In this guide, I’ll share behind-the-scenes of four account-based marketing programs that, combined, generated more than $7 million in sales qualified outline.

I’ll share the key elements that made them a success, the exact ABM framework we used, but also, where and how to adapt it to your unique situation (team, market, product…).

After reading the article, you’ll understand:

- How to go from siloed sales and marketing to a true strategic AND execution alignment, including running joint programs

- How to adapt your strategy to conservative markets with buyers not active on social, v.s. crowded markets with oversupply of content, where buyers are exposed to huge amounts of outreach

- General v.s. niche-specific sources of data you can use to identify accounts that more likely to become sales deals

- How to run ABM and nurture buyers in a market with very long cycles (>2 years)

- What to do when neither marketers or sales have the product and customer knowledge

- The ideal v.s. realistic ABM team structure, and how to solve common team bottlenecks

- How to create account-specific content and support sales reps

- What to do when neither marketers or sales have the product and customer knowledge

Let’s dive in.

Table of Contents

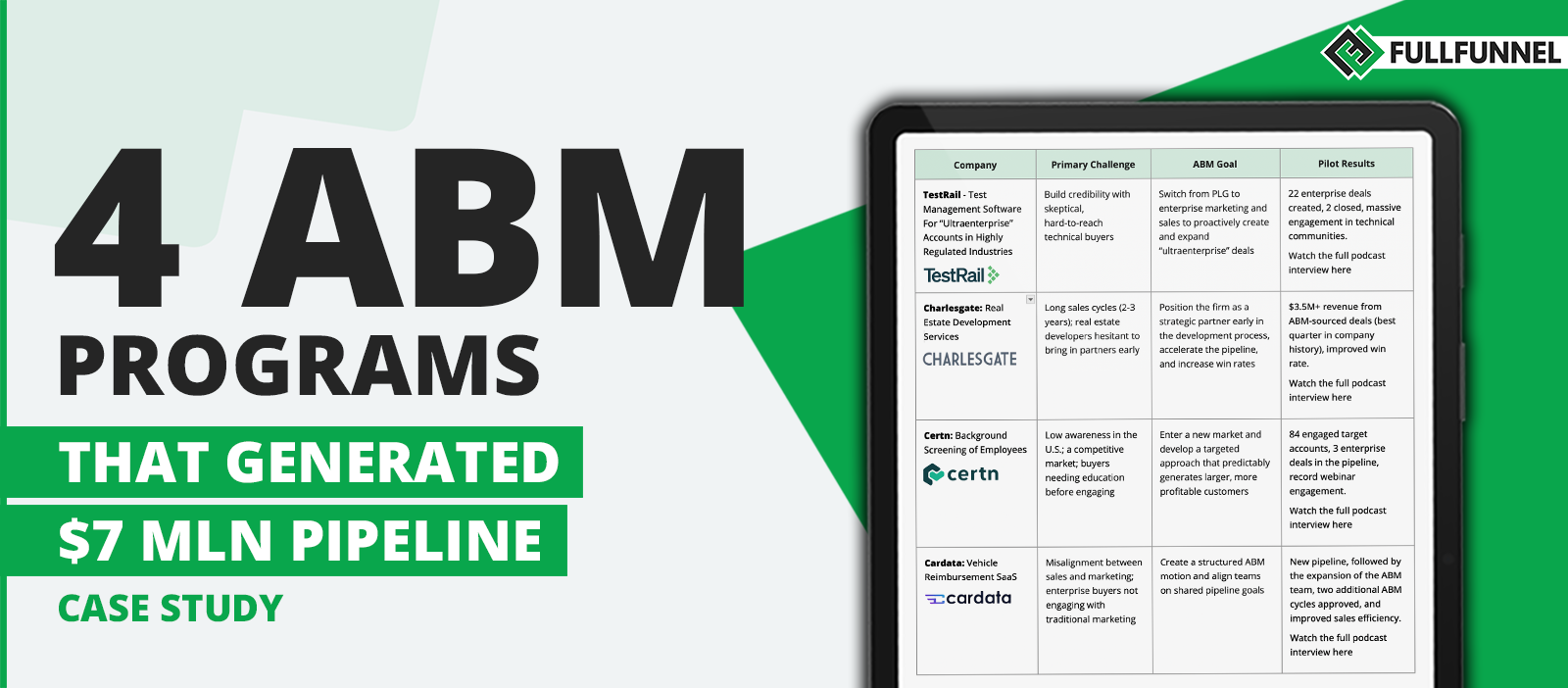

ToggleFour ABM Programs & Results

| Company | Primary Challenge | ABM Goal | Pilot Results |

| TestRail – Test Management Software For “Ultra-enterprise” Accounts in Highly Regulated Industries | Build credibility with skeptical, hard-to-reach technical buyers. | Switch from PLG to enterprise marketing and sales to proactively create and expand “ultra-enterprise” deals. | 22 enterprise deals created, 2 closed, massive engagement in technical communities. Watch the full podcast interview here. |

| Charlesgate: Real Estate Development Services | Long sales cycles (2-3 years); real estate developers hesitant to bring in partners early. | Position the firm as a strategic partner early in the development process, accelerate the pipeline, and increase win rates. | $3.5M+ revenue from ABM-sourced deals (best quarter in company history), improved win rate. Watch the full podcast interview here. |

| Certn: Background Screening of Employees | Low awareness in the U.S.; a competitive market; buyers needing education before engaging. | Enter a new market and develop a targeted approach that predictably generates larger, more profitable customers. | 84 engaged target accounts, 3 enterprise deals in the pipeline, record webinar engagement. Watch the full podcast interview here. |

| Cardata: Vehicle Reimbursement SaaS | Misalignment between sales and marketing; enterprise buyers not engaging with traditional marketing. | Create a structured ABM motion and align teams on shared pipeline goals. | New pipeline, followed by the expansion of the ABM team, two additional ABM cycles approved, and improved sales efficiency. Watch the full podcast interview here. |

Each company followed the same ABM framework but adapted their execution to fit their specific challenges. Below, we’ll break down the common framework and show how to adapt it for different business contexts. But first, let me quickly highlight the core elements that made these programs a success.

Four elements that made these programs successful

1. Committed pilot team

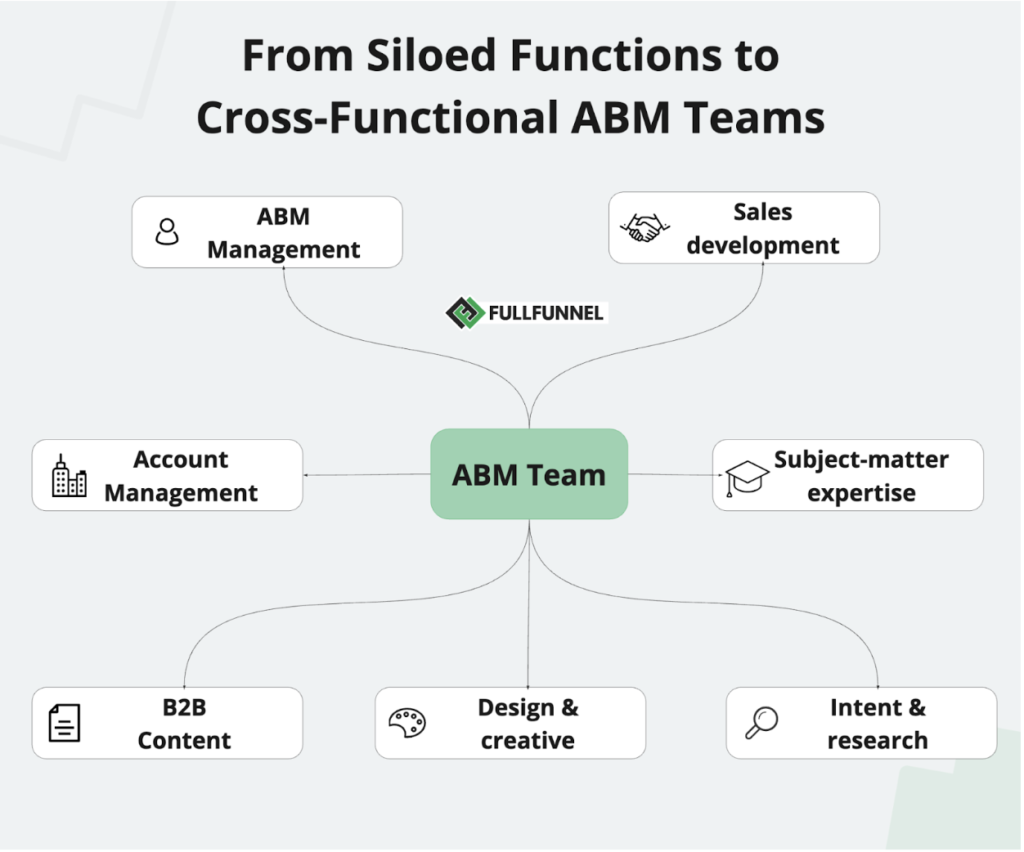

With every client, we had allocated a core pilot ABM team, including:

- ABM lead

- Content marketer

- SDR or AE

The core team had operational support from:

- A subject-matter expert (SME)

- RevOps (In some teams, the RevOps function was executed by the ABM lead).

The pilot team made the ABM program their top priority.

Commitment is the key.

2. Focusing on accounts with high odds of becoming sales-qualified deals

Instead of engaging hundreds of accounts that match an ICP, we defined accounts that:

- Have high revenue potential (Tier 1 and Tier 2).

- Know us (hit our engagement threshold)

- We know them (we have some level of relationship with a buying committee member)

- Exhibit evidence of a challenge that our product can help with

3. Mix of playbooks to drive buying committee awareness and engagement aligned with their buying journey

The biggest mistake with ABM is treating all accounts the same way and running the same playbooks.

Instead, we split other accounts into three groups based on their buying journey stage (unaware, aware & engaged, aware & with evidence of a product need), and ran a mix of playbooks to connect and engage buying committee members, including:

- Cluster content (use-case/challenge-based)

- Cluster webinars or in-person events

- Buyer interviews and collaborations with internal marketing teams to spread awareness

- Constant engagement and content distribution to open conversations

For the first two segments, the core KPI was achieving # of accounts that hit our engagement threshold instead of trying to generate a sales opportunity with them.

4. We turned every week into a sprint

We met with a pilot team every week to:

- Track our progress and weekly KPIs

- Review and fix bottlenecks

- Share newly collected account insights and engagement

- Plan next week including account engagement, playbooks, content, etc.

- Define and report internally on small wins to generate more interest and support for ABM

How we adapt our ABM framework to our clients’ unique situation

How to Choose The Target Market For the ABM Pilot

The most common approaches to account targeting in ABM are:

- The account wish-list: picking the largest fortune 100 accounts from the target territory

- The industry spray & pray: marketing targeting hundreds if not thousands of accounts based on board industry + role criteria, and using generic messaging and content

The ideal market for an ABM pilot should have the following characteristics:

- Account cluster with shared challenges – pick accounts that share a strategic use case and pain points driving their buying decisions. Examples:

- Certn: mid-market tech/SaaS companies in the US that had high hiring volumes and struggled with compliance

- Charlesgate: multifamily housing developers where Charlesgate had the strongest case studies

- TestRail focused on regulated industries and remote software teams, where the need for structured test management was higher.

- Proven success through historical sales velocity – your past closed-won deals should provide evidence that these companies convert well.

- Scalability potential – if your ABM pilot succeeds, you should be able to expand within this market, and replicate the success in other clusters and regions.

- Use-case and buying triggers – you should be able to identify signals that companies have a need for your product.

How To Prioritize Target Accounts: General v.s. niche-specific data you can use to identify accounts that more likely to become sales deals

The best prioritization framework:

- Combines firmographics & technographics criteria with use-case and buying signals, vendor awareness and the level of relationship with target accounts

- Uses dynamic lists—continuously refining the target list based on real-time engagement signals, intent data, and business triggers.

General sources of data:

- Firmographic and technographics data (ZoomInfo, LinkedIn Sales Navigator)

- Engagement and intent data data for vendor awareness and use-case and buying signals (6sense, Demandbase)

- Content and campaign engagement (newsletter, webinar, LinkedIn engagement)

- CRM & historical pipeline data (HubSpot, Salesforce) to establish the level of relationship

- Public company announcements & annual reports

Specific and niche sources of data:

- E.g. Certn monitored hiring trends – Focused on companies with high-volume hiring needs

- E.g. Charlesgate used city planning & development filings to identify developers acquiring land.

- E.g. Cardata monitored regulatory updates that could drive compliance-related changes in reimbursement policies and corporate cost-cutting initiatives—companies reducing fleet budgets were likely to need a more efficient reimbursement solution.

Insider information via sales and SDR engagement and progressive profiling: important, but often missed.

- E.g. Certn used content collaboration featuring target buyers in LinkedIn content to get insights into target accounts’ challenges and priorities

- E.g. TestRail used pre-webinar engagement to collect the target accounts top priorities and challenges

How To Create Awareness: Conservative markets with buyers not active on social, v.s. crowded markets with oversupply of content

1. The Different Challenges of Creating Awareness in Conservative vs. Crowded Markets

| Market Type | Challenges | Examples |

| Conservative Markets | ❌ Buyers aren’t active on LinkedIn or engaging with ads. ❌ They distrust marketing and sales outreach. ❌ It’s hard to find who the actual decision-makers are. | TestRail (QA engineers), Charlesgate (Real Estate Developers) |

| Crowded Markets | ❌ Buyers are overloaded with marketing & sales outreach. ❌ Hard to stand out against competitors. ❌ Content needs to be highly differentiated to be noticed. | Certn (HR buyers), Cardata (HR & Finance decision-makers in large enterprises) |

Each company had to adapt its account-based content & awareness strategy to fit its specific market constraints.

2. Creating Awareness in a Crowded Market: Certn’s and Cardata Approach

Certn: Breaking Through in the U.S. HR Tech Space

Certn faced several challenges:

- As a challenger brand, they had to create brand awareness in the highly competitive US market

- Background screening is not the top-of-mind concern of target buyers. It’s often perceived as one of the last administrative steps of the challenging hiring process.

- The talent acquisition and HR space is super-crowded, with over-supply of content and overwhelmed by sales and marketing messaging from various HR-tech vendors, HR consultants, training organizations and recruiters.

Here is the approach they took.

✅ Narrowed Down on a Specific Industry Use-Case

Background screening is relevant in many types of organization across a wide variety of industries. To make their content and messaging more relevant, Certn decided to focus on a very specific industry use-case: mid-market tech/SaaS companies in the US that had high hiring volumes with high compliance requirements, with specific focus on remote hiring.

✅ Focused on Candidate Experience as a Differentiator

Instead of pitching Certn’s background screening features, the ABM team focused on how screening fits into the entire hiring experience.

“We weren’t just selling background checks. We were selling a better candidate experience—something HR teams actually care about.”

— Ellen Kaross, Global Marketing Communications Manager, Certn

✅ Used Industry Content to Spark Conversations Instead of Selling

Certn’s sales team avoided direct product pitches and instead shared industry insights—such as compliance risks in social media screening.

“Our best-performing LinkedIn posts weren’t about our product. They were about hiring trends and regulatory risks—things HR teams were already talking about.”

— Ellen Kaross

✅ Leveraged a High-Engagement Webinar for Thought Leadership

Certn hosted an educational webinar on compliant social media screening, generating record engagement:

📌 53-minute average view time—proving high interest.

📌 84 engaged accounts added to the ABM pipeline.

“Webinars only work if they provide real value—not if they’re just thinly veiled sales pitches.”

— Ellen Kaross

Cardata: Creating Awareness in a Highly Saturated Market

Cardata faced similar challenges as Certn:

- Standing out and creating awareness in a market saturated by vendors, content and messaging.

- Promoting a solution that is not a top-of-mind concern of their target buyers.

Here is the approach they took.

✅ Targeted Cost-Conscious Finance & HR Leaders with Clear Savings Benefits

Unlike competitors focusing on mileage tracking software features, Cardata focused on compliance and tax savings, which resonated more with HR & Finance teams.

“Finance teams don’t care about software—they care about saving money. That’s how we positioned our message.”

— Lee Adam, Product Marketing Manager, Cardata

✅ Used Website & Engagement Data to Prioritize Accounts That Showed Interest

Instead of mass outreach, Cardata used 6sense intent data to only engage companies actively researching cost-cutting solutions.

“Instead of spamming every HR leader, we focused on companies showing engagement signals—reducing wasted effort.”

— Divash Basnet, VP of Marketing, Cardata

✅ Created Targeted LinkedIn Thought Leadership from Sales Reps

Sales reps built awareness by sharing insights on reimbursement compliance, instead of pitching directly.

“When sales reps act as thought leaders, they get better engagement than a corporate LinkedIn page ever could.”

— Divash Basnet

3. Creating Awareness in a Conservative Market: TestRail & Charlesgate’s Approach

Why these markets are challenging:

- Buyers are not active on LinkedIn or engaging with digital marketing.

- Traditional outreach gets ignored, especially by technical audiences, highly skeptical of sales and marketing messaging.

- Buyers trust peers & industry communities over vendors.

TestRail: Engaging Hard-to-Reach QA Engineers

✅ Built Awareness Through Niche Communities

TestRail’s audience (QA engineers) did not engage with LinkedIn, so they focused on:

- Ministry of Testing community

- QA-focused Reddit threads

- Technical newsletters & blogs

“We found QA teams in places where they actually engage—Slack, Reddit, and industry newsletters.”

— João Crisóstomo, Enterprise Product Marketing Manager, TestRail

✅ Used Educational Content Instead of Sales Outreach

Instead of pushing product messaging, TestRail’s ABM motion centered on technical education, which engineers value.

“Engineers don’t respond to sales pitches, but they will engage with technical content that helps them improve their processes.”

— João Crisóstomo

✅ Ran an Expert-Led Webinar That Attracted 70+ Target Accounts

Rather than a product demo, TestRail’s webinar focused on best practices for test automation—driving 22 enterprise deals.

“Engineers love to learn. If you help them solve problems, they will engage with your brand.”

— João Crisóstomo

Charlesgate: Selling to Real Estate Developers with Long Sales Cycles

✅ Used Industry Networks Instead of Direct Outreach

Real estate developers don’t engage with LinkedIn ads, so Charlesgate used warm introductions from industry partners (e.g., architects, lenders, legal advisors).

“Developers don’t respond to cold outreach—but they do take introductions from industry partners.”

— Amy Loesch, Fractional CMO, Charlesgate

✅ Leveraged Public Project Data to Identify Early-Stage Buyers

Instead of chasing random developers, Charlesgate used city planning & land acquisition filings to identify which firms were starting new projects.

“Developers don’t announce their projects on LinkedIn—we had to find them through public filings.”

— Amy Loesch

✅ Created Account-Specific Case Studies for Direct Outreach

Developers were more likely to engage with case studies of similar projects in their area, rather than generic marketing content.

“Instead of selling our services, we showed how we helped a similar developer increase their leasing speed by 40%.”

— Amy Loesch

What to do when neither marketers or sales have the product and customer knowledge

Marketing & sales teams don’t come from a technical background and lack product and customer knowledge (common in products with technical or highly specialized audiences, and complex B2B solutions).

Here is what we can learn from TestRail, who’s marketing and sales (people with no technical background) had to sell to highly technical buyers.

Challenges:

- TestRail’s marketers and sales team were not engineers and had limited firsthand experience with QA processes.

- QA engineers distrust non-technical marketers, making traditional sales and marketing efforts ineffective.

- The buying process was complex, with multiple stakeholders in software engineering teams.

Solutions:

✅ Embedded Internal SMEs into the ABM Program

- TestRail’s solution architects and former QA leaders provided technical validation for all messaging & content.

- The marketing team interviewed SMEs to extract real-world pain points & terminology.

“I had zero experience in QA, so I relied on internal experts to understand how engineers think. They helped us craft content engineers actually trust.”

— João Crisóstomo, Enterprise Product Marketing Manager, TestRail

✅ Engaged with the QA Community Instead of Relying on LinkedIn

- Instead of pushing marketing content on LinkedIn, TestRail built credibility by engaging in technical communities.

- Joined the Ministry of Testing community, QA-focused Reddit forums, and technical newsletters to observe real buyer pain points.

“QA professionals don’t engage with traditional B2B marketing. We had to find them in Slack communities and forums where they actually talk about their problems.”

— João Crisóstomo

✅ Used Customer Insights & Permissionless Comarketing to Create Educational Content

- Rather than pushing TestRail’s features, the ABM motion focused on QA best practices, automation workflows, and industry challenges.

- Created non-promotional content led by internal SMEs, positioning TestRail as a trusted resource.

“Engineers respect knowledge, not marketing fluff. We built authority by sharing technical insights, not sales pitches.”

— João Crisóstomo

✅ Hosted SME-Led Webinars to Drive Engagement

- Instead of a generic webinar, TestRail hosted an expert-led discussion on test automation strategies.

- This resulted in 70+ tier-1 target accounts attending, generating 22 enterprise deals.

How to run ABM and nurture buyers in a market with very long cycles

Here is what we can learn from the ABM programs where we faced long sales cycles (up to three years in the case of Charlesgate.

✅ Create Evergreen Content That Stays Relevant Over Time

In markets with long cycles, the vast majority are not buying – but most enterprise buyers (83%) shortlist a vendor they discovered BEFORE they start the buying process.

Create content about non-sales topics: challenges, industry trends, process improvements… and challenge the status quo to sow seeds and stay top-of-mind.

E.g. Instead of screening features, Certn’s ABM team focused on how screening fits into the entire hiring experience.

✅ Leverage Peer-Led & SME Content

Since the majority of the buyers are not in the buying mode, they will pay more attention to their industry peers than vendors.

Use internal and external SMEs to increase credibility.

For example, TestRail featured internal SMEs, who had the same background as their buyers, positioning TestRail as a trusted resource.

“Engineers respect knowledge, not marketing fluff. We built authority by sharing technical insights, not sales pitches.”

— João Crisóstomo.

✅ Engage Decision Makers Through Influencers

Instead of only focusing on decision-makers (usually engaged at later stages of the long sales cycles), influence champions and product power-users.

E.g. Instead of targeting CTOs, TestRail influenced engineers who then championed the tool internally.

This peer-driven approach led to bottom-up recommendations for the consideration set.

✅ Use Multi-Channel Touchpoints to Stay Visible

Combine thought leadership, webinars and field events, co-creation (e.g. podcasts), partners, community engagement…

Maintain visibility without directly selling.

“In an industry with long cycles, the key is to be present—not just when they’re ready to buy, but long before that.”

– Amy Leyh Loesch.

✅ Use Industry Signals to Identify Early-Stage Buyers

With long cycles, it’s important to start influencing the buyers early.

For example, Charlesgate monitored city planning & development filings to spot developers acquiring land, even before projects were announced.

“Developers don’t announce their projects on LinkedIn—we had to find them through public filings and industry data.”

— Amy Loesch, Fractional CMO, Charlesgate

✅ Use Relevant Case Study Insights

Buyers not buying still want to learn how their industry peers deal with the same challenges.

For example, when developers engaged, Charlesgate shared case studies from similar projects in their area, proving direct ROI.

Messaging was tailored based on project type, location, and financial goals.

“Instead of selling our services, we showed how we helped a similar developer increase leasing speed by 40%.”

— Amy Loesch

✅ Offer a bridge activity

The biggest mistake in a long sales cycle?

Not matching the activity with the level of buyer intent.

E.g. Instead of pitching a demo, TestRail invited engaged accounts to a private 1:1 session with a senior test architect.

This led to 22 booked meetings after only a single relevant SME-led webinar.

✅ Measure Engagement, Not Just Revenue

Track engagement, conversations, named website visits etc as leading indicators.

Use account-based scoring to monitor which companies are moving through the ABM pipeline.

For a full overview of how to measure ABM, check out this post on our substack.

How to create account-specific content and support sales reps

ABM content isn’t just about brand awareness—it’s about moving specific target accounts through the buying journey. Most content:

🚫 It’s too generic – If your ABM content is just another blog post or whitepaper, it won’t move deals forward.

🚫 Sales doesn’t use it – If your sales team isn’t sharing your content, it’s probably not relevant to their conversations.

🚫 It’s not specific to target accounts – Generic case studies don’t answer a decision-maker’s immediate concerns.

The most successful ABM programs create highly relevant, account-specific content that:

✔️ Engages decision-makers who ignore traditional outreach.

✔️ Gives sales reps valuable material to continue conversations.

✔️ Positions your company as a trusted resource, not just another vendor.

✅ Certn’s “Account Love Letters”

📌 Sales reps shared LinkedIn posts tailored to specific companies, discussing challenges relevant to their hiring model.

📌 These weren’t product pitches—they were insights tailored to each account’s industry.

“Instead of blasting generic content, we created personalized posts that spoke directly to key accounts.” — Ellen Kaross

✅ Cardata Turned Financial & Compliance Challenges into Sales Enablement Content

📌 Instead of selling “mileage reimbursement software,” Cardata sold cost savings & compliance advantages.

📌 Created benchmarking reports comparing different reimbursement models, helping sales reps guide discussions.

📌 Created Interactive ROI & Tax Savings Calculators. Prospects could plug in their numbers and see potential savings from switching to Cardata’s reimbursement model.

📌 This tool became a key sales asset, helping decision-makers justify a budget shift.

“Finance teams don’t care about software—they care about saving money. That’s how we positioned our message.”

— Lee Adam, Product Marketing Manager, Cardata

✅ Charlesgate’s Account Love Letter Example

📌 Target Audience: Real estate developers launching multifamily projects.

📌 Objective: Engage a developer before they publicly announced a new project.

Example Post Title:

“What Real Estate Developers Need to Know About Lease-Up Timing”

✔️ Posted by a consultant or sales team member, NOT Charlesgate’s corporate page.

✔️ Referenced a recent project where Charlesgate improved leasing speed by 40%.

✔️ Mentioned relevant local market trends to make the content feel timely.

✔️ Subtly hinted at Charlesgate’s role in accelerating pre-leasing for developers.

How It Was Used:

- Posted on LinkedIn & shared via direct messages to key decision-makers.

- Sent as a follow-up to developers Charlesgate had lightly engaged with.

- Created inbound conversations—developers responded with interest because the topic was relevant to their current or upcoming projects.

“Instead of selling our services, we showed how we helped a similar developer increase leasing speed by 40%. That started real conversations without a hard pitch.”

— Amy Loesch, Fractional CMO, Charlesgate

Overcoming Sales & Marketing Misalignment

Here is a breakdown of practical steps Cardata and Certn took to move from siloed sales and marketing teams to true strategic AND execution alignment, including running joint programs.

Cardata: Creating a Shared Sales-Marketing Motion for ABM

Challenge:

- Sales and marketing operated separately—marketing focused on engagement, while sales focused on immediate deals. “Our sales & marketing are aligned on paper, but never do anything together in practice”

- BDRs were incentivized to book meetings, not nurture high-value accounts.

- Marketing-generated leads were often ignored because they didn’t fit immediate short-term sales goals.

Solutions:

✅ Shifted Focus from MQLs to Pipeline Contribution

- Instead of tracking MQLs, marketing and sales jointly reviewed account engagement & deal potential.

- Used 6sense & ZoomInfo intent data to prioritize accounts already showing signs of buying interest.

“Instead of pushing every engaged account to sales, we only passed accounts that showed clear buying intent.”

— Divash Basnet, VP of Marketing, Cardata

✅ Guaranteed BDR Commissions for ABM Accounts

- BDRs were hesitant to focus on ABM accounts because they didn’t lead to immediate meetings.

- To fix this, Cardata guaranteed commissions for 3 months for reps working on ABM, ensuring they could focus on nurturing accounts.

“We removed the short-term pressure by guaranteeing commissions. That allowed sales to actually focus on the right accounts.”

— Divash Basnet

✅ Held Weekly Pipeline Reviews to Ensure Alignment

- Instead of working in silos, sales and marketing met weekly to review active ABM accounts.

- Adjusted outreach strategies based on real-time engagement data.

✅ Result:

📌 ABM was fully integrated into the sales process, rather than being a side project.

📌 Sales reps trusted marketing leads more, leading to better follow-up and higher conversion rates.

📌 Cardata expanded its ABM program, adding more BDRs to the effort.

Certn: Bridging the Gap Between Marketing & Sales with Content & Collaboration

Challenge:

- Marketing and sales weren’t collaborating directly—interactions were mediated through internal stakeholders.

- Marketing produced content, but sales wasn’t leveraging it effectively.

- Leads weren’t progressing because sales didn’t have the right messaging to continue the conversation.

Solutions:

✅ Made Sales Part of the Content Creation Process

- Instead of marketing guessing what content sales needed, they worked directly with sales to co-create LinkedIn posts and outreach material.

- Sales reps were trained on how to use marketing content effectively in conversations.

“Salespeople don’t need marketing brochures—they need real insights that help them start conversations.”

— Ellen Kaross, Global Marketing Communications Manager, Certn

✅ Used “Account Love Letters” to Create Sales-Ready Content

- Instead of generic content, Certn created highly personalized LinkedIn posts tailored to target accounts.

- These posts were published by sales reps to increase credibility.

“Our best-performing content wasn’t from the corporate page—it was from sales reps sharing insights that spoke directly to target accounts.”

— Ellen Kaross

✅ Developed a Structured Follow-Up Process for Engaged Accounts

- If an account engaged with content, marketing & sales worked together on a follow-up strategy.

- Sales had clear guidelines on when to reach out, what messaging to use, and what resources to share.

✅ Result:

📌 Sales actually used marketing content, improving engagement rates.

📌 Better alignment between content strategy and real buyer concerns.

📌 Stronger lead nurturing resulted in more long-term opportunities.

Building a Structured Account-Based Sales Prospecting Process

For most of the teams, the prospecting process before ABM consisted of running generic outreach cadences, or trying to engage marketing-qualified leads.

The key to success was implementing a structured prospecting process that was highly targeted, multi-touch, and long-term focused.

A structured ABM sales prospecting process ensures:

- Sales efforts are focused on the highest-value accounts. Each team has implemented a weekly process for identifying, prioritizing, and tracking target accounts

- Marketing and sales work together to warm up accounts before outreach. The activities are aligned with the level of the buying intent. This allowed sales to engage their prospects in a way that builds trust, rather than feeling like they are being pitched.

- Messaging is personalized and relevant to each account’s current business needs.

- Daily outreach routines for sales reps, that helps them know exactly what they need to do to move each account forward

- Regular sales-marketing alignment meetings (pipeline review meetings) to adjust warm-up and prospecting efforts based on real-time engagement.

“Before, we didn’t have a structured prospecting process. Now, our sales team has a defined daily routine and a clear pipeline of high-priority accounts.”

— Amy Loesch

The ideal v.s. realistic team composition, and how to solve common team bottlenecks

The most common team bottlenecks are:

- Lack of dedicated content resources for ABM (marketer repurposes content, run webinars with SME)

- Sales reps’ KPIs are not adjusted or they don’t get enough time to work on the ABM pilot

- Leadership distracts the team by pulling them into too many meetings and other unplanned activities

TestRail’s Selling Without Sales (Marketing-Led ABM)

- The program was executed with minimal sales involvement.

- Marketing did the account research, buyer engagement, and content distribution.

- Sales only got involved after accounts showed clear buying intent.

“This was a marketing-led ABM program. We built trust first—sales only stepped in when the time was right.”

— João Crisóstomo

Measuring Success: Leading & Lagging Indicators

Cardata & Certn tracked two types of KPIs to measure the ABM pilot’s success:

Leading Indicators (Signals of Engagement & Future Pipeline)

- LinkedIn engagement (profile views, comments, connection requests).

- Email & LinkedIn two-way conversations

- Account intelligence gathered (challenges and priorities, people involved in the buying process, procurement timelines, etc.).

- Web engagement with relevant website pages

- Webinar participation and engagement

Lagging Indicators (Revenue Impact Metrics)

- Meetings booked with the right buyers.

- High-value pipeline generated.

- Closed revenue from ABM-sourced opportunities.

“Tracking engagement signals and account intelligence is just as important as tracking meetings and deals. If we don’t see feedback from the market, something isn’t working.”

— Divash Basnet

How to Scale ABM Beyond a Pilot

Cardata expanded ABM investment—company committed to two more ABM cycles and added an additional BDR.

“This isn’t a one-off experiment. We’ve already got two more ABM cycles planned, with more resources allocated. We’re all in on this.”

— Lee Adam

To enable this expansion, they

- Automated & streamlined intent-based prioritization, using 6sense & website analytics to dynamically adjust target accounts based on real-time engagement.

“With real-time prioritization, ABM didn’t require constant manual adjustments—it became a structured, data-driven process.” — Divash Basnet - Created an ABM playbook: documented best practices, outreach templates, content strategies, and account prioritization frameworks to standardize the ABM process.

At Certn, the ABM pilot drove record-breaking engagement and sales success, leading leadership to expand the program.

“After the first ABM cycle, we saw that it wasn’t just generating pipeline—it was changing how we approached sales and marketing collaboration across the company.”

— Ellen Kaross, Global Marketing Communications Manager, Certn

How Certn Scaled ABM Beyond a Pilot:

- Expanded ABM to new segments & global markets, involving regional sales teams

- Rolled out a multi-channel thought leadership program as a core ABM strategy to create awareness and sales engagement opportunities

- Shifted from a Pilot to an always-on ABM program, with regular weekly, monthly and quarterly activities

When to Bring in a Consulting Partner (And When Not To)

You SHOULD consider a consulting partner if

✔️ You are new to ABM and need expert guidance to avoid common mistakes and accelerate the learning curve.

At TestRail, ABM was entirely new to the company, and internal teams lacked prior experience executing a structured ABM motion. João Crisóstomo, who led the initiative, highlighted how a specialized ABM consulting partner helped them avoid trial-and-error and move quickly to execution.

“We didn’t know where to start, and trying to figure it out on our own would have taken months. Working with a consulting partner gave us a proven playbook and a structured approach that helped us get results faster.”

— João Crisóstomo, Enterprise Product Marketing Manager, TestRail

✔️ Your sales & marketing teams struggle with alignment, and you need external facilitation.

Successful ABM requires alignment across sales, marketing, and customer success. Consultants help structure weekly pipeline reviews, define shared KPIs, and ensure seamless lead handoff processes.

For example, Cardata initially struggled with sales and marketing alignment. Bringing in a third party helped secure buy-in from leadership and structured the ABM process in a way that both teams could rally behind.

“Bringing in an external consultant was key in getting everyone aligned. It helped us avoid internal debates about what ABM ‘should be’ and focus on execution.”

— Divash Basnet, VP of Marketing, Cardata

✔️You want to build internal capabilities, and are looking for hands-on support for internal teams execute more effectively

A good consulting partner doesn’t just create ABM strategy decks—they work alongside internal teams to execute key activities, train teams, and optimize campaigns in real-time.

At TestRail, João highlighted how working with an ABM consultant made execution easier and more effective:

“We weren’t left with just a strategy document. We had hands-on support every week to make sure we were executing the right way.”

— João Crisóstomo

✔️ You need help structuring ABM as a REPEATABLE, SCALABLE process instead of a one-off campaign.

One of the biggest challenges in ABM is creating repeatable, scalable processes. Consultants help companies:

- Identify account clusters and segments with the greatest revenue potential—so ABM can be focused on making the most impact and gradually expanding to new markets or verticals.

- Develop playbooks for each ABM tier (1:1, 1:Few, 1:Many).

- Document playbooks and processes for sales and marketing alignment, reducing friction as teams grow.

For example, at Cardata, this structured approach ensured that ABM became a long-term revenue driver, rather than an isolated campaign.

“Instead of treating ABM as a one-off experiment, we built a repeatable process that could be scaled across our sales team.”

— Lee Adam, Product Marketing Manager, Cardata

You may NOT need a consulting partner if:

- You already have a structured ABM team and just need minor optimizations.

- Sales & marketing are fully aligned, executing ABM effectively.

- You’re looking for a full-service agency to run campaigns for you, rather than hands-on consulting.

Takeaways and Next Steps

Lots of organizations want to launch targeted programs to win & retain high-value, long-term customers, but struggle adapting the ABM framework to their unique situation. The four case studies highlighted in this article provide the following key takeaways:

- Ensure a committed pilot team including an ABM lead, content marketer, and a sales rep, with support from a subject-matter experts

- The biggest mistake with ABM is treating all accounts the same way and running the same playbooks. Instead, you need a mix of playbooks to drive buying committee awareness and engagement aligned with their buying journey

- Turn every week into a sprint, by running structured ABM pipeline review meetings.

- Align your content and awareness creation activities with the specific use-case and top-of-mind challenges of your target accounts, leaning heavily into internal SMEs and industry peers

- Measure both leading and lagging indicators to prove ABM impact and keep the momentum going

- Align the activity/call-to-action with the level of buying intent. This includes shifting sales from outreach to consultative engagement with ‘bridge activities.’

- If internal teams lack expertise, a consulting partner can accelerate execution, and help structure ABM as a REPEATABLE, SCALABLE process instead of a one-off campaign.

If you need help with launching or revamping your ABM programs, book a call here or dm me on LinkedIn with additional questions.

If you want to uplift your skills and learn more about the complete ABM strategy, get step-by-step guidelines on developing an ABM strategy from scratch and launching a joint ABM pilot campaign in less than a quarter, in our Full-Funnel ABM Playbook.

Inside you’ll find:

- 18 short, actionable training videos that explain how to launch a pilot ABM campaign on a minimal budget and land sales opportunities with dream accounts just in 6 weeks

- 4 actionable, orchestrated for you ABM campaigns

- Worksheets and dashboards you need to launch a pilot campaign including:

- Ideal customer profile template

- Account research template

- ABM campaign dashboard

- Pilot campaign slides

- Phone follow-ups template

- Account qualification template

- Campaign analysis template

- Lifetime access to the course and future updates

Learn more and access the Full-Funnel ABM playbook here.