In this guide, I’m going to share with you a step-by-step framework we use to develop a GTM (go-to-market) strategy for B2B companies that helps you to sell the way your best customers are buying, including market segmentation, ICP, buying journey, marketing planning, and reporting.

This is the exact framework we used to help:

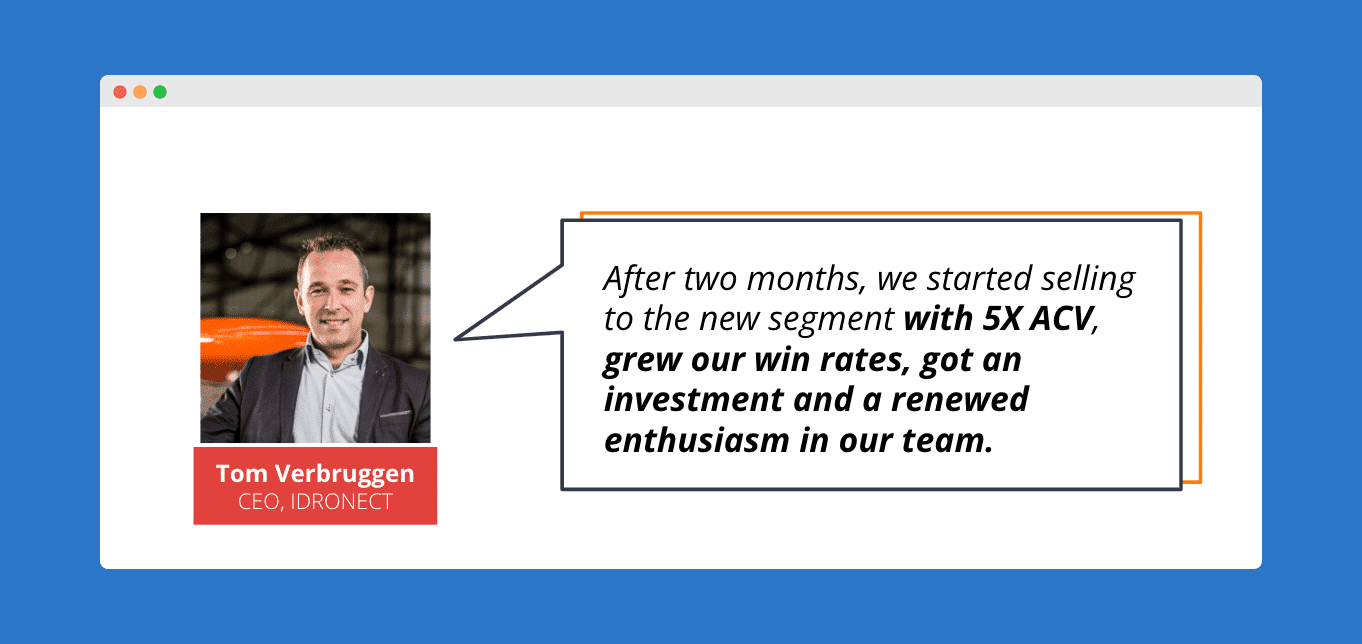

- Idronect, the drone business management platform, to sell to the new, most profitable segment, 5X ACV, grow win rates, and get an investment

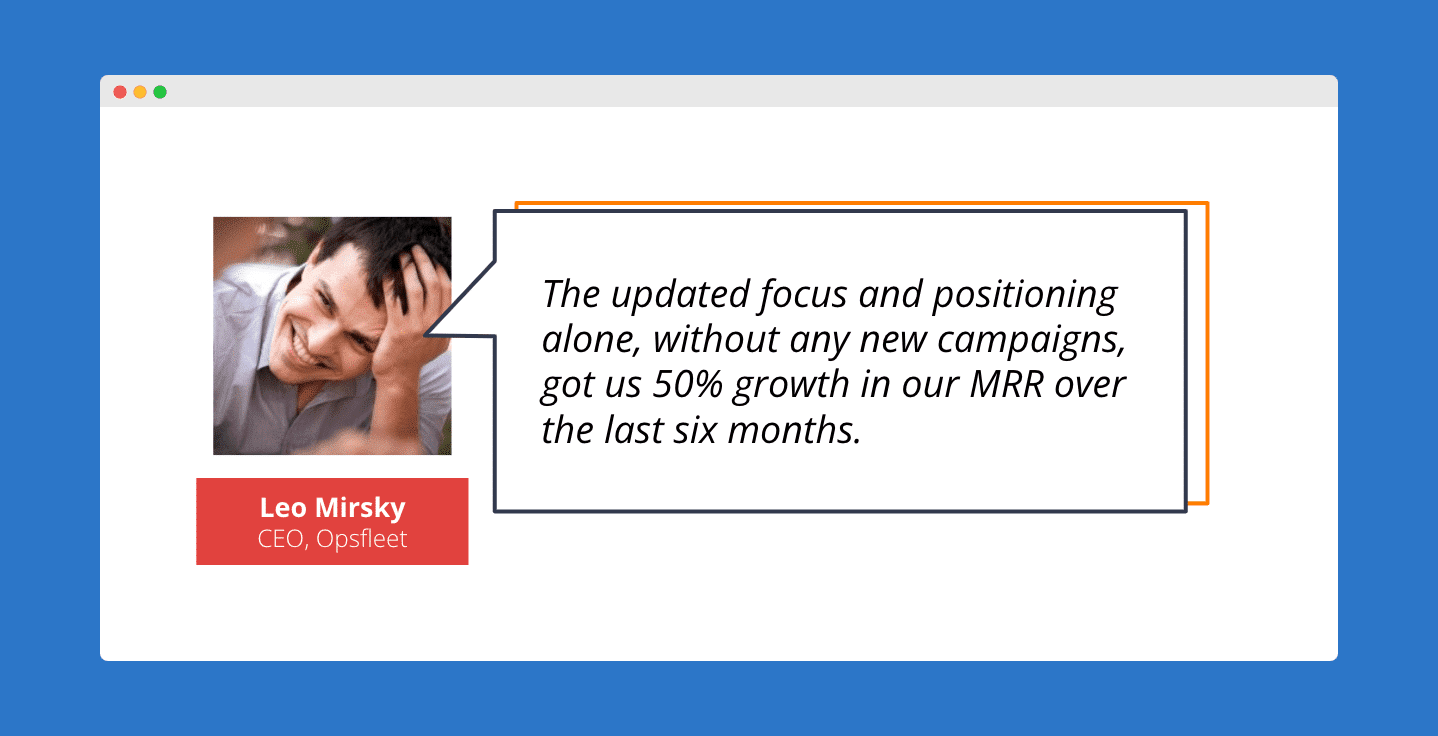

- Opsfleet to change the positioning, and complete makeover of the sales materials and processes that generated 50% growth in their MRR in six months.

- PGS software to develop an effective B2B marketing function

Let’s dive in.

What is a GTM strategy?

Let’s start with the definition.

Too many B2B companies think that marketing strategy is a 40-page document about mission, values, and other corporate fluff nobody cares about. I’m a big fan of simplifying things, so the way I define it is:

GTM strategy is a clear path from point A (where you are now) to point B (revenue targets and other objectives) with necessary resources (people, tech stack).

To develop an effective B2B marketing strategy you need to answer these 6 questions:

- Who are you going to market?

- How are you going to stand out and differentiate your product while resonating with target buyers?

- Where these buyers are searching for professional information, and how do they buy?

- How are you going to attract their attention and make them interested in your product?

- What skillset and budget do you need?

- How will you measure the efficacy of your strategy?

While it sounds obvious, most B2B companies I know can’t clearly answer these questions. Here is how the majority of them market and sell.

How most B2B companies market and sell, and the ugly truth behind it.

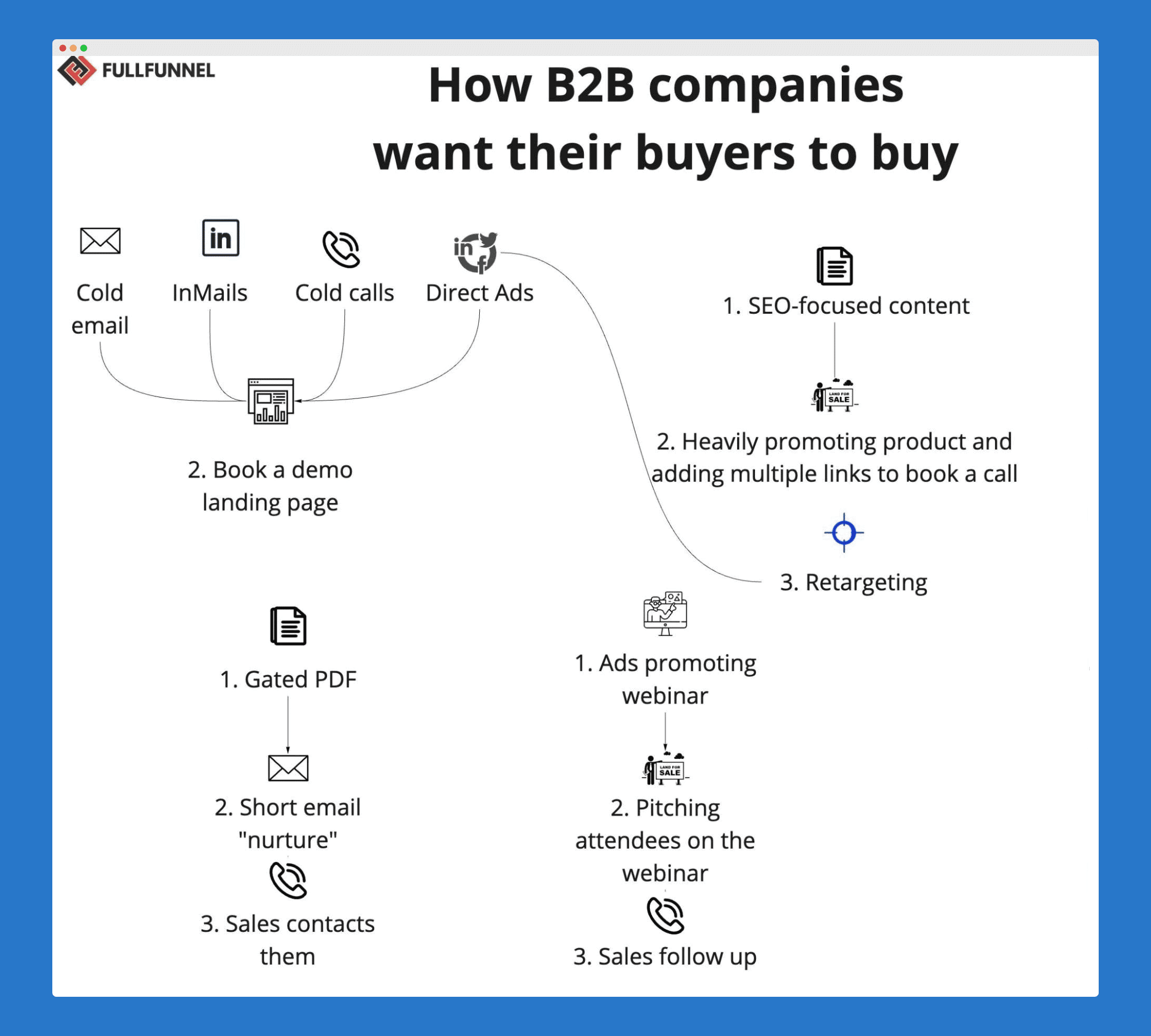

When I ask to describe a marketing strategy, quite often B2B marketers start immediately talking about the tactics.

Here are the most popular ones:

1. Promote gated content and webinars that are wrapped as “value educational” events, and transfer the contacts of everybody who downloads PDF or signs up for the webinar to sales.

The ugly truth: A download or a webinar registration is NOT a buying intent. B2B buyers don’t download an e-book and get “nurtured” into an opportunity with a 5-email sequence. They ask their network and buy from people they know, like, and trust.

2. Drive cold traffic via ads or emails to the landing page promoting a demo or a trial.

The ugly truth: If you’re running ads on social or sending emails, you are effectively wasting 97% of your budget. These are not intent channels, and only a small percent of your market is actively buying.

Even if you consider that 3% of companies who are in the buying mode are enough to target, you’re already late. There are companies that have a better brand, market presence, and recognition.

You don’t have trust and credibility and will be dealing with extremely high cost per click and cost of acquisition. The win rates will also be low since you’ll always be compared to other vendors.

3. Publish occasional updates on the company’s social pages about the investment raised, won awards, or events the team has attended.

The ugly truth: Nobody cares about tradeshows or conferences you’ve attended, funding (aside from SDRs who’ll use it as a trigger to attack you), pictures from your corporate events or awards you won.

It provides 0 value to your buyers and doesn’t generate demand to purchase your product. The only engagement you can get is from other team members who’ll like the post.

But you have Teams or Slack for it 😉

Here is the truth.

People don’t open LinkedIn, Twitter, or Facebook because they want to find a new product.

They open it to see updates from communities, peers, and thought leaders. They come for content and entertainment. But here is a caveat I’ll cover in the next section.

4. Publish content in their blog focused on keywords with high traffic volume and written by low-quality writers.

The ugly truth:

Most B2B companies hire cheap SEO content writers that find keywords with high traffic, analyze the 10 most popular articles, and just rewrite the summary of these articles adding your product features.

This approach is doomed.

Even if you’ll be able to rank, the chances that this content will generate inbound opportunities are closer to 0.

Low-quality articles covering the basics (e.g. How to develop a healthcare mobile app) are rather moving people away than generating demand for your product.

Your buyers don’t need MORE content. They need better, high-quality content that answers specific questions they have as they move through the buying process.

Look at Sales Hacker’s case study on how they grew revenue and traffic by focusing on high-quality content.

Think about this.

What if marketing stepped out from the keyword research for their content strategy and set down with sales asking about questions, concerns, needs, and challenges across the buying journey?

What if sales invited customers to contribute to the content?

Then content starts resonating with a target addressable market.

Sales proactively distribute it to the target accounts because they have a good reason for a non-sales touch.

Customers happily share the content inside their organization and with their network.

Sales get lots of pieces of content to share on social media.

This simple shift leads to inbound opportunities and opens doors to engage target accounts way better than expensive ip-based ads, gated ebooks, or virtual events your audience doesn’t care about.

If you want to launch effective virtual events, check out our ABM tactics guide where we share a campaign that generated 5 clients and 34 sales opportunities from a virtual summit. Read it here.

5. Automated email & LinkedIn outreach.

The ugly truth: Ask yourself when you last time replied to a spammy email or message from an unknown SDR? Your buyers are not different.

6. Purchase modern marketing software without establishing processes for leveraging it.

The ugly truth: No software will ever replace GTM strategy, marketing function, and marketing operations. Software only helps to automate, accelerate or refine the processes, but you need to create them first.

A fool with a tool is still a fool.

What do these outdated tactics have in common?

They ignore the reality of the modern buying process. They are based on how B2B companies want to sell, not on how their customers buy.

Here are the “outcomes” these companies get:

- Miserable “lead” to opportunity conversion and endless debates about the quality of the leads

- Growth is not stable and depends on referrals and sales function

- High CAC (cost of acquisition)

- Very long sales cycle

Here is the truth.

All marketing tactics will suck until you nail down the fundamentals – your GTM strategy.

In the next section, I’m going to reveal our 10-step framework to nail down each of the elements and develop a full-funnel B2B marketing strategy.

How to develop a Full-Funnel GTM Strategy: 9-steps framework

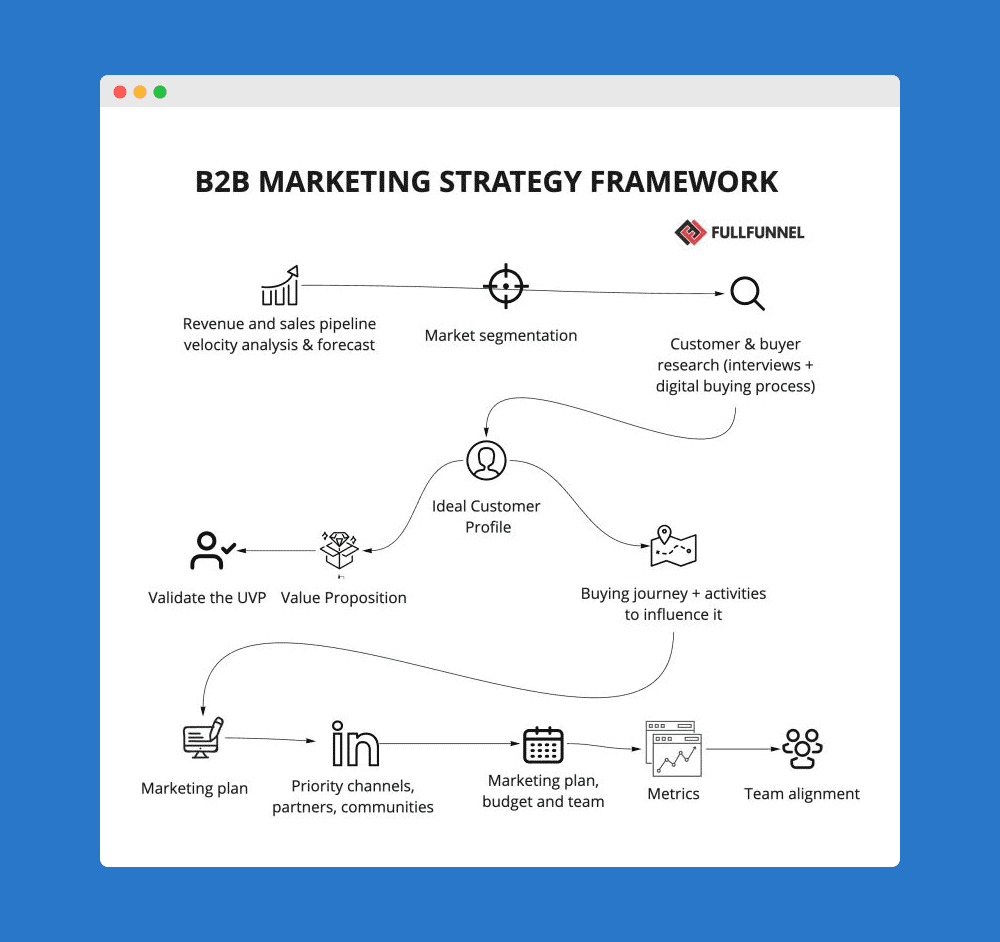

Here are 9 steps we use to develop a GTM strategy (you can use it as a GTM strategy template).

1. Full-funnel analysis and sales pipeline velocity to set up realistic revenue goals and objectives.

The first step is always an analysis of where we are and where we can realistically be. We dive deeply into 4 areas.

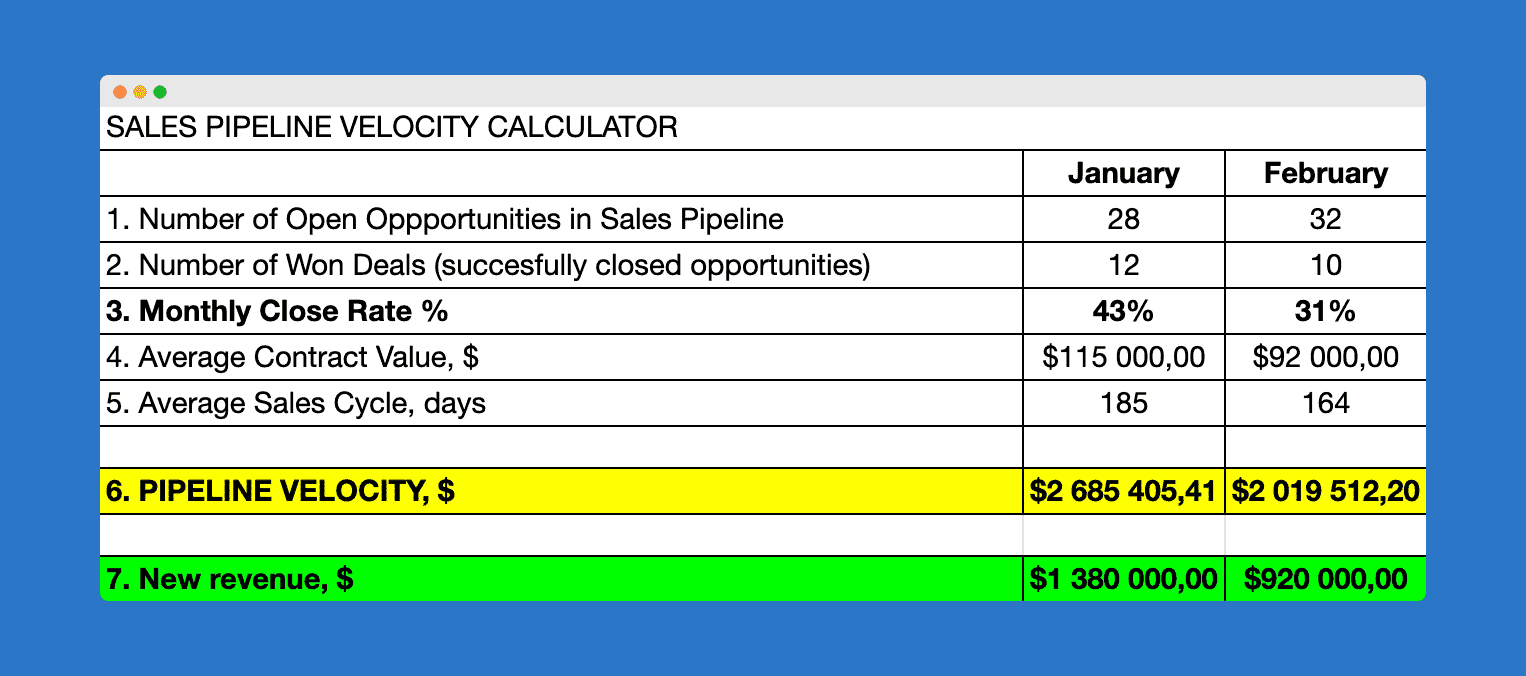

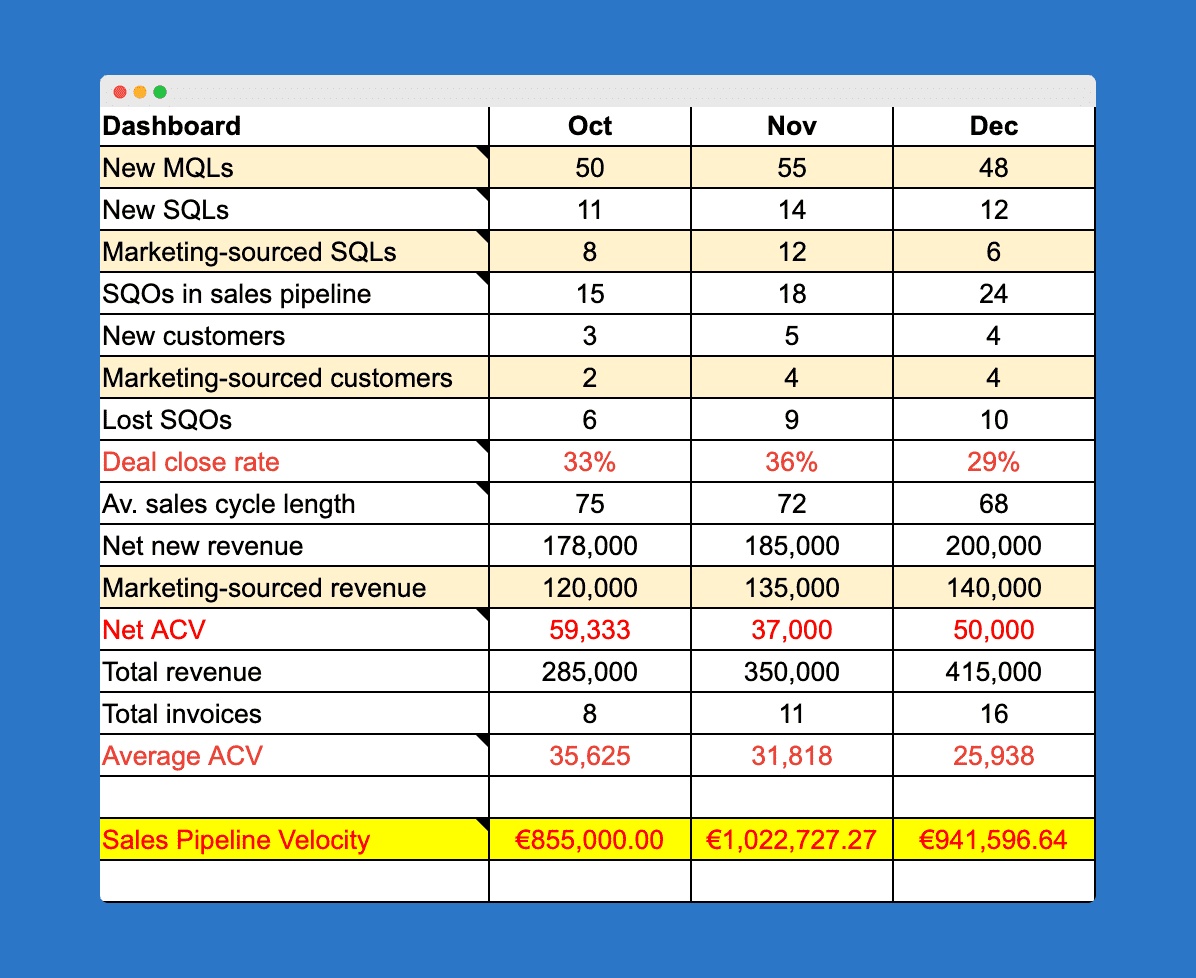

1. Sales pipeline velocity or where we are currently

Sales pipeline velocity shows us the revenue trajectory according to your sales cycle length, ACV, win rate, and the number of generated sales opportunities.

By analyzing a year-to-date we can clearly see the efficacy of marketing and sales processes and their impact on revenue.

P.S. We use sales pipeline velocity when mapping out the B2B sales funnel as a part of a full-funnel strategy. You can also get a copy of it by subscribing to our Full-Funnel Insider newsletter below.

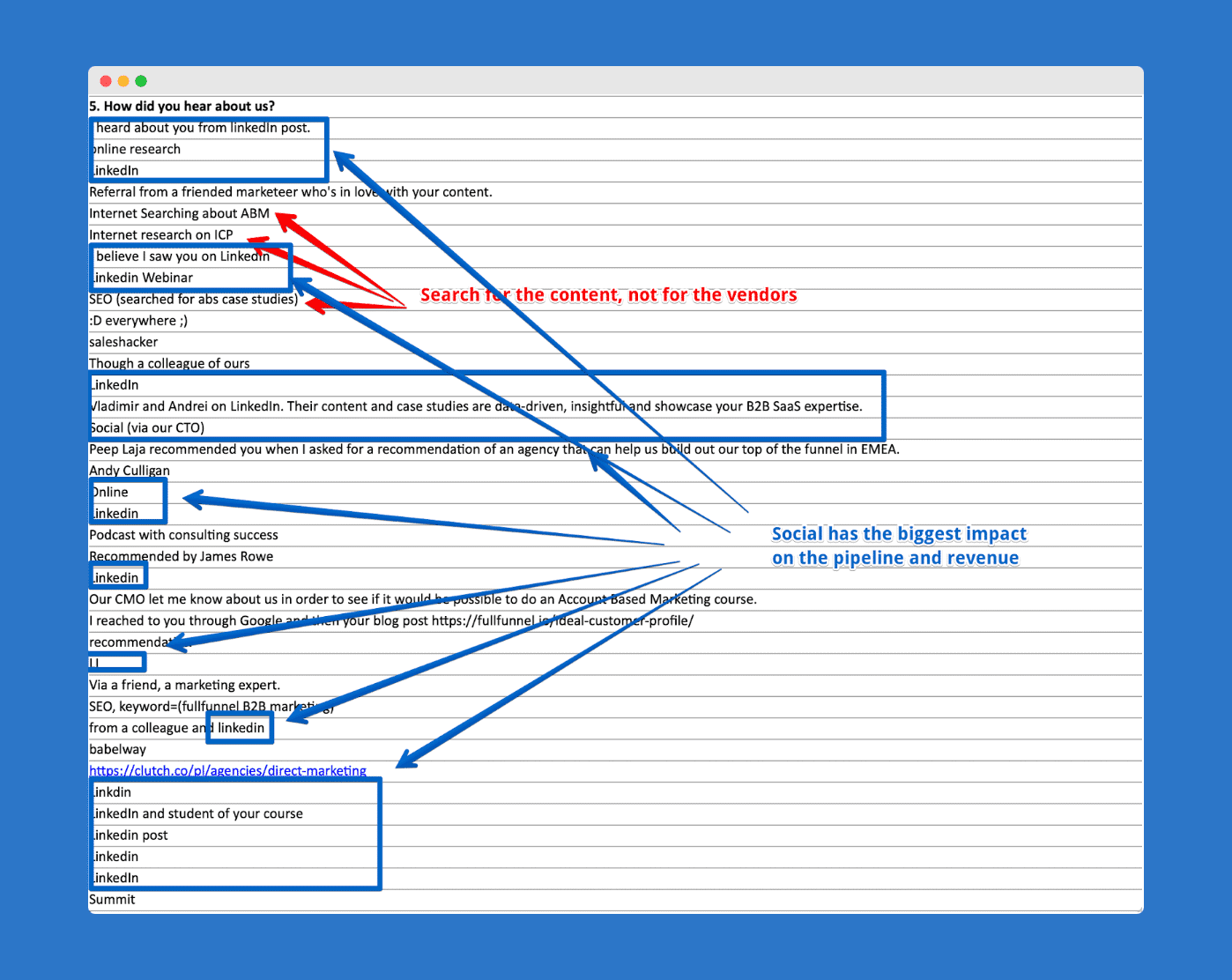

2. How do we grow currently?

The next step is understanding what helped us to achieve the current numbers.

Referrals? Retention? Thought leadership on LinkedIn? Outbound programs?

One of the most important insights you can get is by analyzing all the year-to-date won deals and looking at the “How did you hear about us?” column to understand the channels and programs that source the pipeline.

If you don’t have these insights, try to call or send a survey to your customers.

The insights won’t be precise since some time has already passed from the moment of purchasing your product, but it’s better than nothing.

The next step is analyzing the full funnel to identify the weakest and strongest stages, and friction points at each of the stages.

3. Challenges and full-funnel analysis.

As a first step, I recommend having a conversation with your senior executives, marketing, and sales team about the challenges the company currently faces.

You should give everyone a chance to share the challenges and bottlenecks that are preventing them from reaching their goals. Next, prioritize the top challenges that must be addressed.

The next step is putting these challenges into a business context.

Ask your team questions like:

- What’s the biggest risk to our business right now?

- What would be the impact on the business if we won’t solve the challenges and won’t’ mitigate the risks?

- What happens if we solve it? Is this part of a larger plan, or a standalone project?

You’ll get a big picture and will be able to align your marketing strategy with it.

After the interview, I recommend running a full-funnel analysis.

Start with analyzing what works, what doesn’t, and why by diving deep into the existing marketing and sales funnel, programs and campaigns.

The goal is to understand what’s working, what’s not, and why—and to identify other bottlenecks and challenges.

Interview people who were in charge of specific campaigns and get their opinion on why some campaigns and processes worked well and why some failed.

The last step is a marketing audit.

Dive deep to identify the root bottlenecks, often found in ICP, value proposition, content strategy, customer journey, friction points, missing out on opportunities to expand and upsell, etc.

Here is a collection of standard friction points I see at B2B companies.

Marketing

- Hide the product price on the pricing or demo request page.

- Vague, broad copy that doesn’t describe what the product does

- Lack of product tour/product overview or GIFs describing core features

- Calling «leads» email subscribers, companies that visit the website, click the ads, webinar attendees or people who downloaded gated content, and sending them to sales

- Website doesn’t explain the promise you make in your ads

- Lack of alignment with sales on ICP, account qualification and leads handoff.

- Lack of buyer enablement content to help buyers find the answers to their questions and make the right decisions

Sales

- Demo request call doesn’t redirect to the calendar, so a prospect should wait for the email reply.

- Demo request is substituted by discovery call where SDR asks a bunch of BANT questions and then books a call with AE, instead of finding the prospect’s needs and showing how the product can help.

These friction points should be added to the marketing plan.

4. Goals and objectives setting.

You definitely need to involve your leadership and key people from your sales team.

You can’t just accept the revenue target aka “We want to generate $20 mln in ARR next year” when you generate $3 mln in ARR.

Play together with the sales pipeline velocity calculator. Increase different revenue metrics and look at the impact on revenue trajectory.

I suggest building 3 scenarios:

- Pessimistic

- Standard

- Optimistic

Set up your revenue forecast based on the standard forecast, but also make sure to present a pessimistic scenario and reasons why it might happen (e.g. new strong competitor joining your market).

Aside from revenue goals, you’d set up objectives based on the full-funnel analysis.

Put the key people from sales, executives, and marketing together, and get clarity and alignment on the goals and priorities.

Objectives could be about raising brand awareness in a specific market, improving client onboarding and satisfaction, improving marketing message, etc.

For every objective, you’d set up specific indicators to measure the progress.

E.g. Raising brand awareness -> Getting at least 10 inbound inquiries from a specific vertical.

I’ll cover the metrics later in this guide.

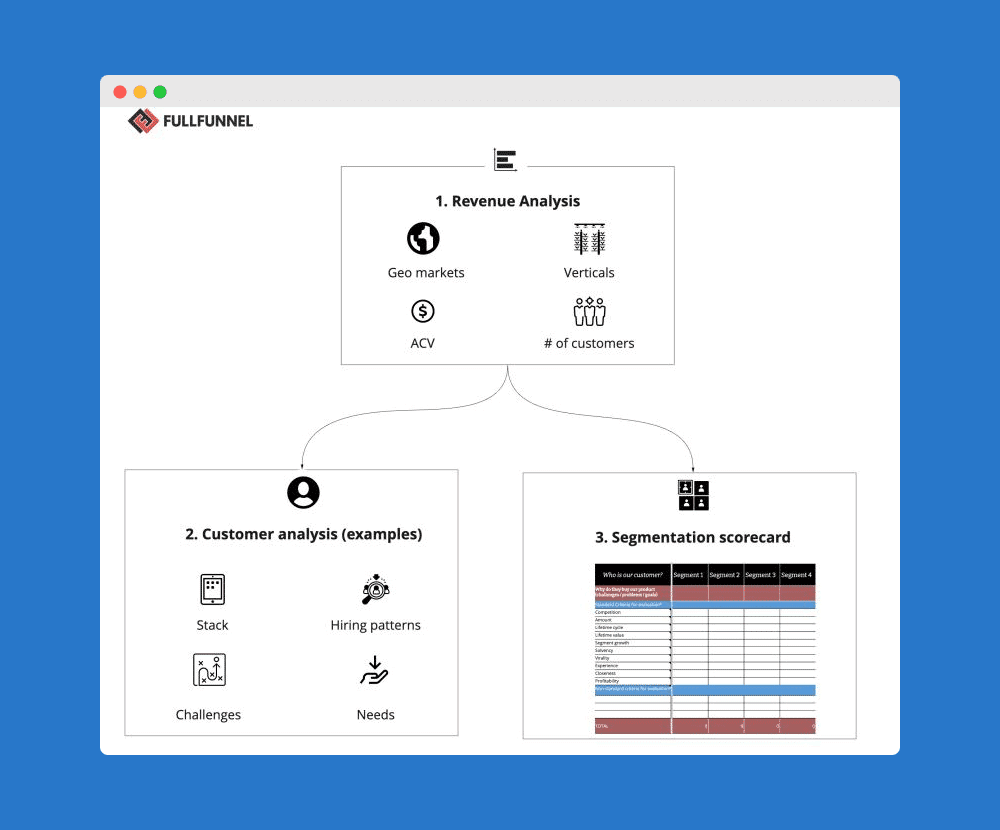

Everybody who says that ICP is the first step (after goals, objectives, revenue analysis, and role of marketing) in developing a GTM strategy makes a huge mistake.

The first step is market segmentation.

While on the surface your buyers purchase products to solve a common broad need (e.g. automate processes), in reality, every segment has different needs, different reasons to buy, and a different buying process.

Hence, ICP should be created separately for every market segment that you are going to target.

Not all segments were created equal.

Some of them are easier to target. Some of them have a higher purchasing power. Some of them are growing or stagnating.

Finding the most prolific and lucrative market segments can have a HUGE impact on your GTM strategy and revenue.

Here are 3 steps we use to define the most lucrative market segments.

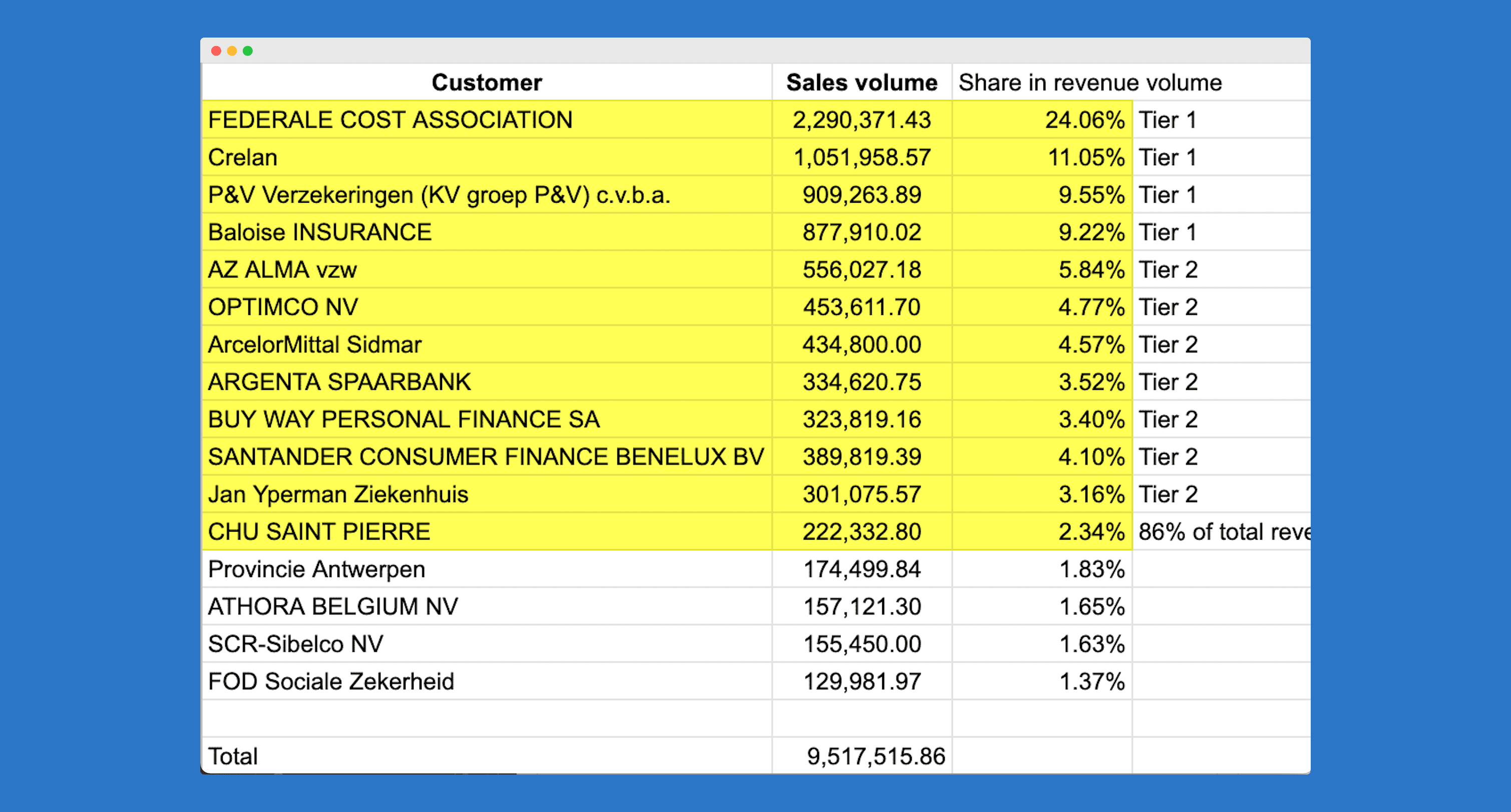

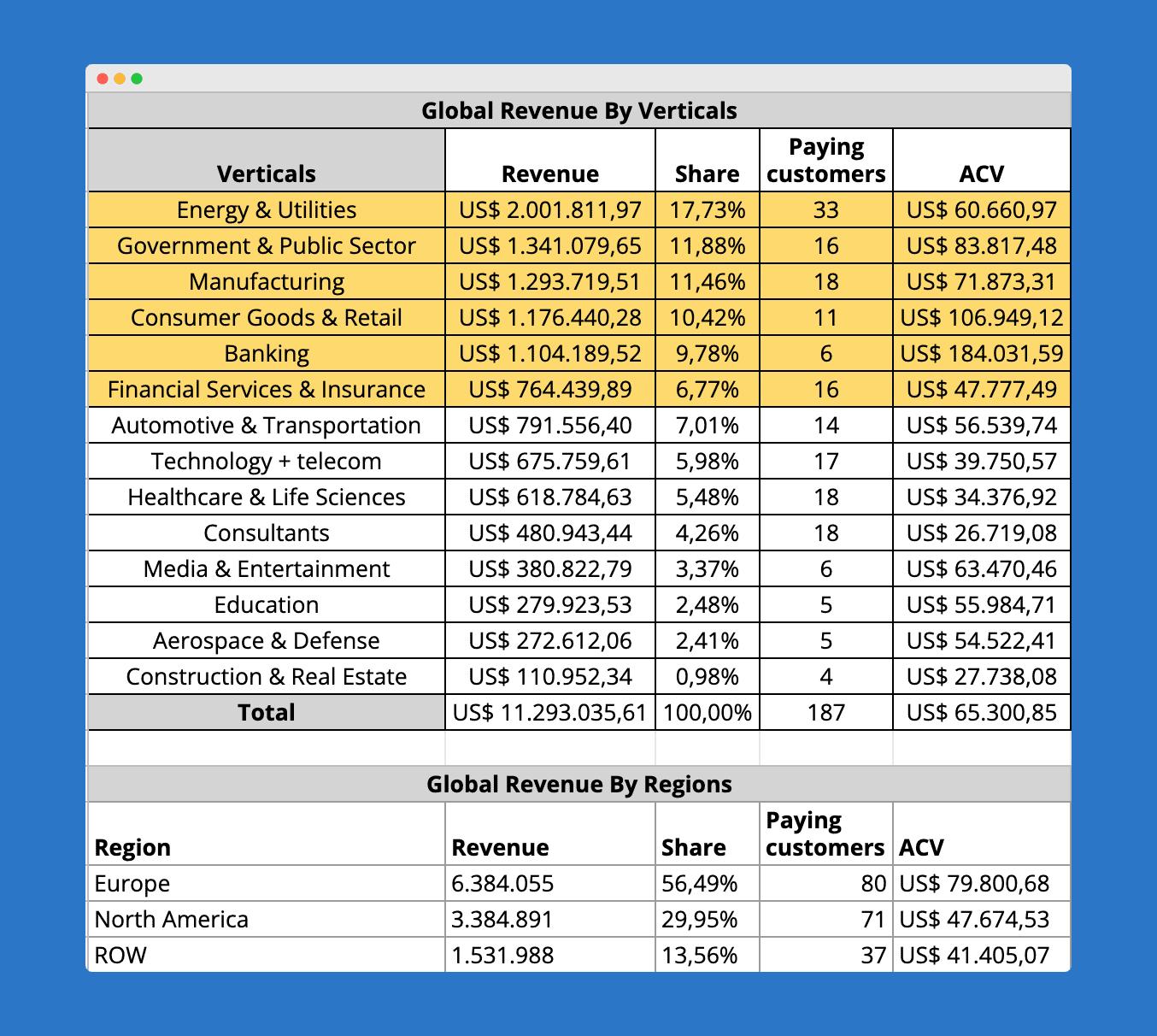

- Revenue analysis by geo markets and verticals.

We look at historical revenue, churn rate, ACV, and the number of customers to define the first set of markets and segments to focus on.

Usually, you’ll end up with 5-7 segments that generate >80% of revenue.

2. Analyze the best customers from these segments.

What commonalities do these companies have?

E.g. They are actively hiring for a specific role (VP of innovation) or the export dominates in their sales.

These criteria will be used as non-standard segmentation criteria in a market segmentation scorecard.

We have a defined set (which can be tweaked) of standard segmentation criteria including

- Competition

- Segment size

- Lifetime value

- Segment growth

- Purchasing power/price sensitivity

- Advocacy potential

- Track record

- Decision-maker accessibility

- Profitability

The next step is scoring segments through the non-standard criteria I mentioned in the previous step.

This way you’ll be able to:

- Get a holistic overview of target market segments,

- Select the most promising segments,

- Create a crystal clear ICP,

- Develop your marketing and sales processes based on how customers from a specific segment buy.

If you want to define the most lucrative market segments to focus on, sign up for our market segmentation workshop. You’ll come up with the results in 90 minutes.

3. Customer research.

I know many B2B companies prefer to skip this process and jump into refining their marketing and sales tactics because it’s time-consuming and «non-scalable». But this is the exact reason why their marketing is pouring more water into a leaky bucket.

Interviewing your customers is the only way to understand how they research & buy products like yours, and what influences their buying decisions.

Here are 6 groups of questions you’d ask your customers during the interview.:

- Buying triggers. What leads them to start looking for products like yours?

- Research process. Where and how do they search? What information are they looking for? What questions do they have when evaluating and comparing different products?

- Decision-making process. What influences their decision? Who is involved in approving the product purchase?

- Value. What business outcomes does the product generate for your customer?

- Functionality. What are the business needs to use the product? What challenges does your product solve?

- Channels. Where do your customers get industry or professional information? Who do they follow?

We cover the entire process of customer interviews and the questionnaire in the ICP guide. Read it here.

The insights you’ll get will help you to

- Better qualify accounts and refine ICP.

- Improve your positioning, value proposition, and messaging

- Improve your sales deck, pitches, and ads

- Create content your buyers are searching

- Adapt your marketing and sales to the way your customers are buying

Tune in to my chat with Zineb Layachi where we are covering the art of running customer interviews.

One fundamental mistake B2B companies make comes from B2C — developing an Ideal Customer Profile (ICP) the way B2C companies do it.

In B2C you are selling to a concrete person:

Mary Jane, a 45 years old mom of two kids, lives in New Jersey, loves Tony Robbins, wants to be a good fit, and goes to the gym 2x/a week.

You end up with a broad group of women who fit these criteria. Your goal is to target them all by promoting a commodity product.

In B2B you’re selling to different market segments that have different needs and reasons to buy.

You can’t sell to “all startups from New Jersey that raised money recently”.

The higher your product ACV, the more specific and personalized should be your targeting and marketing message.

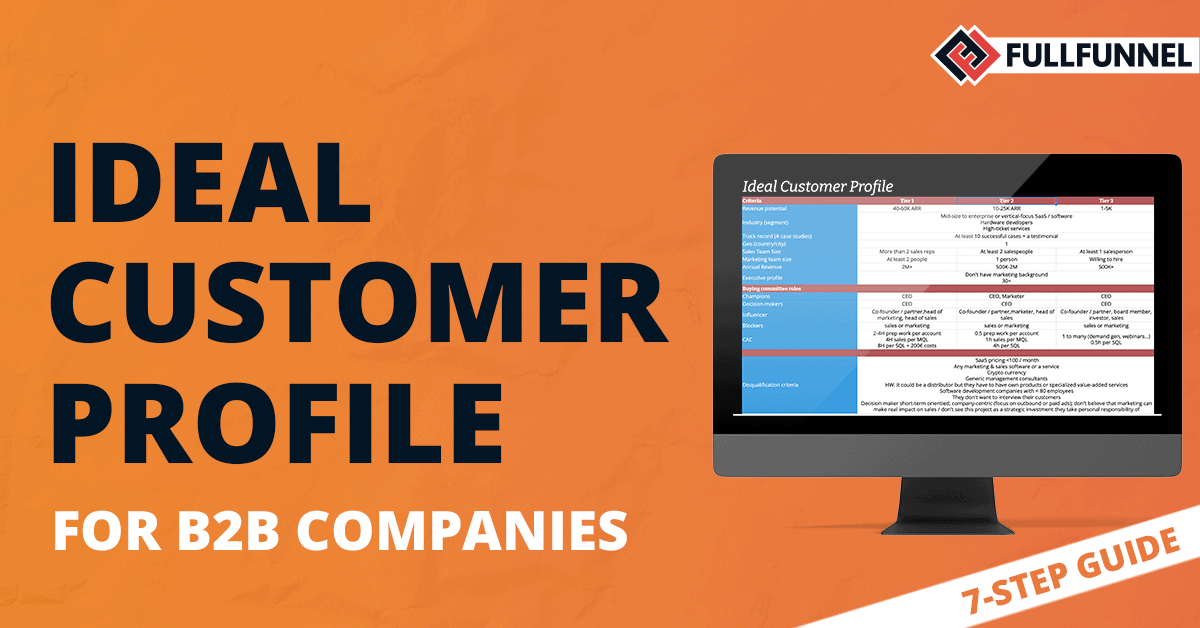

When developing ICP for a B2B company, you need to work on five pillars.

5 Pillars of the Ideal Customer Profile (ICP) for B2B companies.

a. Firmographics.

- Select the top 10 accounts by revenue from a specific segment.

- Define firmographic criteria that are important for you (stack, revenue, location, team size, etc.) and enrich each of the 10 accounts.

- Combine the firmographic data.

b. Buying committee.

You don’t sell to B2B companies, you sell to concrete people that create a buying committee.

Here is a typical buying committee structure in B2B companies.

- Champions.

Champions are usually in charge of initial product/vendor research.

They attend discovery calls with you, prepare comparison reports, and provide info with personal takeaways from calls to the decision-makers.

- Decision-makers.

- Influencers.

Influencers don’t take part in research or negotiations, but participate in vendor evaluation and provide feedback on your offering.

- Blockers.

Blockers are the buying committee members who are not interested in your solution or might see a danger to themselves.

c. Account qualification.

Define tangible criteria:

- What makes an account a good fit?

E.g. ACV is above $50k.

- What makes the account a bad fit even if it fits firmographics?

E.g. The CFO is in the 1st year in a current position.

d. Tier segmentation.

Not all prospects are created equal.

If one company can generate 10x more revenue than others, why should it be prospected and marketed the same way?

e. Account enrichment.

Your ICP won’t be complete without understanding how your customers are buying and why.

The only way to figure it out is by hosting in-depth customer interviews (check the previous step).

I’m not dividing deeply in ICP since we have a detailed guide about developing ICP for a B2B company. Read it here.

5. Positioning and unique value proposition.

After completing 70+ marketing and sales audits, we saw a clear pattern of why most of our clients were losing sales opportunities. Here is the most common reason:

«Our leads don’t fully understand the value of our product and how it is different from our competitors».

Translating it into marketing language, it means:

“We have a broad vague positioning and value proposition that don’t differentiate us from the competition and don’t articulate the value our product provides”.

This challenge is an extension of a previous one – lack of clear ICP.

B2B companies try to satisfy broad, diversified groups of customers with a universal marketing message. As a result, they are always perceived as a mediocre vendor without any added value and compared to dozens of other companies.

There is one more reason why B2B companies are afraid to differentiate – playing safe. Nobody will challenge them if they say:

“Hey, our competitor is saying this. We’d say this as well.”

But you already know how it ends up.

Tune into the live marketing message teardown session we’ve hosted with Peep Laja to see why and how the marketing message of too many B2B companies sucks.

The higher the ACV of your product and the longer the sales cycle, the more specific and tailored to concrete ICP should be your marketing message including positioning and value proposition.

At Fullfunnel.io, we have developed a 4-step framework to create a killer positioning and defined 11 positioning strategies you could use:

- Interview your best customers and learn how they describe the product’s value, its strength, and what makes it different from the competition.

- Analyze your competitors’ positioning and marketing message.

- Pick your positioning category by leveraging one of the 11 positioning strategies to differentiate yourself from the competition.

- Craft a clear marketing message by adding the core product strength, value, and differentiation. Your target buyers should immediately understand what your product does and how it’s different.

- Validate positioning with panel tests. You can use tools like Wynter to get feedback about your positioning ideas and marketing message.

- Refine the marketing message with market feedback and update all your marketing assets (website, LinkedIn profiles, social media pages, sales decks, etc.)

Tune in below to our conversation with April Dunford where we discuss this framework and positioning strategies for B2B tech companies.

You can refine sales cadences, buy a modern sales and marketing stack, test new channels, but before you tailor your marketing message to a specific group of buyers, make it clear, unique and concrete, you’ll never be able to create sustainable growth for a B2B company.

Learn more about our marketing positioning framework and 11 positioning strategies here.

6. Buying process.

B2B buyers aren’t purchasing solutions because of a nice ad, fancy landing page or smart email headline.

B2B purchasing decisions are way more complex and sophisticated. We spoke with B2B marketers from our Trenches – B2B marketing community, and here is how they prefer to learn about new solutions.

1. Ask their peers in the community how they solve a particular issue? What products or vendors will they recommend?

Peers recommendations often become the Top Of The Funnel entry point, not search or paid.

2. Live events of industry thought leaders.

People trust the recommendations of thought leaders and are willing to implement solutions they have heard from them.

3. LinkedIn/Twitter content.

Lots of B2B marketers stated that LinkedIn is the #1 industry and learning source for them. They prefer to connect/follow people that are sharing actionable advice.

The logical solution would be developing marketing and sales processes based on how customers research and buy, but most B2B never do it because

- They can’t attribute it to revenue

- They don’t understand when and how they can generate leads

- It requires investing in demand generation, hiring content marketers, a building owned PR programs that seem to be sophisticated and unpredictable because of the 2 points I mentioned above.

- They don’t understand how to align marketing and sales with the buying journey.

How to align your marketing and sales processes with the buyer journey.

While the processes might vary from industry to industry, the 1st step is always the same – interviewing your best customers (check step 3).

Here are some questions that help to understand the buying process:

- What leads them to buy products like yours?

- What factors influence their purchasing decision?

- What are their current challenges that are related to your business?

- What social media do they regularly use?

- Which industry blogs, websites, or influencers are they following?

- What are the recent webinars they’ve recently attended and why?

The next step is leveraging insights and refining your marketing and sales process.

Based on customer interviews, we extract different triggers that motivate buyers to start looking or learning more about your product.

For each trigger, we map out the steps they take. For each step, map out:

– Buying committee members involved

– Information they sought

– Critical questions, concerns, or doubts they had

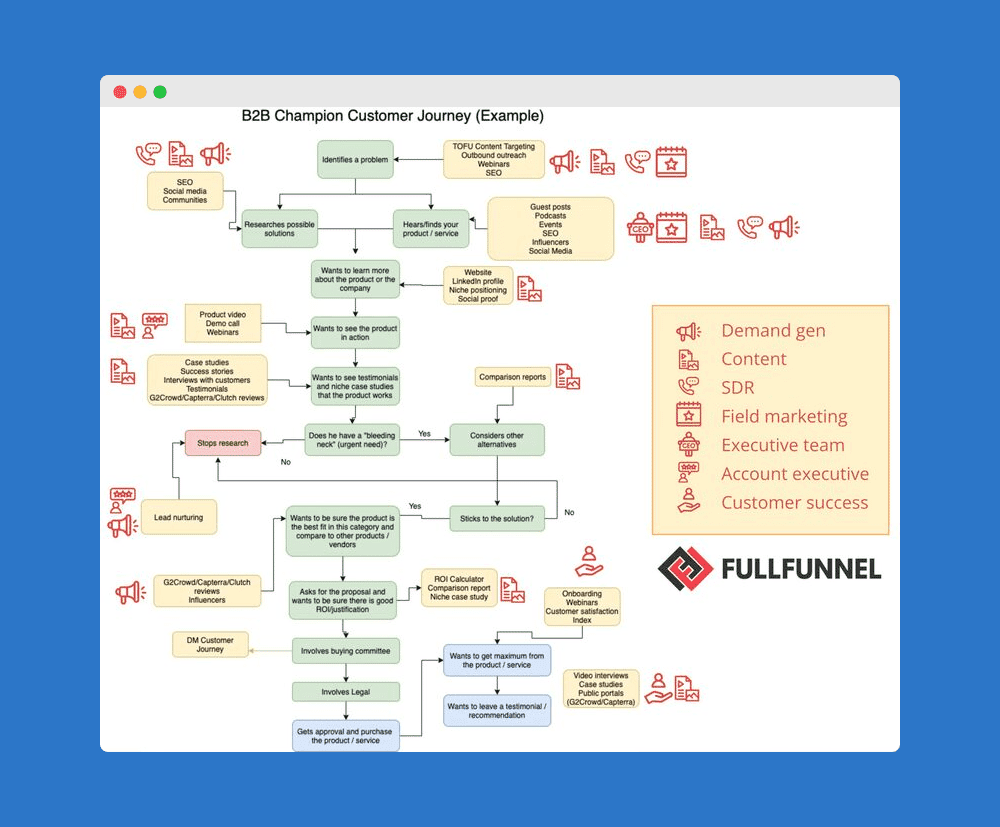

Here is an example of aligning marketing and sales with the buying process.

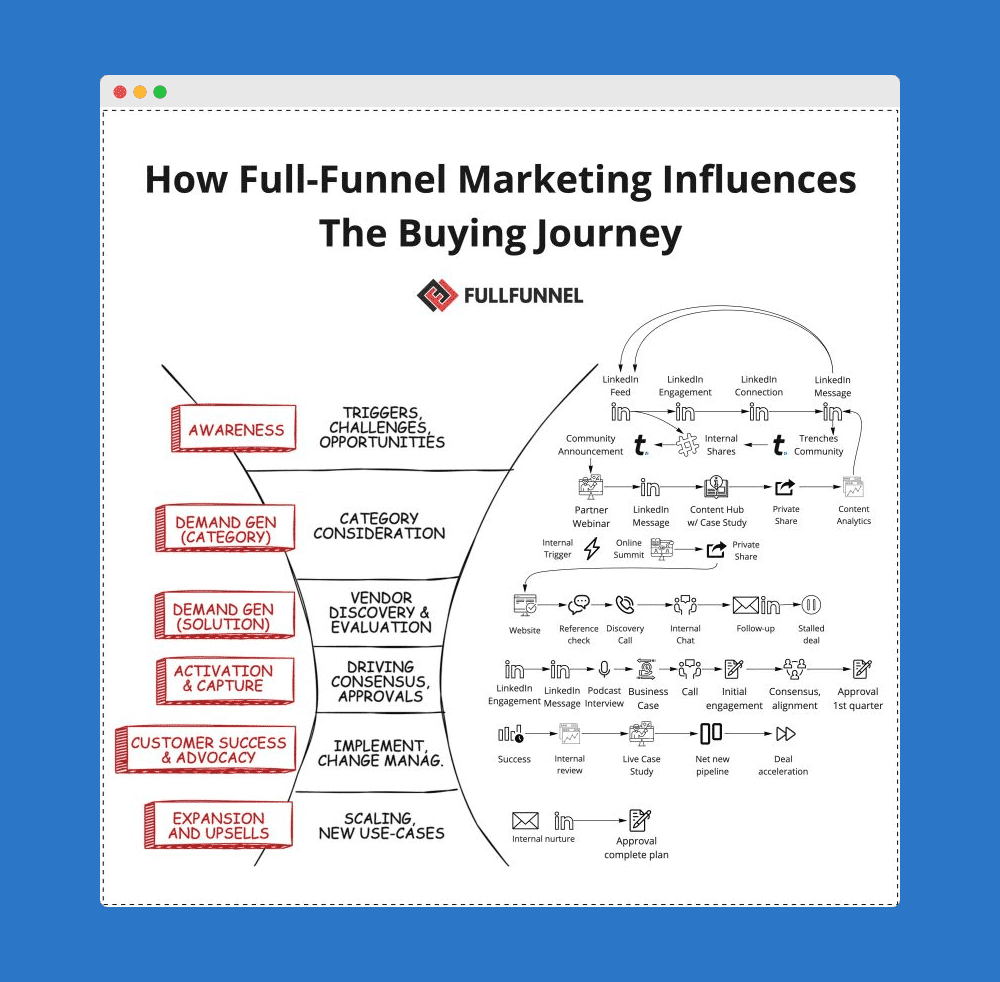

Learn more about the modern B2B buyer journey and how to influence it with full-funnel marketing here.

7. Full-funnel marketing plan including budget and resources

After finishing the buying journey, you’d have a list of ideas on how to influence the buying process and launch full-funnel marketing activities.

But don’t fall into the trap of thinking you need 50 different tactics or programs to run in parallel. Define the key activities to create awareness, attract attention, generate demand, and activate target accounts.

Here is one important thing I’d like to highlight.

Most B2B marketing plans fail because of one reason:

Lack of clarity.

Demand gen is not about showing up consistently and sharing random content on social media.

ABM is not about making a wish list of accounts, running display ads, tracking clicks, and reaching out with templated emails or direct mails.

Lead nurturing is not about setting up an automated sequence of emails to promote the product.

Content marketing is not writing about how great your product or company is, and sharing corporate news.

The list of “is not about” is endless

B2B marketing is not taught at schools.

Most B2B execs and salespeople don’t support marketing programs not because they don’t understand marketing, but because they don’t see:

- Detailed campaign playbook that describes goals and objectives, required resources and budget, timeline, metrics, and basic forecast.

- How the marketing program will help to grow revenue, increase ACV, close more deals, or shorten the sales cycle

This is why many marketing initiatives are killed beforehand and B2B marketers become sales order takers.

Not all B2B companies want to sink into the lead gen swamp. There are lots of them who want to get out but don’t know how. Our goal as B2B marketers is to educate and help them.

7 steps to create an efficient marketing plan

- Provide revenue analysis from different markets and verticals, narrow ICP replicating the best customers, and explain how ICPs buy based on the insights collected from customer interviews.

- Explain what programs can help us to drive awareness in a target market, and how are we going to measure them.

- Show what programs we can run to generate demand for our product

- Explain how we can identify warm-up accounts and activate them together with sales.

Check out our account-based marketing tactics guide where we share a warm-up program that had 70% reply rate.

- Show what we are going to do to nurture accounts that are not sales-ready without being pushy.

When you connect the dots, suddenly marketing starts making sense to everybody.

- Next step: get feedback and listen to all the concerns about the program suggested. Come up with ideas on how to mitigate the concerns.

- Prepare a detailed marketing plan that includes a detailed breakdown of the campaigns you want to run:

- Clear goals, objectives, and revenue forecast

- Leading indicators to measure campaign efficiency. I’ll cover it in detail in the next section

- Detailed action plan, timeline, and task distribution among team members

Keep in mind:

Executives don’t get brand marketing, demand generation, ABM, or any other marketing program.

Executives don’t understand how likes, followers, account-based ads, or «delivering value consistently» converts into revenue.

Flip the funnel.

Put revenue, ROI/payback on the top.

Define leading indicators.

Create a detailed marketing plan explaining how suggested activities/campaigns are going to hit the targets you set for leading indicators, and how they will turn later into revenue.

Suddenly, everybody in your team will start «getting marketing» and supporting it.

8. Metrics and marketing report.

Lots of B2B companies still measure marketing like B2C companies.

One of the reasons is that they are obsessed with scaling and growth. They want to find several scalable channels, put more dollars in and enjoy revenue.

Unfortunately, the B2B buying process is not linear.

In most cases, buyers use a lot of different channels (lots of them are untraceable like “asking a vendor recommendation in the community”) for research and evaluation.

Quite often, the first touch that attracts their attention is your content that is coming through social, recommendation, or organic search.

After the first touch, you’ll need to have much more touches to generate demand that could have happened across multiple channels and platforms.

While in B2C you can capture the existing demand and figure out the channels with the highest ROI.

If you follow B2C marketing measurement, you’ll focus on the last touch (rarely, on the first) and will make wrong decisions about what works and what doesn’t.

Here is an example.

Google Analytics shows that our last inbound opportunity came from a search, while the truth is that one of the buying committee members was engaging with me and Vladimir on LinkedIn, and when wanted to book a call, just searched for our brand name.

B2C decision: invest more in search.

B2B decision is made by analyzing three factors:

- Self-attribution (How did you hear about us?)

- Channels that were identified in the digital analytics

- Customer interview (asking customers how they identified us, what channels they used, etc.)

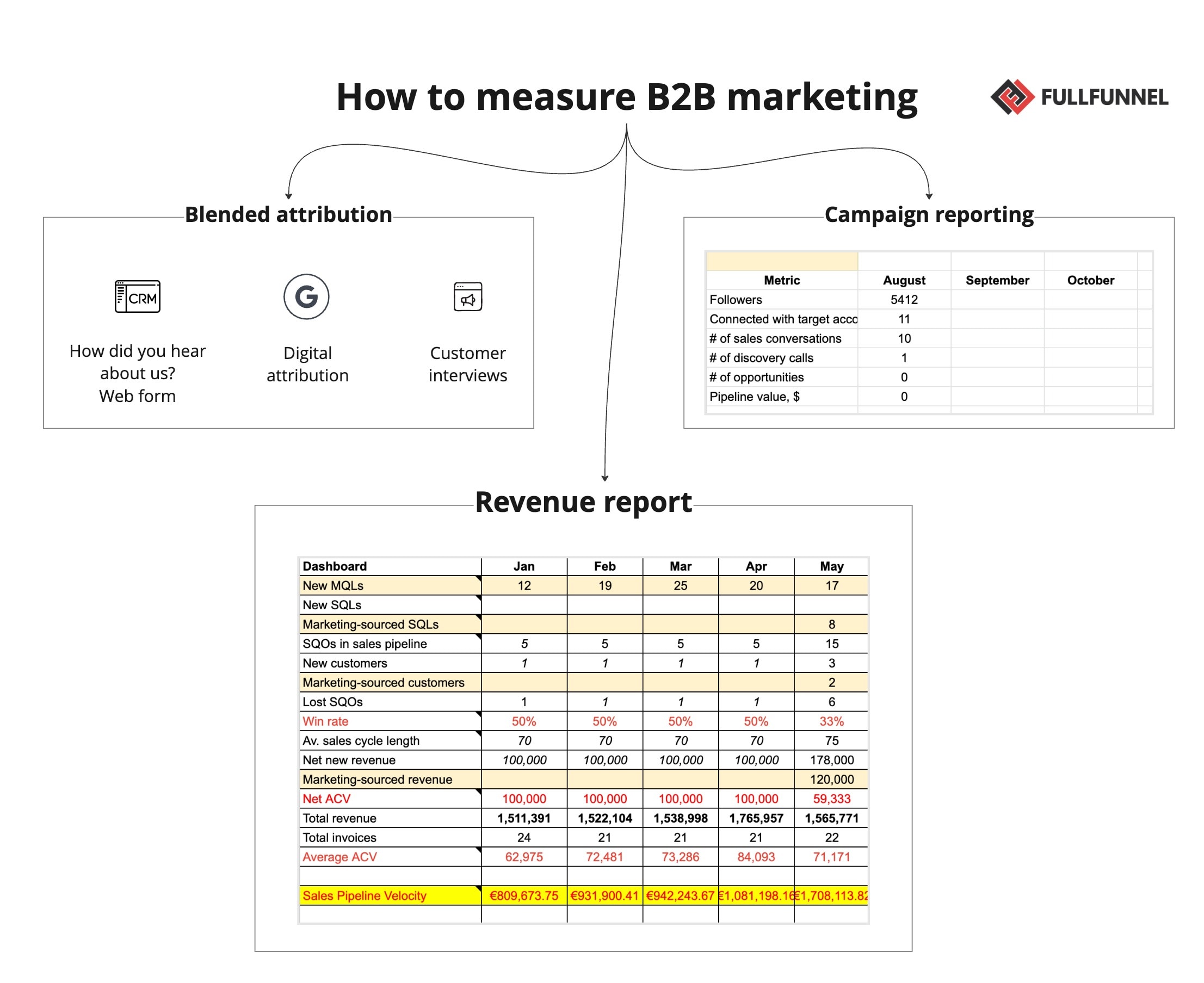

How to measure B2B marketing and make the right decisions about what works, and what doesn’t?

You need to have a blended analytics, neither self-attribution nor digital attribution solely will give you a full picture.

Here are 3 sources of data and 3 reports you need to have.

1. Blended attribution model.

The best insights come from a blended attribution model:

- Self-attribution (“How did you hear about us?” included your website)

- Channels that were identified in the digital analytics

- Customer interview

2. Campaign report.

You need to set up the right metrics for every campaign you’re running.

You can’t measure the efficiency of paid ads that promote your top content by leads or revenue. The goal of this campaign is to warm up and nurture target accounts.

Hence, every campaign should have an individual report with leading indicators – metrics that are not directly connected to revenue, but showing the campaign progress.

Example leading indicators for LinkedIn thought leadership:

- # of followers

- # of connections with target accounts

- # of target accounts visiting your website

- Inbound requests

- Media invites

- # of conversations with target accounts (for sales)

3. Consolidated revenue report.

If you set up two previous steps, you can easily connect the dots and show marketing impact on revenue by:

– pipeline and revenue sourced

– engaged accounts that were transferred to ABM or sales team

– sales pipeline velocity positive changes

By leveraging these 3 reports you’ll be able to see the full picture and make smart decisions about what works and what doesn’t.

9. Team alignment and buy-in.

You can follow all the 9 steps, and develop a great strategy and buyer-centric marketing plan, but if you don’t get buy-in and support from the leadership and sales, you wasted your time.

Here is how we (Fullfunnel.io team) get the buy-in of our clients (sales, executives and the marketing team) for new marketing programs.

1. Align on goals and objectives.

Put the key people from sales, executives, and marketing together, and start by getting clarity and alignment on the goals and priorities.

Make sure to capture the KPIs and metrics you’ll use for top-priority goals.

2. Align on challenges and bottlenecks.

Give everyone a chance to share the challenges and bottlenecks that are preventing them from achieving their goals.

As a team, prioritize the top challenges that need to be addressed.

3. Present campaigns and programs you want to launch, connecting them to goals, objectives, and challenges.

Present the key programs and initiatives to achieve the goals and solve the challenges you’ve identified during the first steps.

4. Address the concerns.

For every campaign, you plan to launch, ask everybody to share their questions and concerns. Figure out the most probable and severe concerns, and map out together the ideas to mitigate the concerns.

5. Update the marketing plan with the ideas collected from the risk mitigation workshop (previous step).

Update the playbooks and the timeline. Tweak the leading indicators and allocate responsibilities, so everybody on your team will approve the campaigns.

6. Make a revenue forecast.

Forecast the impact of each proposed program and initiative, and show the milestones of how you’ll get there. Show data and case studies you’re using for estimates.

Takeaways and next steps

Forget about linear marketing and sales processes.

For stable long-term growth, you need to know your best customers, and how they buy and adopt your marketing & sales.

Here are 9 elements of a buyer-centric B2B marketing strategy:

- Full-funnel analysis and sales pipeline velocity

- Market segmentation

- Customer research

- Ideal Customer Profile

- Positioning and unique value proposition

- Buying process

- Full-funnel marketing plan including budgeting and team set up

- Metrics

- Team alignment and buy-in

Next steps

If you need help with launching ABM campaigns, book a call here or dm me on LinkedIn. You can learn more about our services here.

If you learned something new from this guide, then you’ll love our on-demand course B2B Marketing Strategy Playbook.

It’s actionable training to align your marketing, sales, and executives on the focus target market, positioning, channels, campaigns, and content to land ideal customers, grow your deal size, and accelerate your pipeline.

Learn more about B2B Marketing Strategy Playbook here.

Andrei Zinkevich