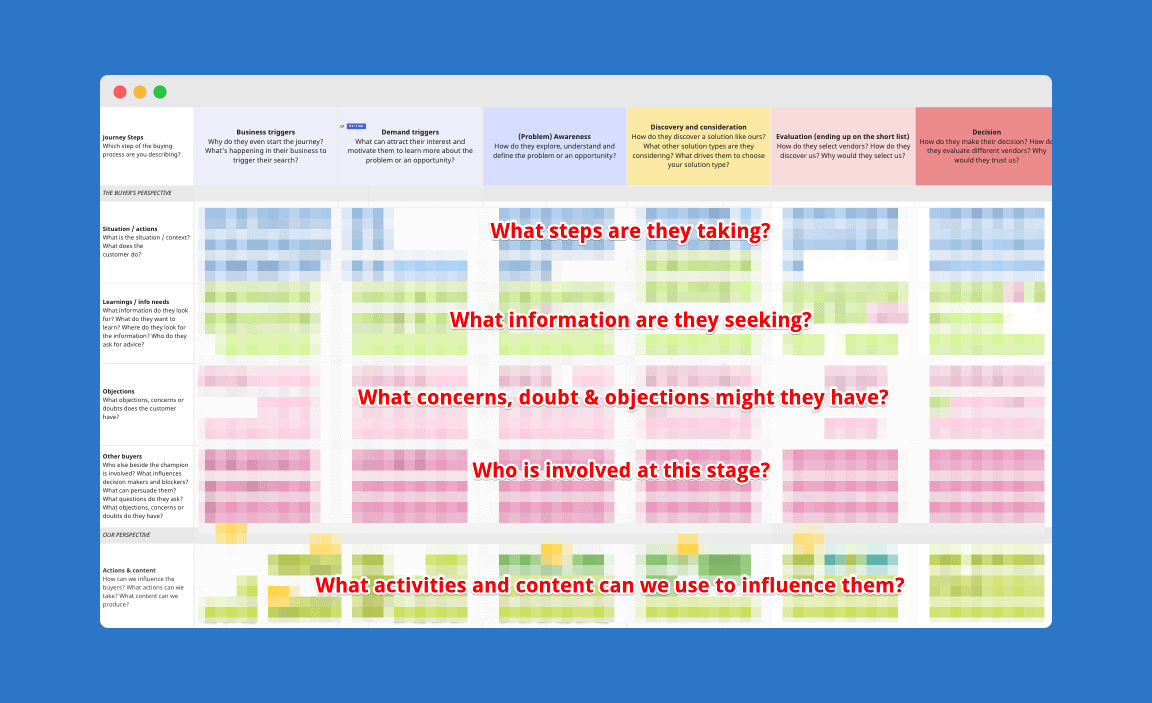

Now, that you’ve collected the public information, time to analyze the buyer journey.

5. Analyze the buying process

Here are three steps to analyze the buying process.

1. Interview your sales team

During the interview, ask your sales team the next questions:

- What were the goals of each of the buying committee members?

- What concerns or objections did you face during the sales process? At what stage did the objections appear, and why? How did you handle the concerns?

- What factors influenced the purchasing decision of every buying committee member?

- When every buying committee member joined the conversation?

- What are the benefits every buying committee member gets from our product? Ask about personal gains and the benefits their department gets.

2. Analyze emails and sales calls

Besides interviewing a sales team, I recommend running a manual analysis of all sales calls and emails.

If you aren’t interviewing sales about the fresh deal, it’s obvious that they can forget the details and share only what they remember.

If you do additional research and analyze sales calls and emails, you’ll be able to figure out way more objections, concerns, and doubts. This information will help you to improve your marketing message and prepare a buyer enablement program.

3. Run in-depth customer interviews

The last step is vital but most B2B companies never do it – in-depth customer interviews. Your ICP and GTM strategy should be based on customer insights, not assumptions.

We’ll cover the process in the next step.

6. The Diver Survey Method: enrich the ideal customer profile with in-depth customer interviews

Your ICP won’t be complete without understanding how your customers are buying and why. The only way to figure it out is by hosting in-depth customer interviews.

As I mentioned in the beginning, here are 6 groups of questions you need to ask.

- Buying triggers. What leads them to start looking for products like yours)

- Research process. Where and how do they search? What information they are looking for?

- Decision-making process. What influences their decision? Who is involved in the product approval process?

- Value they got from the product.

- Goals, needs, and challenges.

- Channel presence. Where do they get industry information? Whom do they follow?

Here are typical questions from each of the groups:

- What was going on in your business that made you want to seek a solution like ours?

- When looking for a solution like ours, what steps do you usually take?

- What factors influence your purchasing decision?

- What are your current challenges?

- What are the problems our product solves for you?

- What might happen if these problems won’t solved?

- Why did you choose our product?

- What do you love most about our product?

- Are you satisfied with everything (quality, service, support, results, etc.), or something that can be improved?

- What features you’d like to see in your product?

- Can you give a testimonial or would you recommend our product?

- What social media do you regularly use?

- Which industry blogs, websites, or influencers are you following?

- Who of your colleagues was involved?

- How did you introduce our solution and the proposal to the management?

- Did you get any questions from other colleagues?

You can download the complete questionnaire here.

The insights you’ll gain not only will help you to develop a better ICP but amplify your value proposition and positioning, help to differentiate your brand, and align your marketing and sales with the buyer’s journey.

Tune in below to my interview with Zineb Layachi where we dive deeply into the art of running customer interviews.

Initially, it is a time-consuming process, but I highly recommend to incorporate it into your onboarding and client success processes.

Split the questionnaire, define the timeline and regular talk to your customers.

7. Combine the data and fill in all the 5 pillars of your ICP.

The last step is the easiest one.

Combine the data and fill in the ICP template. Next, present the ICP to senior leadership and sales, and get an alignment on it.

A part of Fullfunnel.io Ideal Customer Profile description

The process I’ve just described is valid for established B2B companies, but what if you are a startup and don’t have enough customer data?

Let’s quickly cover it.

[cboxarea id=”cbox-Xl24t1Q5y2p8mA4x”]

How to create an ideal customer profile for a new product or a new market segment if you don’t have customers yet?

Great question!

Here is what I recommend doing.

1. Leverage your network.

1. Make a list of the top 100 customers from this market segment.

Think about the customers that you want to do business with. You feel you are a great match.

2. Define a buying committee.

Make a hypothesis about the buying committee and write down the appropriate job roles.

3. Find the buying committee.

Find these people on social media (LinkedIn, probably, would be your go-to channel) and collect public information about them (check Step 4)

4. Connect with them.

Send these folks a connection request and invite them for lunch (if you are in the same city), or ask if they are available for a quick chat about problems your product solves.

You don’t need to pitch or mention your product at all. You can say:

Hey Andrei.

Every week I meet/talk with Job Role from INDUSTRY to discuss the CHALLENGES. During the last couple of weeks, I met/spoke with FULL NAME, and he provided insights on the TOPIC.

I love what you guys are doing at COMPANY and wanted to invite you for a lunch/quick chat to share your insights and see how we can be helpful to each other.

Are you open for 30 minutes lunch/15 minutes call?

Cheers,

Andrei

5. Follow-ups.

If you don’t get a reply, you can send several follow-up emails and send a private message on social media

6. Interview.

If you got a positive response, try to interview them with the questions from Step 6

Here is a caveat.

Instead of asking: «What do you love most about our product?» ask them: «What do you like most about the products that solve these CHALLENGES?» 🙂

2. Leverage communities.

1. Make a list of target communities where this audience might hang out.

Usually, these are Facebook, LinkedIn, or Slack groups. Our Trenches community might be a good fit for you 🙂

2. Join these communities and become active member quickly.

It’s really simple. Introduce yourself, mentioning what you are working on now, what kind of help you are looking for, and how you can help other community members.

Start answering questions and ask yours. Connect with admins and ask how you can help them.

In two weeks, you’ll be a prominent and well-known member of any online community. Believe me, as a long-time community admin :).

3. Reach out to the admins and share your challenge.

Ask whom they recommend you to talk with and can then connect you with them. As well, ask if you can make a post that you are looking to chat with ten people regarding the problems your product solves.

In most cases, you’ll get a positive reply and valuable connections.

You can thank me later. 🙂

One caveat: once you’ll finish your research, don’t leave or forget about the community. You can decrease your engagement, but don’t forget to visit it from time to time. Who knows when you might need help again?

When you get your first customers, return to this guide, and repeat all the steps.

The 5W technique or how to validate your ideal customer profile

One of the most common questions I get about the ideal customer profile is: how to be sure I did everything the right way?

Here is a 5W technique that will help you to validate ICP.

1. Who is my best customer?

At the beginning of this guide, we talked that all customers weren’t created equal. Be sure that you’ve analyzed your best customers from a particular market segment and didn’t add mix it with customers from other segments.

If you have doubts, double-check your CRM and filter it by segments and average deal value or LTV.

2. Why do they buy my product?

Theodore Levitt is known for the famous quote when he said:

People don’t want to buy a quarter-inch drill. They want a quarter-inch hole.

You should apply the same approach when analyzing what problems your product solves. It will help to get more clarity on how to approach and prospect the companies that are similar to your best customers.

3. Who influences my deals?

Don’t forget that in B2B, you usually deal with a group of people we call the buying committee. Some of them influence your deal directly, while others (influencers and blockers) can impact it in the latest stages.

You need to think beforehand about how to engage with the entire buying committee. As well, as how to motivate all the members to move further with your deal.

4. Where can I find them?

You need to figure out what channels you can use for prospecting and lead generation. The only way to figure this out is to analyze the social media activity of your best customers and run in-depth customer surveys.

When you obtain this information, you’ll never need to ask yourself what channels should I try.

5. What influences their decision-making process?

The last question helps you understand the typical buying process and the customer journey of your best customers.

You can leverage this information to improve a content strategy, prospecting, lead nurturing cadence, sales enablement, and sales processes.

As well, this information helps you to understand how to improve a company’s positioning and unique value proposition.

The most common mistakes with ICP

1. Mixing customers from different segments.

Once I had a conversation with the B2B SaaS founder who sells a $10k enterprise solution.

When I asked about target market segments and ideal customer profiles, he answered that his target audience is marketers and BDMs from North America.

– Really? I asked. Will you treat a request from a marketer or BDM as a high-quality lead despite market segment, team size, or revenue?

– Yes, he answered.

– So, if a marketer of an early-stage startup or from the FMCG market will reach out, you’ll be able to help him?

– Oh, no. We don’t work with an FMCG, and early-stage startups can’t afford our service.

Should you be surprised they were struggling with lead generation?

Mixing customers from different segments leads to a “one size fits all” customer profile and, as a result, to problems with positioning and targeting.

2. Define ICP by firmographics only.

Just knowing that your ideal customer is a B2B service-based company located in the US, Canada, or Australia with a team size of 20-50 people and annual revenue of around $500k, won’t help you for better prospecting.

Yep, you definitely will narrow focus, but there is still a big market to prospect.

You need to segment prospects by tiers, define account qualification and disqualification criteria, and understand how your prospects are buying.

3. Forget about the buying committee.

The next typical mistake is to focus on firmographics only and eliminate the buying committee.

There is a famous quote: People buy from people, not businesses.

So when making a list of target accounts, you need to add people you’ll be prospecting.

But who you’ll add to the list?

Senior executives only?

Think beforehand about who are the buying committee members inside your target prospects, and understand the reasons why they can buy your product and their motives not to buy.

4. Assume how the buying process looks like instead of learning from customers.

The only way to understand what motivates your buyers to move forward or block your deal is through in-depth customer interviews. Period.

Next Steps (W/Free ICP Template)

You can have the most advanced sales & marketing stack.

You can get the most creative copywriter to write your cadence. Or the best designer to create display ads.

But if you don’t know:

- who exactly you are prospecting,

- why and how do they buy,

- who and what influences the buying decision

Your marketing and sales are doomed.

Your teams should have a clear alignment on ICP. This guide gives you step-by-step instructions on how to achieve it.

Click here to download a PDF copy, ICP template, and in-depth interview questionnaire.

Learn more about the ideal customer profile

Here are some more steps for you if you want to learn more, have any questions, or need any help:

- If you want to understand the entire market segmentation process and look over my shoulder at how I create ICP live, join our full-funnel marketing strategy course.

- If you need help with defining ICP, book a call with us here.

- Join our Trenches community