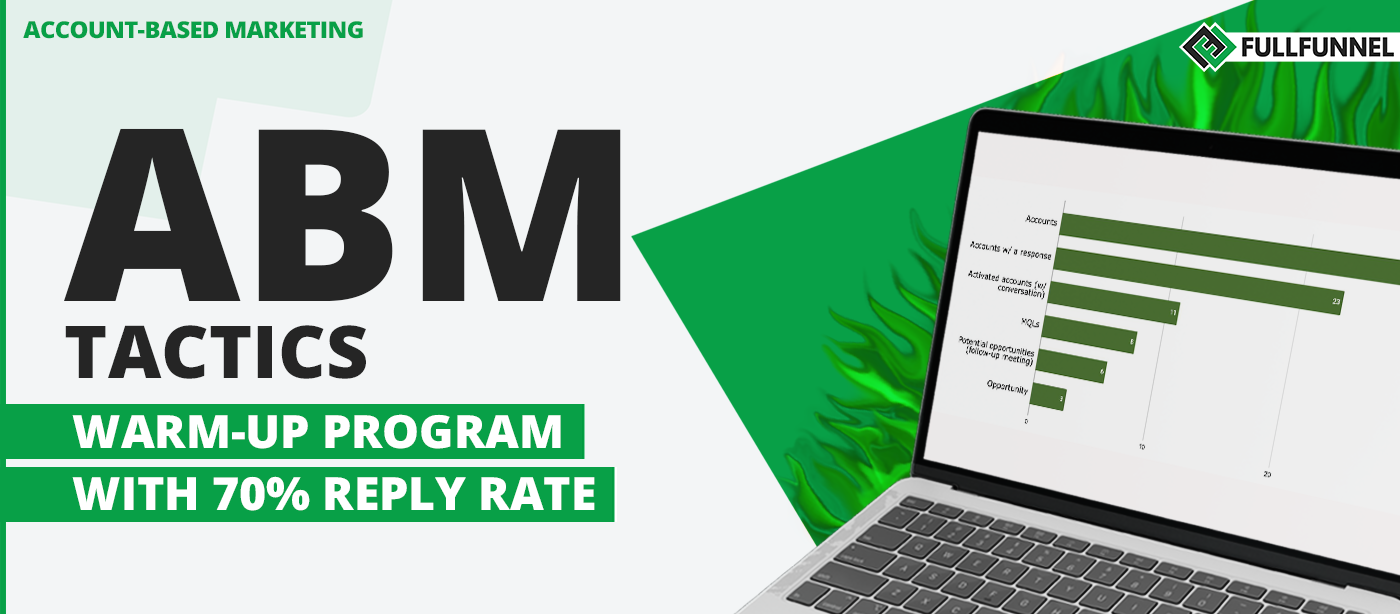

In this guide, I’ll share a step-by-step process of how we used one of the account-based marketing tactics to warm-up strategic accounts, generate a 70% reply rate and create sales opportunities.

The best part?

Aside from revenue results, you can:

- Learn more about the goals, priorities, and challenges of your strategic accounts

- Partner and get support from the industry association and media

- Create unique market research you can use later in awareness and demand generation campaigns

But before I dive in, let’s start with why you should run a warm-up program.

Why your ABM campaigns need a warm-up program

People buy from people they know, like and trust.

When I’m discussing this inevitable law of marketing with my clients’ marketers or SDRs, they always nod their heads in agreement.

That is, until I ask:

If you know this, then why don’t you warm up and build a relationship with your target accounts before reaching out to them?

Because, here is the truth:

Nobody is looking out for another unsolicited cold call, email, or a LinkedIn message (even if it’s creative) from an SDR who wants to pitch their product.

Think about it: what is the one criterion you use to decide if you’ll read someone’s message? It’s whether you know the sender.

That’s why you can drastically increase the chances of getting a reply if you have a relationship with your target accounts.

Now let’s touch on the biggest myth about warm-up created by ABM tech vendors: targeting accounts with display ads.

If you limit warm-up to display or text ads, your ABM campaign is doomed.

Here is why.

A) Banner blindness.

How often do you click on banners?

Buyers are no different.

Surely, you can try to play with highly-personalized and creative ads, just to make sure they remember your logo, but then you need:

1) A 6-figure budget for ads

2) 5-figures to purchase a stack to deliver those ads

B) Platforms without display ads.

Your target contacts spend most of their time not on LinkedIn or other platforms, but in CRM, team communication, project management, Google Docs, etc., where you won’t be able to reach them with ads.

Now, you might have one question:

“How can I warm up my strategic accounts then?”

Here are my 3 favorite warm-up account-based marketing tactics.

1. Targeted demand generation strategy and thought leadership.

2. Virtual events.

3. “Connect & qualify” interviews, or market research.

The last one is essential if you don’t have enough market knowledge, your market is close, or you are going to prospect a new market.

Table of Contents

ToggleMarket research as an account-based marketing tactic

We use market research to connect with multiple strategic accounts, learn more about their goals and challenges, build relationships, and also create unique insights you can use later in demand generation campaigns.

Here’s the campaign blueprint.

- Invite buying committee members of strategic accounts to feature them in industry- and market-specific publications

- Cultivate relationships through a conversation and follow up

- Research and qualify target accounts and buyers through conversations

- Activate accounts through personalized outreach

- Create and distribute user-generated content to create awareness and generate demand

Market research campaign is an example of “Content-based networking”.

Essentially, you’re co-creating content with your buyers and industry leaders, while building relationships with them and doing account research.

11 steps to use market research to warm-up strategic accounts

Before we dive in the step-by-step playbook, let’s address the two most critical questions:

- Why would busy buyers take the time to participate in your research?

The first 6 steps in the playbook are all designed to help you increase response rates:

- The right angle (step 1) and narrow targeting (steps 2 & 3) will help make the research more relevant to your buyers

- Communities, partners and influencers help give your research credibility

- Seeding your research provides it with the social proof

- Personalized multi-touch, multi-channel outreach helps engage your buyers and get more of them to respond

- How do you move from research into a sale?

This campaign allows you to run account research by interviewing the target buyers. You ask about their key priorities, initiatives, goals and challenges.

As a result, you have unique insights that you can use to completely personalize your activation plays, rather than sending generic outreach.

This process is described in the steps 7-9.

The last two steps of the playbook deal with creating and distributing user-generated content to create awareness and generate demand.

Let’s dive in.

Want to launch an effective ABM campaign just in 6 weeks?

We share 4 different campaigns you can launch on a shoestring budget with minimum resources just in 6 weeks in our 6-Weeks ABM playbook.

1. Market research angle (with examples)

The angle (how you position your research) helps:

- Make the topic relevant to buyers and increase response rates

- Give you the “in” top ask qualification questions

Here are examples of different angles you can use.

1. “The state of” / trends/challenges angle is the simplest and the most straightforward option. It also allows you to dive into the challenges your product can help solve.

This angle works well for narrowly targeted industries, e.g. “The state of the UK potato sector: Trends and Challenges for 2022”.

The more narrow your target (step 2), the more relevant it will be to the target buyers (and the less competition your content will have).

In addition, this angle works well when linked to a specific period of time (e.g. start of the new year), or an event that’s impacting the industry. For example, when the initial COVID crisis struck:

- A corporate wellness client ran research about how companies were taking care of their employees

- A client with a software for manufacturing ran “European Food Industry: Disruptions and challenges of 2020”. The industry was struck by fluctuating demand and disrupted supply (both challenges our client could help with)

2. The free publicity angle.

You’re offering your buyers some free PR on an industry-relevant publication. This can be appealing to smaller companies or companies in competitive markets like tech.

Here are several examples.

- “The Drone pioneers of South Africa” targets local drone companies offering free publicity in a tech magazine, and via an international Drone summit. The process is easily scaled across different regions.

- “The best Belgian marketing agencies to work with in 2021”. This was an angle for a recruitment tech company that targets agencies. There is a natural match between chatting about “best marketing teams to work for” and chatting about team growth and recruitment challenges and strategies.

3. The Ego play.

You’re featuring your buyers in an industry-relevant publication appealing to their ego. For example:

- A podcast series featuring leaders from top B2B tech companies from a specific region.

- A roundup post featuring opinions of customer success leaders, about efficient scaling of teams and ticket volume.

- A guide, featuring examples and opinions from buyers (and industry influencers), like this guide on positioning in marketing.

4. The community play.

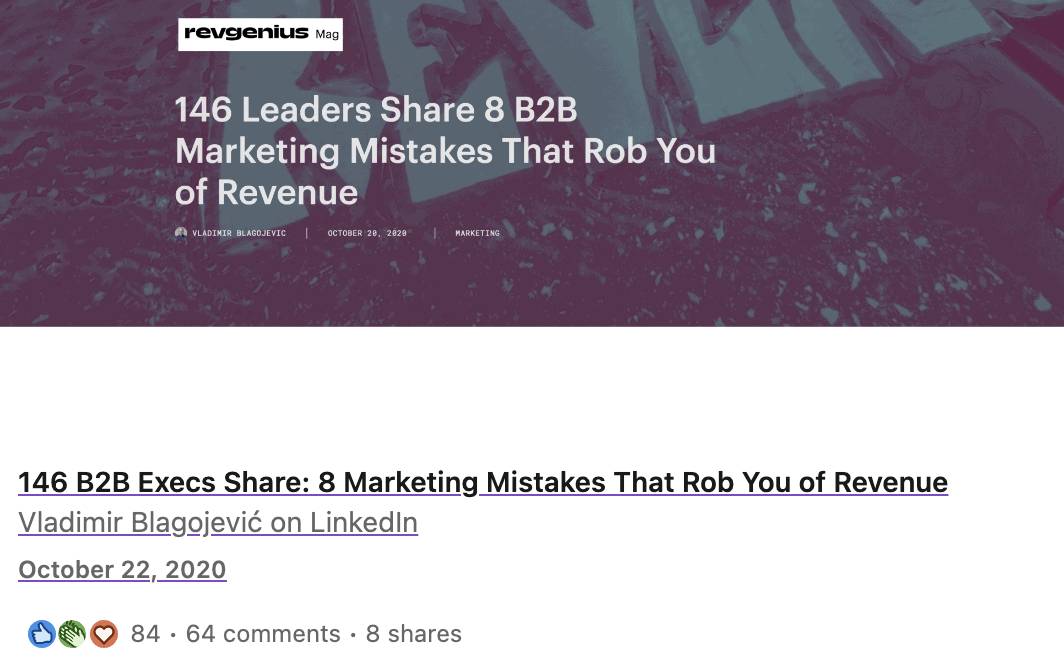

For this play to work, you first need to get an agreement from a community to have your research published (on their website or at their event).

Then you reach out to selected members of the community asking for their contribution.

For example, when publishing our research about common B2B marketing mistakes on RevGenius’ website, I reached out to the members of the RevGenius community.

We ended up with 146 contributions to our research.

2. Target segment and geography

In ABM, you stack the odds in your favor by targeting verticals that are proven to be more profitable and a better fit. You target narrowly.

With market research, there’s another reason to narrow down your target to a single vertical — and even to a single region: the client-message fit.

Imagine you’re a production planning leader at a potato processing plant from Manchester, UK. You’re struggling with fluctuating demand and disrupted supply chain caused by Covid restrictions.

You get two invitations for market research:

- One about “predictive planning in manufacturing”

- The other about “how the UK potato sector is dealing with fluctuating demand and disrupted supply chain”

Which one sounds more relevant?

With narrow targeting, it’s easier to:

- Reach the client-message fit and be more relevant

- Profit from social proof (word-of-mouth spreads more easily in a well-connected segment)

- Partner with industry influencers and network or event organizations, associations, and publications

- Stand out, as the narrower you go, the less competition you will have.

3. Buying committee roles / functions

Lots of B2B companies make the mistake of prospecting the decision-makers only. But buyers spend more time talking to their colleagues than talking to vendors.

Consider reaching out to multiple roles of your buying committee (champion, user, decision maker, influencer, blocker, people involved in implementation etc.).

You’ll gain a deeper understanding of the needs and objections of the accounts and be able to better influence the different buyers.

4. Leveraging communities, influencers, associations or publications

Involving partners can help amplify your reach, give your initiative more credibility and increase your response rates.

In the “community play” above, I described how you can leverage a target community to engage buyers who are the members of the community.

Other orgs you can partner with:

- Industry associations or network/event organizations (e.g. a client published their article on the association of facility managers)

- Implementation partners or resellers (e.g. a client collaborated with software companies who help manufacturers implement the client’s solution)

- Industry authoritative media (to publish your research report). The better known the publication is to your target accounts, the more credibility. This can be (online) industry magazines or events, and prominent websites (e.g. we got our research published on CXL). Associations and communities may have their own magazine (and while it may not have large traffic, they surely have a large email list).

- Thought leaders or industry influencers. They add social proof and credibility to your research, making it more enticing

- Clients of your customers. A client targeting food producers involved Tesco, a large customer of their customers, to get their perspective. As a result, food manufacturers wanted to be included in the article, knowing that Tesco is involved

5. Seeding your market research

By seeding your research, I mean going out to existing customers or other friendly people in the target industry and interviewing them first.

This way, when you’re reaching out to new accounts and people who don’t know you, you can drop these names as social proof.

You can also look at prior interviews and surveys you’ve done.

Note: if you’ve never conducted client interviews to develop an Ideal Customer Profile or a case study, this is the opportunity to kill two birds with one stone.

For example, our client conducted customer interviews to seed their market research campaign. But what they got out of the interviews was even more valuable:

- We discovered that the way my client positioned their products and services does not correspond to how their best clients perceive them. As a result, we updated their positioning and unique value proposition

- They’ve developed a case study with a well-known company in the target industry, which they later used in account activation

6. Multitouch, multichannel outreach

In all the cases with high response rates mentioned above, we used a simple cadence with a LinkedIn invitation or a message and a maximum of 2 follow-up emails.

A client used their SDRs to book interviews by calling the prospects.

Please note that there is nothing special in this cadence. The reason it works so well is because:

- Of the preparation steps 1-5 above. The better angle and target you choose, and the more you leverage partners and existing customers, the better your results will be.

- Whenever possible, we ask common connections for a referral. For example, I’m currently inviting marketing leaders of top B2B tech companies to a podcast series and have a 70% acceptance rate. More than half of them came through a referral.

- Whenever possible, we’ll engage with their content, or start the conversation in the comments before moving to direct messaging.

- We personalize our outreach. While the core message is essentially the same, we always run basic research to personalize the invitation. Look through their social posts, search for interviews, news or even company’s posts they engaged with like in an example below.

The reason we use email in addition to LinkedIn is simple: not everyone is active on LinkedIn.

And even if they are, LinkedIn inbox is notoriously bad at helping you organize your conversations, so many get missed.

Don’t stay on LinkedIn and email only.

If you’re already connected to them in another way, such as Twitter, Slack or WhatsApp, it’s always a good idea to follow up on another channel.

7. The interview

The interview is one of the most important steps in the market research campaign.

Lots of companies make the mistake of only running surveys, which usually only provides superficial information (or is too long and has a low response rate).

You want to get people to talk to you. That’s because, with 1-1 interviews, you’re doing three important things:

- Building a relationship with your buyers

- Qualifying them to see if there is a need, what current solution they are using, what key initiatives are on their road map, and what their challenges and priorities are

- Doing account-based marketing research, which gives valuable insight into how to personalize your follow-up and outreach instead of using generic messaging

What questions you’ll ask during the interview depends on the topic of your research.

In my interviews, I always ask the same qualification questions that I use during our discovery calls. You’ll be surprised how open people can become during the interview.

To help people relax, it’s important to let them know what they can expect, what the goal is — and let them feel in control by saying that nothing will ever be published without double-checking it with them.

8. The survey

There are two crucial things to remember about the survey used in this campaign.

1. The survey is only a fallback option.

For reasons mentioned above, you shouldn’t skip the interview and only run the survey.

However, you can always use it as a fallback and say, in your last follow-up attempt “In case you don’t have the time, I’ve also prepared a 3-min anonymous survey”.

2. The primary goal of the survey is NOT to collect all the information you need for your final report.

The goal is to maximize engagement and response rates.

If you would design the survey from the research perspective (necessary when running proper research), you would never get enough detailed responses from your potential buyers and would have to purchase the responses.

To keep the survey engaging and maximize the responses, we usually stick to only 5-6 questions, most of which are simple qualification questions presented as multiple choice, with one, maximum 2 of the questions being open-ended.

We also always include one or two optional opt-in questions at the end.

You can ask people if they want to receive the result of the research, and if they would be willing to dive deeper via an interview.

We had a surprising number of participants opt-in for one or even both of these options.

9. Activation and follow up

Running an ABM campaign without an activation play is like folding on a royal flush: you’re leaving a lot of money on the table.

Below are three example activation plays you can use.

Example #1: Activation during interviews and follow-up.

It’s really important NOT to “bait and switch” and use the interviews to pitch your product. However, the interview may give you an opening for a soft pitch. Let me share a few examples.

For example, your prospect may ask to know more about what you do. Or, they could mention a specific challenge you know you can help them with.

You could then mention a case study with a client in a similar situation, and offer to tell them more in a separate call.

Or you can simply ask for a referral, saying something like

“Just one more question: we help with . Do you know a company that would be a good fit?”.

In addition, there are several more opportunities for a similar soft pitch. Immediately after the interview, you can send a thank you message.

You can also write a recommendation on your interviewee’s LinkedIn profile – and contact them for 1-1 content distribution (see section 11 below).

Example #2: Creative outreach via direct mail.

You can reach out to the buyers you interviewed AND accounts who did not respond, but your research gives you the reason to believe they may have a need for your product.

The main idea is to send a personalized gift and a letter, using what you’ve learned during your research and interviews to personalize the offer.

This process is described in detail in this article.

Example #3: Activation events.

You may run a webinar, or a mini-conference (e.g. a keynote and a panel discussion) to disseminate the results of your research. You can invite buyers from the campaign, as well as others who are a good fit.

During the event, you can present research findings, and as examples of best practices, share case studies describing how your clients are dealing with the challenges identified in the research.

The key here is to be educational and NOT pitch your product.

The simple truth is that the vast majority of your market will not be in a buying mode and will not be ready to book a demo call with you.

That’s why, as a follow up to the event, you can share a content hub with the webinar recording, more detailed case studies and information about your product.

Using a tool like Paperflite to share the content hub, you’ll be able to see exactly visited this content hub, what content they consumed.

Because you know what exact content they consumed, how much time they spent on each page, you now have priceless insights for timely and personalized follow-up.

10. Writing & publishing the report/article

By now you understand that producing the report is not the only goal of this campaign.

However, done well, use the expert, “user-generated” content to create awareness, while positioning your brand as an important industry player.

Here are a few examples:

- This is a classic industry report on a specific topic by Hubspot “The 2021 Sales Enablement Report” (click here for the ungated 2020 version)

- The following two articles were created based on the same research data but were published in two different guest publications: “Common B2B Challenges and How To Solve Them (published on CXL)” and “146 B2B Execs Share: 8 Marketing Mistakes That Rob You of Revenue (published on RevGenius)”.

- This one was created from the start as an “ultimate guide”, and has featured both buyers and the industry leaders: “Marketing Positioning: 6-Step Guide to Win in 2021 + Checklist”

Few notes about producing the report.

1. If you are writing for a specific publication, follow their guidelines and make sure it’s relevant to their specific audience. If they don’t publish guidelines, check the existing articles and reports

2. When possible, publish longer articles and incorporate unique insights and quotes you got from the interviews. This adds value to the content and increases a chance of sharing your content

Also, readers will treat you as an industry expert because of unique data.

3. If you publish your article externally, you will be limited in how many links and case studies you can include.

Unless the publication doesn’t forbid this (most don’t), you can always republish it on your LinkedIn as an article, mentioning where it was published originally.

There, you can add more links.

11. Content distribution

Like I mentioned, content creation and distribution are not the main goals of the campaign. Especially if you’re using this play to test new segments or regions.

However, if you’ve put in the effort to create a unique piece of content, the question is, how can you share it? How to get the maximum reach? And how can you use it to engage your target accounts?

Because there are great guides out there about content distribution, I will only include a few approaches that will help you engage the target accounts.

1-1 distribution.

Share the content with everyone you’ve personally spoken to using 1-1 personalized messages. The insights you collected during the interview should give you plenty of opportunity for personalization.

You can include a soft offer to explore this further on a call as outlined in section 2 — and can also follow up with a call to get their feedback and explore a potential opportunity.

Email.

Distribute your content via your newsletter (as a stand alone email, not as one of the many links you share once a month) – but don’t forget to include people who opted in to receive more information about the survey.

LinkedIn.

What we usually do is a two-step share. The first post is a warm up post announcing your article or report the day before you intend to publish it.

You end the post by asking for a comment if people want to receive the article. Your second post promotes the article and includes a direct link.

To get the maximum out of this approach, you can:

- Tag the main contributors to the research either in the body of the second post, or thank them for their contribution in the comments.

- Share the link with everyone who requested the report (by commenting on the first post). In addition, you can reply to each comment, sharing the link to the second LinkedIn post

Takeaways

Running successful ABM campaigns doesn’t require an expensive tech stack, a large budget, or a big team.

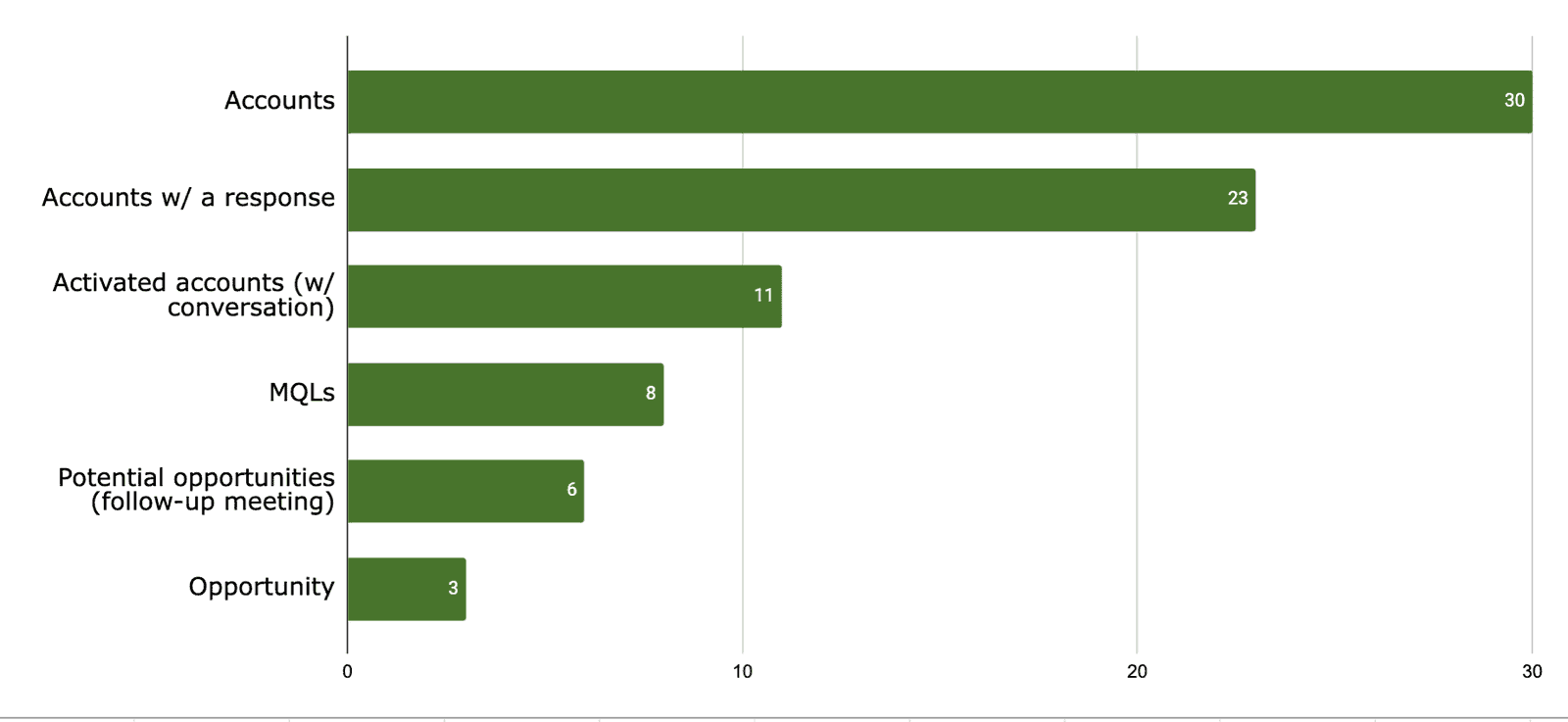

Here are the results of a pilot market research campaign that was run by just one marketer and one SDR over 6 weeks (both completely new to ABM).

If you need help with launching ABM campaigns, book a call here or pm me on LinkedIn. You can learn more about our services here.

If you learned something new from this case study, then you’ll love our 6-Weeks ABM Playbook. We share our entire account-based marketing process and 4 different ABM campaigns you can launch on a shoestring budget with minimum resources just in 6 weeks

Learn more about 6-Weeks ABM Playbook here.

Give this guide a boost

If you liked this article please share it on LinkedIn or RT my thread below. Thanks.

I've just finished a new case study about ABM warm-up playbook with 70%+ responses and 36% contact-to-conversation rates in 8 weeks.

— Andrei Zinkevich (@AZinkevich) January 19, 2022

Interested?